- United States

- /

- Residential REITs

- /

- NYSE:MAA

Will Mixed Ratings and Dividend Streak Test Mid-America Apartment Communities' Resilience Strategy (MAA)?

Reviewed by Sasha Jovanovic

- In recent days, analyst ratings for Mid-America Apartment Communities have ranged from "Buy" to "Hold" as the company faces challenges from rising interest rates and an evolving supply-demand landscape in its core markets.

- This period also saw the company announcing its 127th consecutive dividend payment, highlighting a track record of financial stability even as concerns about market conditions and earnings outlook have surfaced.

- We'll explore how mixed analyst sentiment and pressure from higher interest rates may reshape Mid-America Apartment Communities' investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Mid-America Apartment Communities Investment Narrative Recap

To be a shareholder in Mid-America Apartment Communities, you’d need to believe that strong demographic trends and stable demand for rental housing in the Sun Belt will eventually outweigh the current pressure from rising interest rates and persistent new apartment supply. Recent analyst ratings and modest price target adjustments reflect mixed sentiment, but they do not materially change the near-term outlook, the biggest catalyst remains stabilization of new supply, while the greatest risk is that elevated development in key markets continues to suppress lease growth and revenue.

The company’s announcement of its 127th consecutive quarterly dividend payment is especially relevant here, as it underlines a record of financial stability in tough market conditions. While this persistent dividend suggests confidence, the real test for MAA will be whether its earnings can withstand the ongoing headwinds from sluggish market fundamentals and rising costs.

By contrast, investors should pay close attention to the risk that continued lease-up challenges in oversupplied markets could...

Read the full narrative on Mid-America Apartment Communities (it's free!)

Mid-America Apartment Communities is expected to generate $2.5 billion in revenue and $488.4 million in earnings by 2028. This outlook assumes a 4.8% annual revenue growth rate, but a decline in earnings of $79.4 million from the current $567.8 million.

Uncover how Mid-America Apartment Communities' forecasts yield a $156.72 fair value, a 18% upside to its current price.

Exploring Other Perspectives

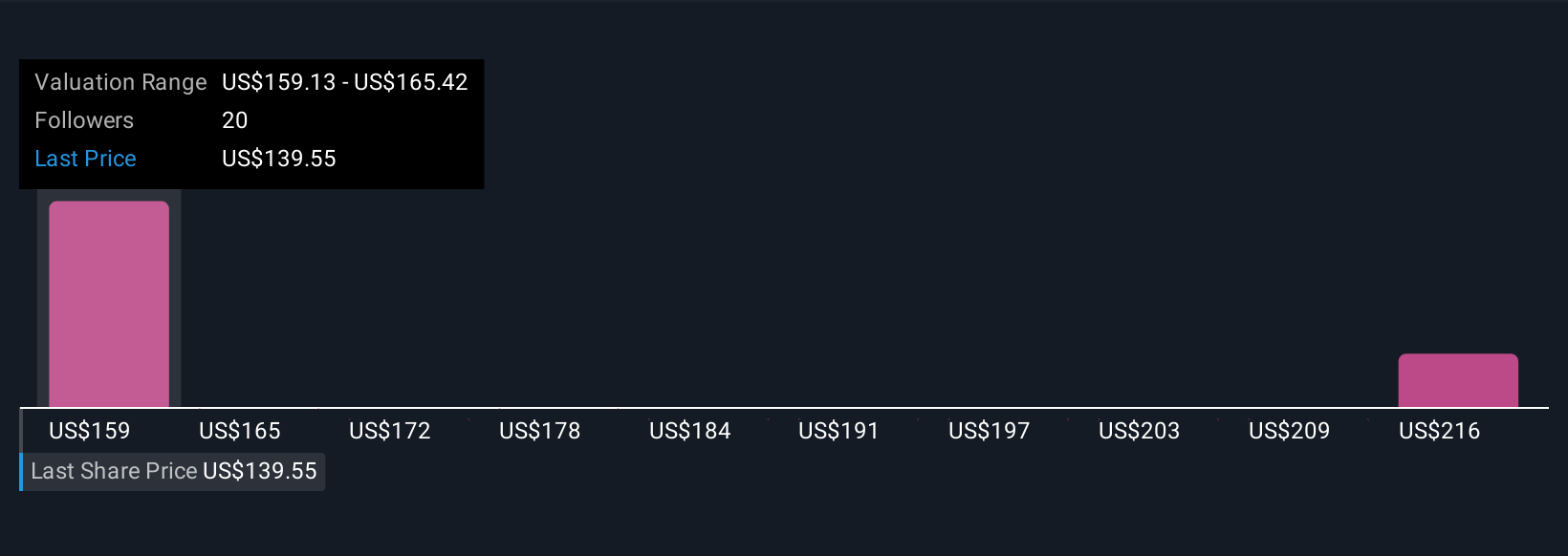

Fair value estimates from five Simply Wall St Community members range from US$90.19 to US$225.09 per share, highlighting strikingly different views. With earnings expected to decline over the next three years, the wide range of opinions shows why it’s helpful to explore multiple perspectives before making a decision.

Explore 5 other fair value estimates on Mid-America Apartment Communities - why the stock might be worth 32% less than the current price!

Build Your Own Mid-America Apartment Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mid-America Apartment Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mid-America Apartment Communities' overall financial health at a glance.

No Opportunity In Mid-America Apartment Communities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives