- United States

- /

- Health Care REITs

- /

- NYSE:LTC

A Fresh Look at LTC Properties’s Valuation Following Senior Housing Expansion and Strategic Portfolio Shift

Reviewed by Simply Wall St

LTC Properties reported a busy quarter, with management highlighting faster than expected growth in its senior housing operating portfolio after exiting skilled nursing. Portfolio repositioning, improved revenue, and new partnerships are front and center for investors this week.

See our latest analysis for LTC Properties.

Despite a mixed quarter with lowered earnings guidance and a reported net loss mainly due to non-cash write-offs, LTC Properties’ strategic pivot toward senior housing investments has caught investors’ attention. The stock delivered a 1-year total shareholder return of -2.6%. With the share price up around 5% year-to-date and new acquisitions driving momentum, sentiment appears to be on the mend for the long haul.

If LTC’s bold moves in real estate have you rethinking what’s possible, this could be the perfect time to discover fast growing stocks with high insider ownership

With momentum building around LTC’s ambitious pivot, investors are left to weigh whether recent gains leave room for more upside or if the market is already factoring in the company’s growth prospects and operational turnaround.

Most Popular Narrative: 5.2% Undervalued

With LTC Properties closing at $35.88 and the most-followed narrative targeting fair value at $37.83, the consensus pins current pricing slightly below the calculated worth. The difference signals cautious optimism from analysts, who anticipate that recent changes could set the stage for future upside.

*Long-term relationships and partnerships with strong regional operators, along with the focus on retaining experienced management teams for acquired assets, are expected to reduce operational risk and support stable, increasing rental income. This directly impacts earnings stability and growth.*

What critical assumptions lift this company above the crowd? There is a powerful earnings engine at play and a surprising margin twist hidden in the forecast. Unlock the full analysis to decode the numbers behind this narrative’s fair value call.

Result: Fair Value of $37.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition for acquisitions and rising debt costs could hinder LTC’s ambitious expansion and put pressure on future margins and earnings growth.

Find out about the key risks to this LTC Properties narrative.

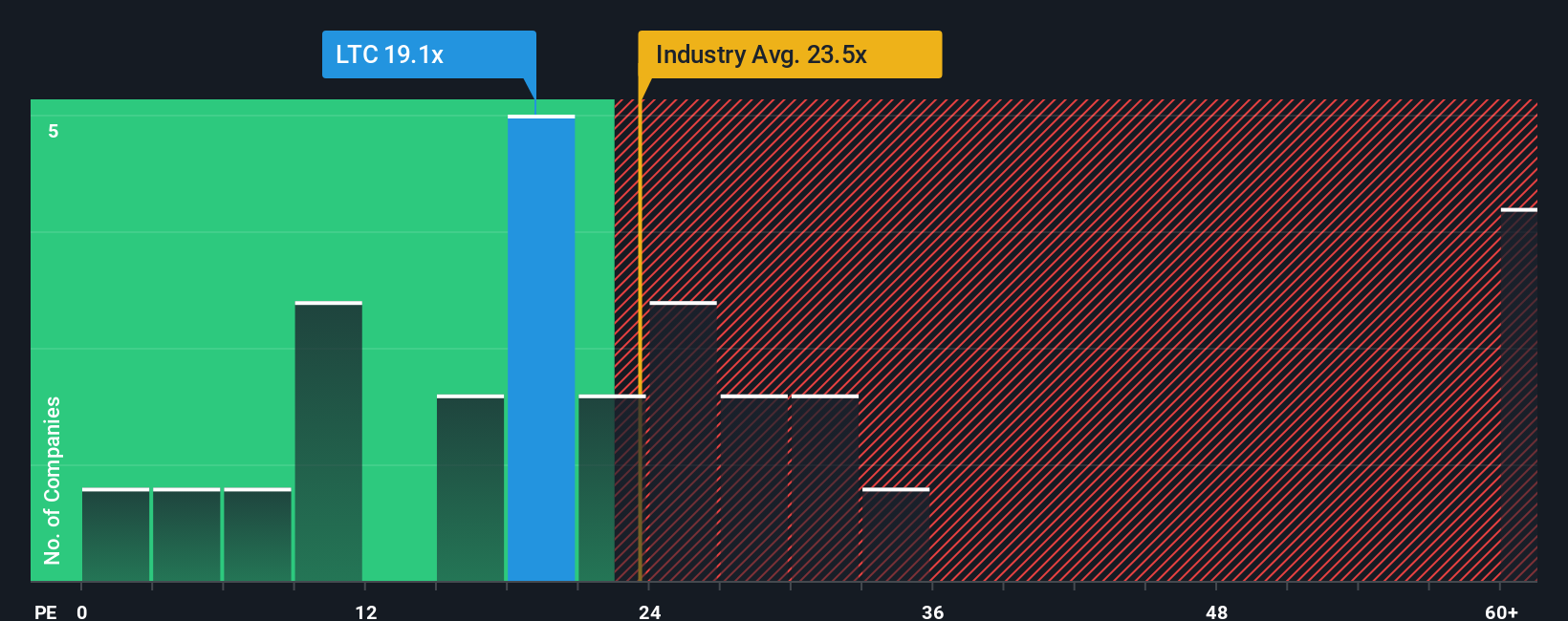

Another View: Multiples Tell a Cautionary Story

Turning to the price-to-earnings ratio, LTC trades at 51.4 times earnings, which is significantly above both the peer average of 26.5x and the broader Health Care REITs industry at 24.7x. Even the so-called fair ratio sits lower at 45.8x. This steep premium could signal valuation risk if the company’s ambitions take longer to materialize. Is the market being too optimistic or just early?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LTC Properties Narrative

If you see things differently or want to dig into the details yourself, you can create and share your own narrative in just a few minutes. Do it your way

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for the usual stocks and miss out on high-potential opportunities. Level up your watchlist with companies building tomorrow’s growth stories today. Let Simply Wall Street’s powerful screener help you uncover them before others do.

- Capture the upside of rapid tech advances by starting your search with these 25 AI penny stocks shaping artificial intelligence progress and transforming global industries.

- Unlock tomorrow's winners as you find out which opportunities could be undervalued right now using these 875 undervalued stocks based on cash flows.

- Maximize income potential and grow your portfolio by checking out these 16 dividend stocks with yields > 3% delivering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

High growth potential established dividend payer.

Similar Companies

Market Insights

Community Narratives