- United States

- /

- Health Care REITs

- /

- NYSE:MPW

How Investors Are Reacting To Medical Properties Trust (MPW) Dividend Increase and $150 Million Buyback

Reviewed by Sasha Jovanovic

- Medical Properties Trust announced a 12.5% increase in its regular quarterly cash dividend to $0.09 per share, payable January 8, 2026, to shareholders of record as of December 11, 2025.

- This dividend hike and the introduction of a new $150 million share repurchase program reflect management’s focus on returning value to shareholders and confidence in reaching a goal of $1 billion in annualized cash rent by 2026.

- We’ll examine how Medical Properties Trust’s commitment to shareholder returns through its dividend increase could impact the company’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Medical Properties Trust Investment Narrative Recap

To be a shareholder in Medical Properties Trust, you need confidence in a recovery driven by improved tenant performance and increasing rental income, despite ongoing exposure to tenant risks and sector-wide challenges. The recent dividend increase and share repurchase program reflect a focus on shareholder returns but do not change the most important short-term catalyst: the timely ramp-up of rental payments from new operators on previously distressed assets. The biggest risk remains continued credit and cash flow concerns from underperforming tenants, and the news does not materially shift that dynamic.

Among recent company actions, the announcement of a $150 million share repurchase program stands out in relevance to the enhanced dividend. While improved capital returns may help bolster investor sentiment, execution on portfolio stabilization and cash rent growth will remain crucial for addressing near-term uncertainties.

Yet, investors should be aware that despite the positive headline, ongoing tenant credit risks may still threaten dividend sustainability if...

Read the full narrative on Medical Properties Trust (it's free!)

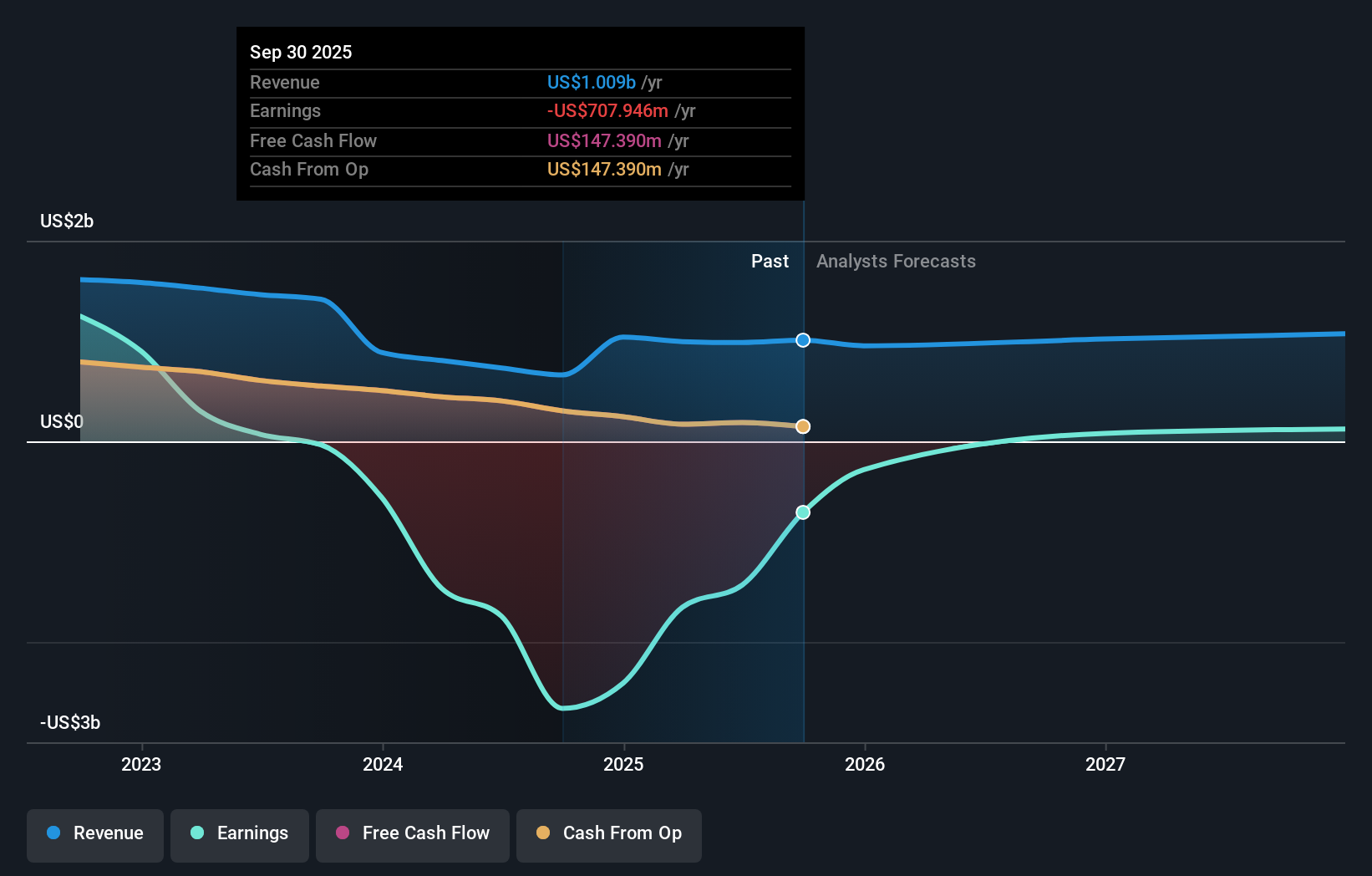

Medical Properties Trust's narrative projects $1.1 billion revenue and $136.7 million earnings by 2028. This requires 3.1% yearly revenue growth and a $1.54 billion increase in earnings from -$1.4 billion currently.

Uncover how Medical Properties Trust's forecasts yield a $5.00 fair value, in line with its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community range from US$5.00 to US$13.43 per share, revealing wide variance in expectations for Medical Properties Trust. These divergent views reflect ongoing uncertainty as tenant concentration risk and earnings volatility remain key concerns for future performance.

Explore 11 other fair value estimates on Medical Properties Trust - why the stock might be worth just $5.00!

Build Your Own Medical Properties Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Medical Properties Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medical Properties Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives