- United States

- /

- Industrial REITs

- /

- NYSE:LXP

Assessing Lexington Realty Trust (LXP) Valuation as Investors Weigh Recent Share Price Moves

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 12.2% Undervalued

According to the most widely followed narrative, LXP Industrial Trust is currently considered undervalued, with analysts estimating its fair value significantly above current market prices.

Continuous demand from e-commerce, 3PLs, and advanced manufacturers for modern, strategically located logistics facilities, especially in Sunbelt and Midwest markets benefiting from reshoring and supply chain reconfiguration, is supporting high occupancy (guidance of 97 to 99 percent) and robust leasing activity. This is likely driving steady revenue and NOI growth. LXP's focused capital recycling and portfolio repositioning toward high-quality, Class A, single-tenant facilities in supply-constrained, business-friendly states positions the company to benefit from favorable supply-demand dynamics. This translates to sustained net margin expansion and improved earnings quality.

What exactly is driving this bullish fair value? There is a bold expectation behind the numbers. The future depends on robust demand and high-quality properties. Ready to uncover which key financial projections underpin this surprising target and what makes LXP stand out even as earnings come under pressure?

Result: Fair Value of $10.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as persistent vacancies in single-tenant properties or slower than expected rent growth could quickly challenge the optimism underpinning LXP’s current valuation.

Find out about the key risks to this LXP Industrial Trust narrative.Another View: Market Ratios Tell a Different Story

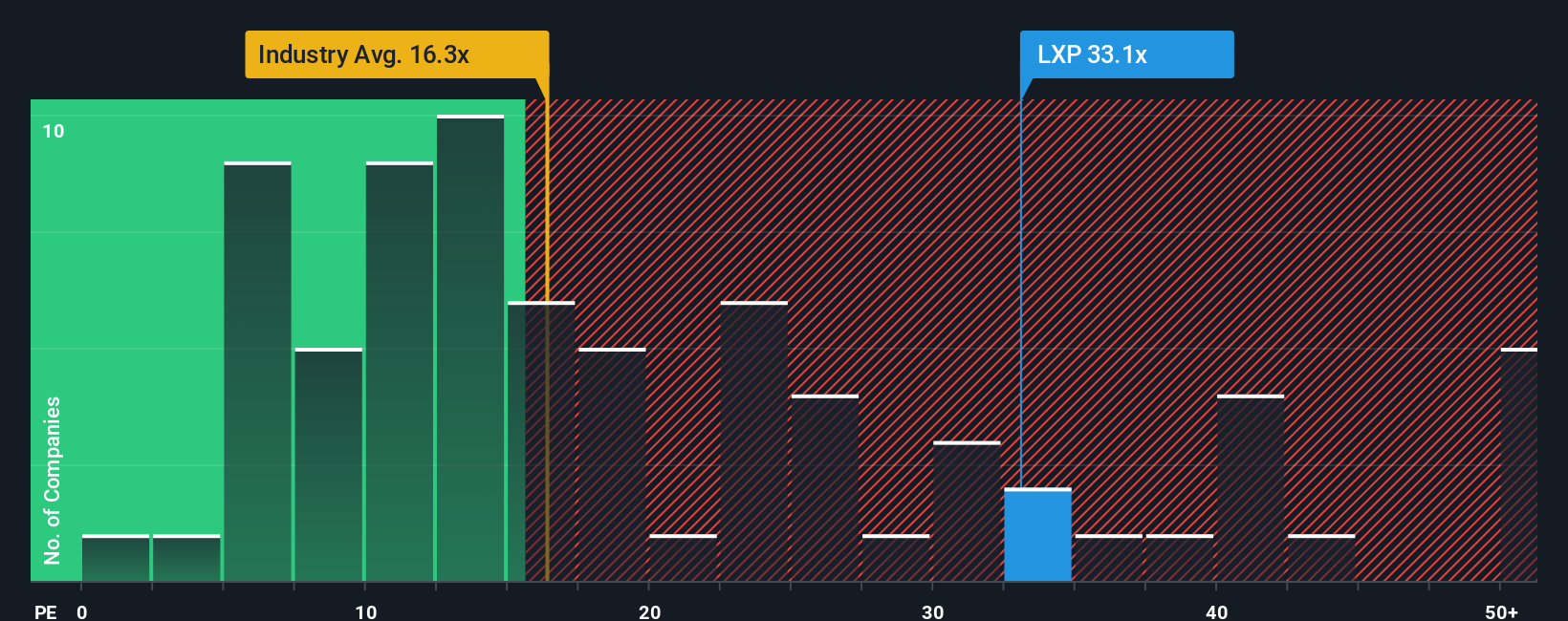

Looking from another angle, shares appear pricey when compared to similar companies using the most common valuation benchmark in the industry. This finding presents an alternative challenge to the previously bullish fair value. Which approach should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding LXP Industrial Trust to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own LXP Industrial Trust Narrative

If these viewpoints do not align with your own or you value doing your own deep dive, you can easily build your personal take in just a few minutes. Do it your way

A great starting point for your LXP Industrial Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by hunting for tomorrow’s leaders today. Don’t just watch from the sidelines; expand your portfolio horizons with these compelling opportunities now.

- Pinpoint undervalued gems with potential for strong gains by seizing your chance through our undervalued stocks based on cash flows tool.

- Capture the income advantage by scanning for companies offering consistently high payouts with our dividend stocks with yields > 3% shortcut.

- Ride the future wave by targeting companies revolutionizing medicine and care using our healthcare AI stocks pathway.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LXP

LXP Industrial Trust

LXP Industrial Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) focused on Class A warehouse and distribution investments in 12 target markets across the Sunbelt and lower Midwest.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives