- United States

- /

- Retail REITs

- /

- NYSE:KIM

Does Kimco Realty’s Recent Property Acquisitions Mean It Is Trading Below Fair Value?

Reviewed by Bailey Pemberton

- Wondering if Kimco Realty offers solid value in today's volatile market? You're not alone, and we're about to dive straight into what the numbers really say.

- Even with strong five-year gains of 75.1%, the stock has faced some turbulence lately, including a 1.7% move up this week and a drop of 8.5% in the past month.

- Recent headlines have spotlighted Kimco Realty's ongoing expansion efforts, including new property acquisitions and portfolio updates. These have helped drive investor sentiment both positively and negatively. Broader market concerns about real estate and interest rates have also played into these recent price swings.

- As a quick snapshot, Kimco’s valuation score stands at 5 out of 6 based on our standard checks for undervaluation. This sets up an intriguing look at the usual valuation tools, as well as one approach you may not have considered until now.

Find out why Kimco Realty's -16.3% return over the last year is lagging behind its peers.

Approach 1: Kimco Realty Discounted Cash Flow (DCF) Analysis

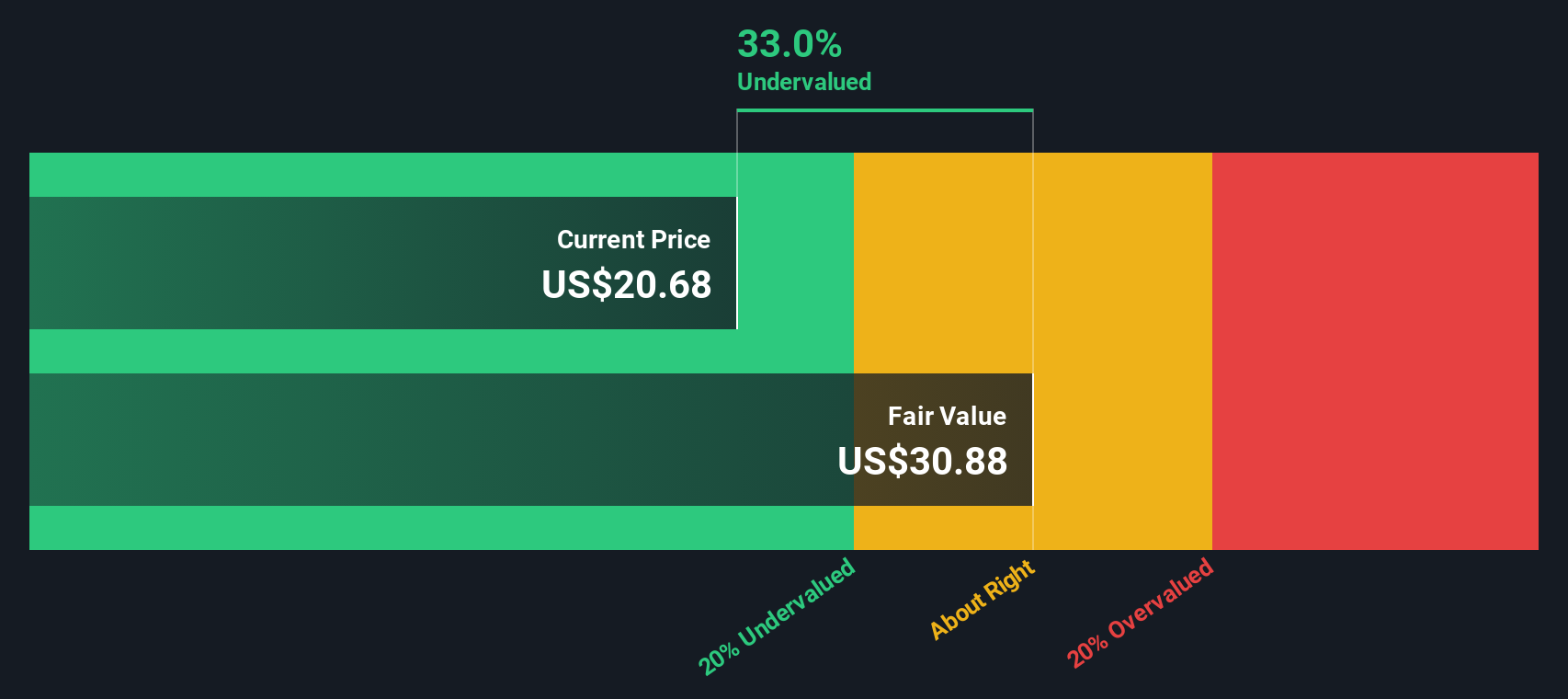

The Discounted Cash Flow (DCF) approach estimates a company's intrinsic value by taking its expected future cash flows, specifically adjusted funds from operations in this case, and discounting them back to today's dollars. For Kimco Realty, this method focuses on projecting free cash flows over the next decade and assessing what they are worth in current terms.

Kimco Realty's latest reported Free Cash Flow stands at $919.7 Million. Analyst estimates for future cash flow only extend five years out, but further into the decade, projections suggest continued growth, reaching about $1.40 Billion by 2035. All projections are given in dollars, and future cash flows after 2029 are based on trend extrapolations rather than direct analyst estimates.

This model generates an estimated intrinsic value of $30.84 per share for Kimco Realty. Compared to recent market prices, this calculation suggests the stock is about 33.7% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kimco Realty is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Kimco Realty Price vs Earnings

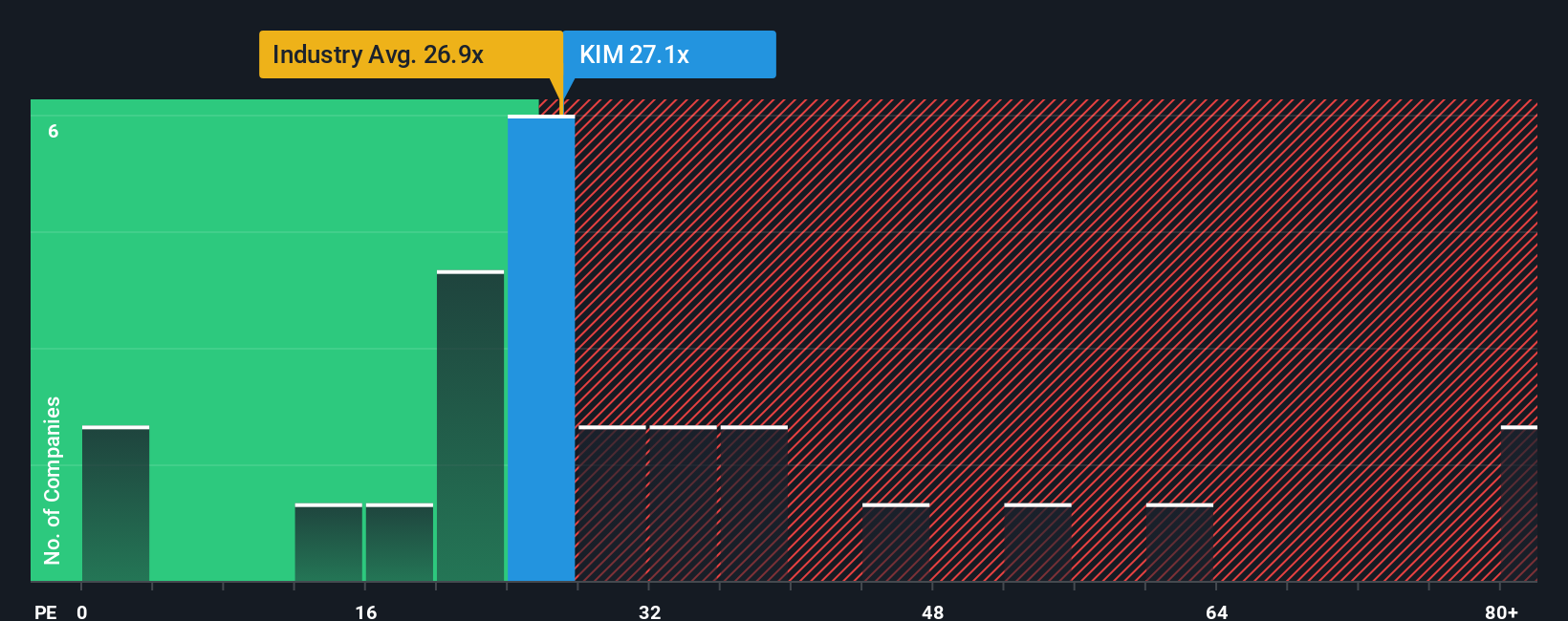

For profitable companies like Kimco Realty, the Price-to-Earnings (PE) ratio is a widely accepted valuation metric. It gives investors a straightforward way to measure how much they are paying for each dollar of the company’s earnings. A lower PE suggests a stock could be undervalued relative to its profit stream, while a higher PE may reflect optimism tied to expected growth or lower perceived risk.

Growth expectations and risk levels play a big part in determining what counts as a reasonable or “fair” PE ratio. Companies with strong earnings growth or lower risk profiles generally justify a higher PE, as investors are willing to pay more now for anticipated future profits. On the other hand, if growth outlooks are tepid or risk appears elevated, that fair number drops accordingly.

Kimco Realty is currently trading at a PE ratio of 24.7x. For comparison, the average for its closest peers sits at 25.3x, and the broader Retail REITs industry average stands at 26.7x. Simply Wall St's proprietary "Fair Ratio" for Kimco comes in at 30.8x, factoring in the company’s earnings growth, industry trends, profit margins, market cap, and risk profile. Unlike a plain average, the Fair Ratio offers a more tailored benchmark. It reflects Kimco’s unique business shape and performance outlook rather than one-size-fits-all comparisons.

Since Kimco’s current PE is noticeably below this Fair Ratio, the stock appears attractively valued by this standard.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1436 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kimco Realty Narrative

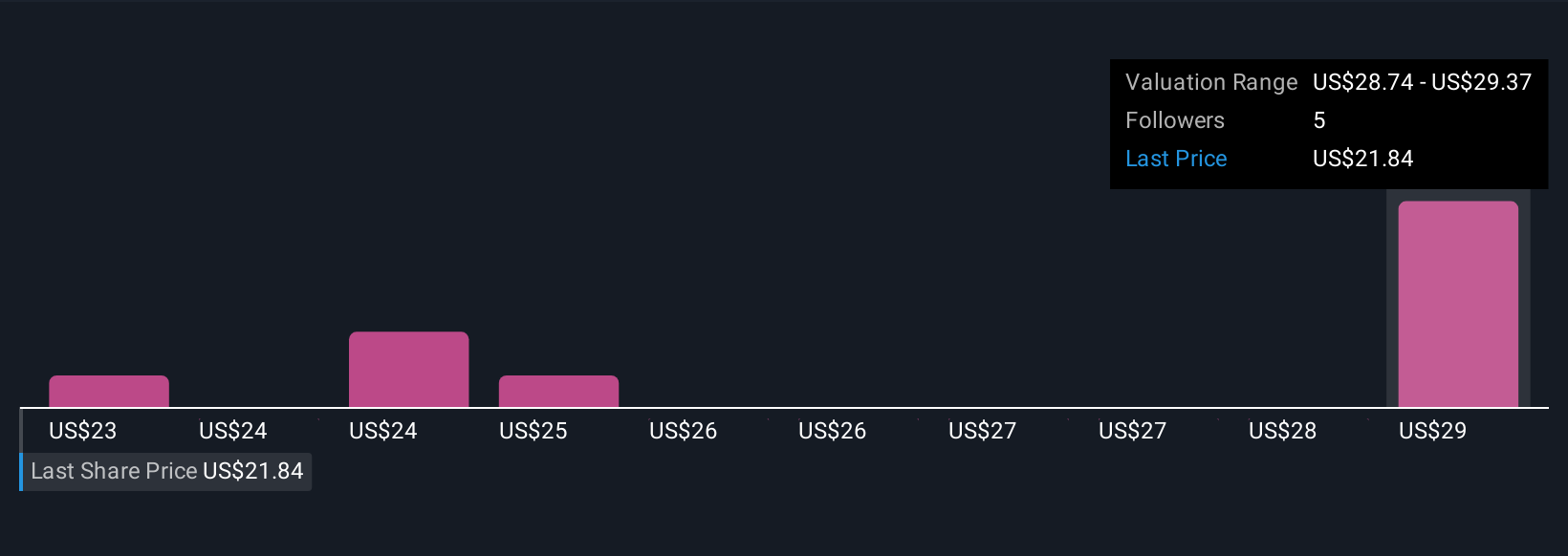

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your unique investment story for Kimco Realty that blends your view of the company's prospects with your own assumptions about its future revenue, earnings, margins, and a fair value estimate. This story is then connected to a financial forecast. Narratives make investing more dynamic and personal by allowing you to go beyond static ratios and directly link the business drivers you believe in with the numbers that should follow.

Available to millions of investors on Simply Wall St's Community page, Narratives are simple to use and can be updated in real time as new information or news arrives. They help you decide whether to buy, hold, or sell by comparing your Fair Value to the current Price so your outlook adapts instantly to major announcements or changing earnings trends.

For example, one Kimco Realty Narrative highlights resilience. An investor may see grocery-anchored centers fueling predictable income and assign a Fair Value near $30.00. Another Narrative focuses on risk, anticipating margin pressures from retail shifts and rising costs, resulting in a Fair Value as low as $21.00. Your Narrative empowers you to put your perspective and convictions at the center of every investment decision.

Do you think there's more to the story for Kimco Realty? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimco Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KIM

Kimco Realty

Kimco Realty (NYSE: KIM) is a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success