- United States

- /

- Office REITs

- /

- NYSE:KRC

Kilroy Realty (KRC): Assessing Valuation After Record Leasing Activity and Strategic Portfolio Moves

Reviewed by Simply Wall St

Kilroy Realty (KRC) just reported its highest level of leasing activity in six years. The company capped the quarter with substantial property sale and acquisition moves. Kilroy Realty also raised its outlook for the rest of the year.

See our latest analysis for Kilroy Realty.

The upbeat leasing numbers and recent portfolio reshuffling have nudged Kilroy Realty’s share price up over 12% in the last three months, with the stock now trading at $42.25. That kind of short-term momentum, along with a 1-year total shareholder return of 15.2%, suggests investors are starting to recognize both the company’s growth moves and its improving profitability, not just the headline revenue trends.

If you’re interested in what other companies are quietly building momentum, this is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares trading just above analyst targets after a surge in performance and major asset moves, the big question is whether Kilroy Realty remains undervalued or if the market has already priced in its next phase of growth.

Most Popular Narrative: Fairly Valued

With Kilroy Realty’s current share price of $42.25 essentially matching the narrative’s fair value estimate of $42.00, the biggest question is whether the current profit surge can outpace future headwinds and support this pricing over the coming years.

The need for ongoing significant ESG investments to keep buildings compliant with tenant and investor sustainability demands may strain capital expenditures. Failure to keep up could risk reputation and occupancy, while maintaining compliance may weigh on net margins. Industry-wide stagnant or declining rents and persistent tenant downsizing trends accelerate vacancy, necessitating costly repositioning of assets and increasing capital requirements. This will constrain FFO growth and elevate refinancing risks in a risk-averse capital market.

Curious what high-stakes assumptions about future profits and razor-thin margins are baked into this fair value? The narrative hinges on controversial forecasts, including a major squeeze on profitability and a reliance on pricey property upgrades. Want to know which looming shifts and sector trends could tip the balance? Dive into the full narrative to see how these bold projections shape the valuation.

Result: Fair Value of $42.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a stronger than expected recovery in leasing momentum or surging demand from AI-driven tenants could quickly shift the outlook for Kilroy Realty’s future growth.

Find out about the key risks to this Kilroy Realty narrative.

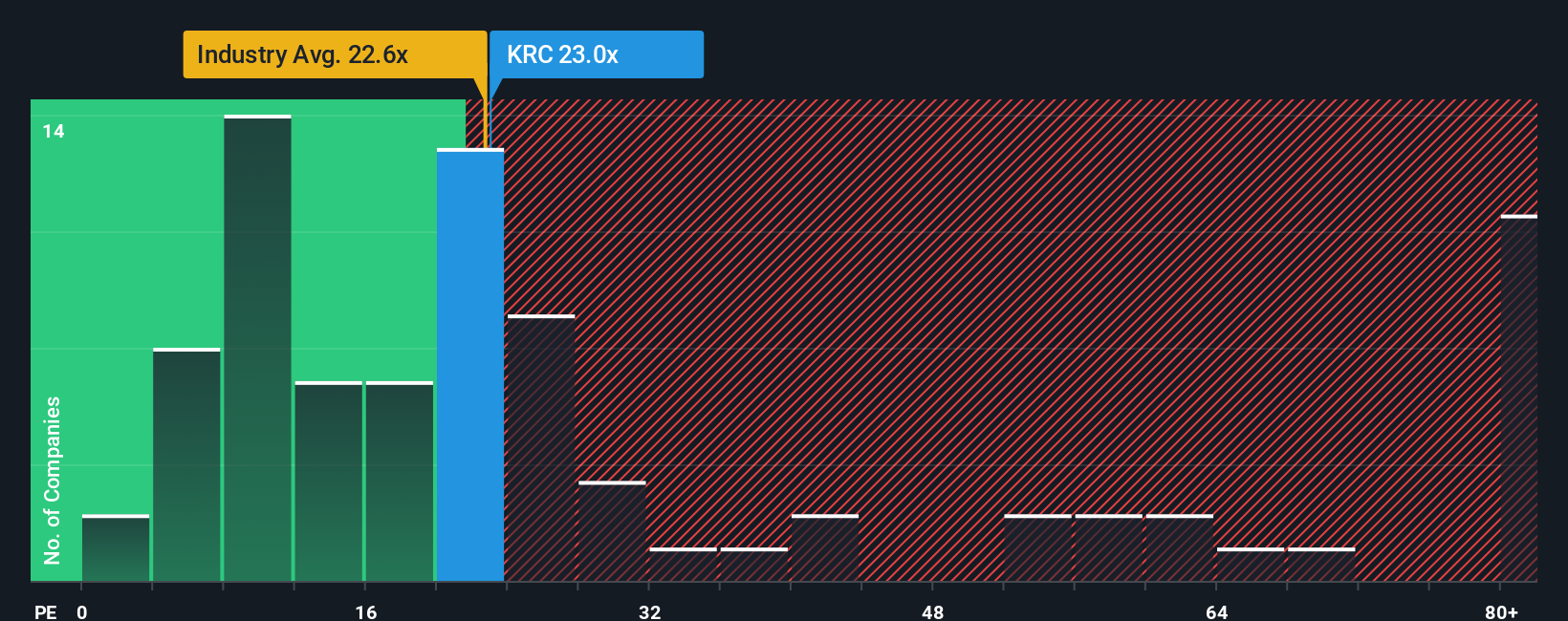

Another View: Looking at Valuation Ratios

While the main narrative pegs Kilroy Realty right around fair value, a quick check against valuation ratios adds more nuance. Kilroy’s price-to-earnings ratio of 15.5x sits below both the global Office REITs industry at 22.4x and peers at 32.8x, and is nearly identical to its fair ratio of 15.6x. This alignment hints the market is pricing Kilroy more conservatively than many rivals, but does that signal a bargain or caution over shifting fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kilroy Realty Narrative

If you want to dig deeper or come up with your own take on Kilroy Realty’s story, it only takes a few minutes to review the data and shape your personal view. Do it your way

A great starting point for your Kilroy Realty research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing strategy by seeking out companies that offer rare opportunities. Leverage these expert-vetted ideas below and make sure you catch tomorrow’s winners today. Don’t let smart moves pass you by.

- Unlock fresh potential for your portfolio by analyzing these 839 undervalued stocks based on cash flows that the market may be pricing too low. These could be prime for a closer look.

- Boost your returns and income stream with these 22 dividend stocks with yields > 3% that have yields above 3%. This can help you stack steady gains on top of growth.

- Get ahead of the curve in artificial intelligence by targeting these 26 AI penny stocks poised to benefit from breakthroughs driving the next innovation wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kilroy Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRC

Kilroy Realty

Kilroy is a leading U.S. landlord and developer, with operations in San Diego, Los Angeles, the San Francisco Bay Area, Seattle, and Austin.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives