- United States

- /

- Retail REITs

- /

- NYSE:MAC

Macerich (MAC): Exploring Valuation After Improved Q3 Results and Narrowing Losses

Reviewed by Simply Wall St

Macerich (NYSE:MAC) just posted its third quarter results, showing steady progress with higher revenue and sales compared to last year. The company also narrowed its net loss, which signals a shift in performance.

See our latest analysis for Macerich.

Following the upbeat earnings news, Macerich’s share price climbed 3.6% in a single day and notched a 5.1% gain over the week, signaling renewed market optimism. Despite a shaky start this year, with year-to-date share price return still down nearly 11%, the long-term picture tells a different story. Macerich delivered a solid 62% total shareholder return over three years and an impressive 155% return over five years, evidence that momentum is gathering as fundamentals improve.

If the renewed momentum for Macerich caught your attention, now's a great time to broaden your search and discover fast growing stocks with high insider ownership

With recent improvements in revenue and a slimmer net loss, some investors may wonder if Macerich’s stock still trades at a discount, or if current prices already reflect the company’s momentum and future growth expectations.

Most Popular Narrative: 7.7% Undervalued

Macerich's fair value estimate sits higher than its last close, reflecting optimism around recent momentum and future earnings potential. This narrative spotlights strategic portfolio changes as a key driver for the price outlook.

Ongoing asset dispositions and disciplined portfolio refinement are concentrating capital in top-performing, high-barrier, urban and coastal assets. This is enhancing pricing power, stabilizing cash flows, and allowing for continued improvements in balance sheet strength and lower interest expense, all positively impacting net earnings.

Curious about how much future profits and improving margins matter in this valuation? The narrative hinges on dramatic earnings shifts, surprising margin forecasts, and bold assumptions about Macerich’s long-term strategy. See what’s powering this ambitious valuation.

Result: Fair Value of $19.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in traditional malls and Macerich’s high leverage could quickly shift earnings momentum if retail headwinds intensify or if refinancing costs rise.

Find out about the key risks to this Macerich narrative.

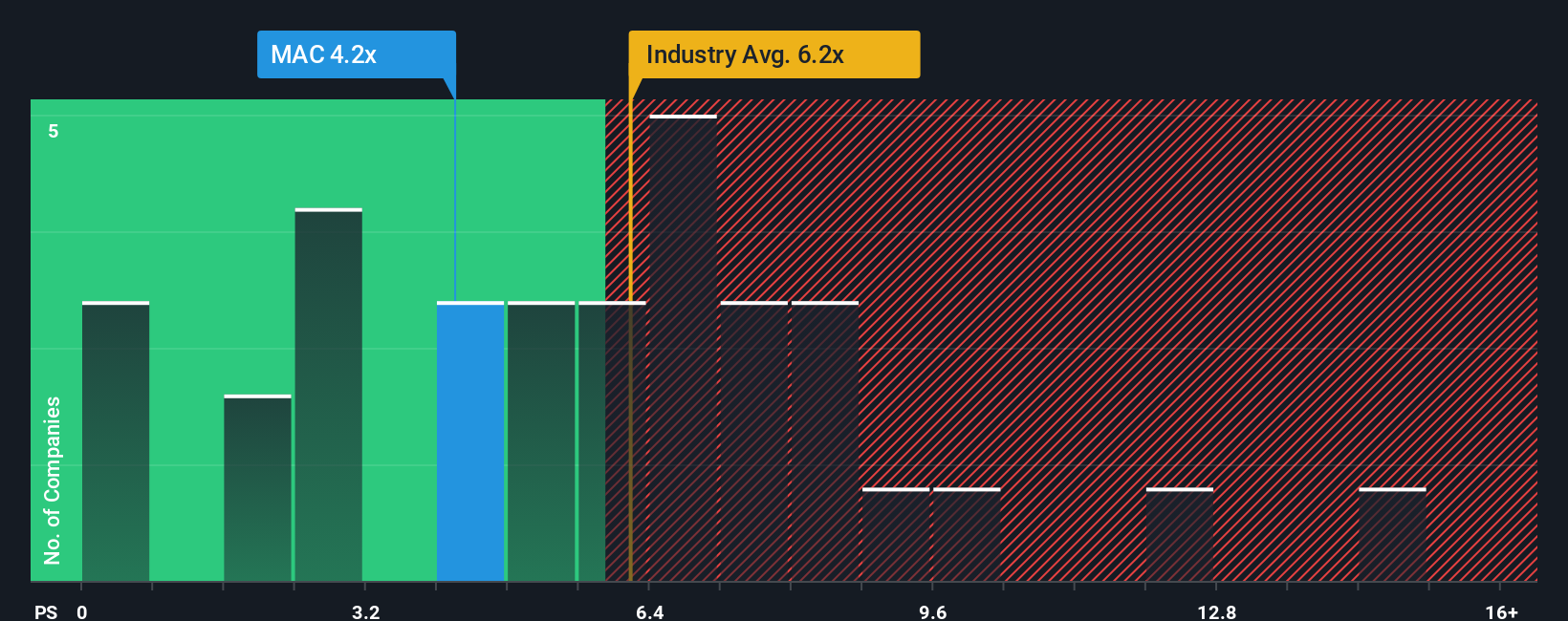

Another View: Looking Through the Lens of Sales Multiples

While the fair value narrative suggests Macerich is undervalued, a look at its price-to-sales ratio tells a more nuanced story. Macerich trades at 4.2 times its sales, which is lower than both the industry average of 6.1x and its peers’ average of 6.8x. However, it remains above the fair ratio of 3x. This gap could indicate there is lingering valuation risk if the market adjusts toward the fair ratio. Is the market expecting too much, or is there more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Macerich Narrative

If you see things differently or want to dig into the numbers yourself, you can easily build your own version of the Macerich story in just a few minutes. Do it your way

A great starting point for your Macerich research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the market curve by checking out these standout investment themes, perfect for anyone who wants to level up their stock search with a smarter edge.

- Uncover yield potential by scanning through these 16 dividend stocks with yields > 3%, which spotlights companies that offer reliable income streams and above-average payouts.

- Ride the wave of artificial intelligence, where innovators are reshaping industries. Start with these 24 AI penny stocks to find tomorrow’s leaders.

- Target standout bargains most investors overlook by browsing these 870 undervalued stocks based on cash flows, packed with hidden gems trading for less than they’re worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAC

Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT).

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives