- United States

- /

- Hotel and Resort REITs

- /

- NYSE:INN

Summit Hotel Properties (INN) Profit Margins Stagnate, Undermining Bullish Valuation Narratives

Reviewed by Simply Wall St

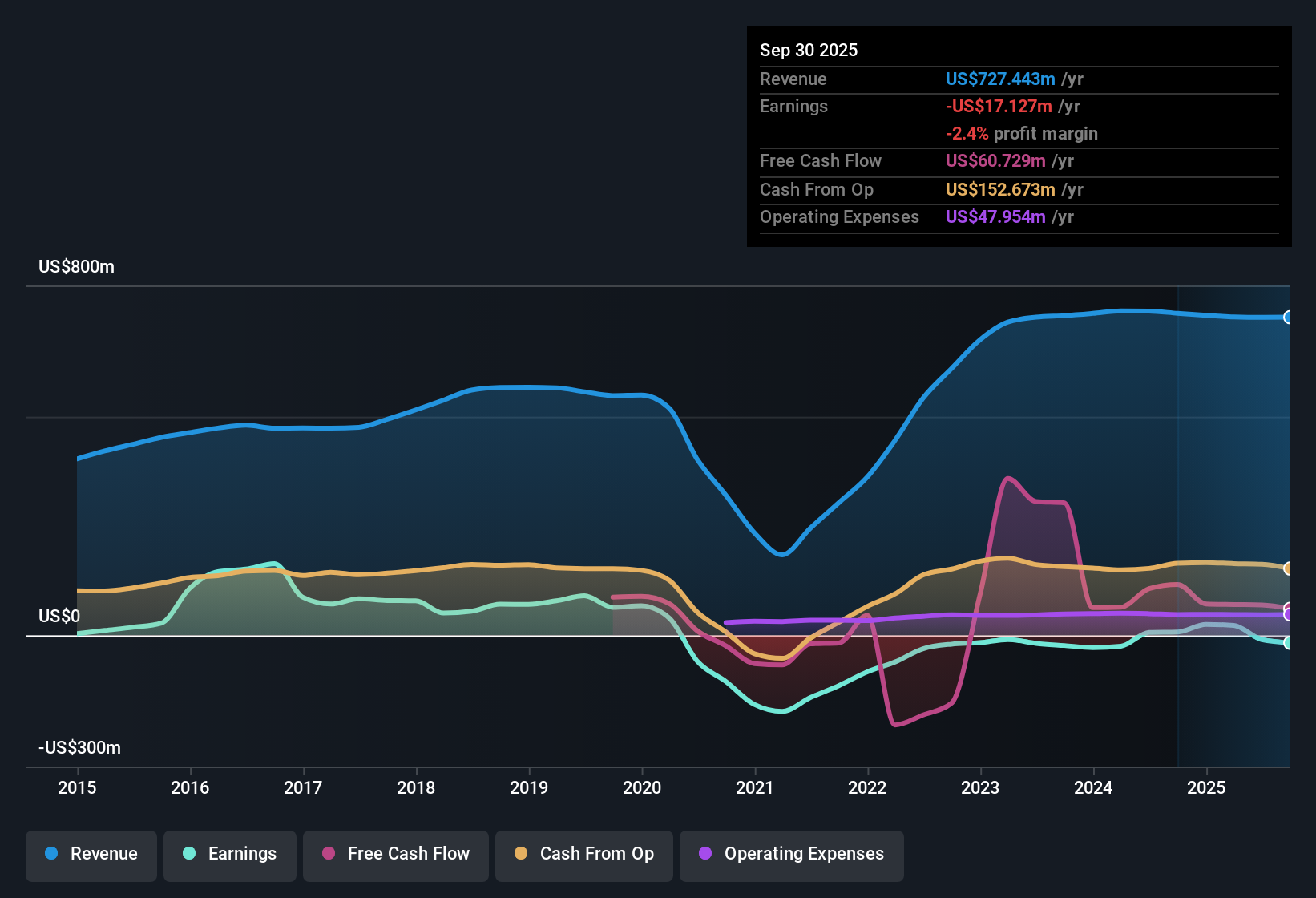

Summit Hotel Properties (INN) remains unprofitable, with net profit margins showing no improvement over the last year. Despite the lack of accelerated profit growth, the company has reduced its losses over the past five years at a steady annual rate of 66.5%. Revenue is forecast to rise by 2.1% each year, which trails well behind the broader US market’s 10.5% pace. For value-focused investors, shares trading at $5.27, well below the estimated fair value of $17.75, create an intriguing setup. However, ongoing losses, a slow growth outlook, and an unsustainable dividend weigh on the overall picture.

See our full analysis for Summit Hotel Properties.Up next, we’ll see how these numbers stack up against the key narratives circulating on Simply Wall St. Some established stories might get reinforced, while others could be put to the test.

See what the community is saying about Summit Hotel Properties

Margin Pressure Limits Earnings Recovery

- Net profit margin remains negative, with no sign of improvement across the past year. Consensus narrative points to margin resilience being increasingly reliant on cost management rather than top-line growth.

- Consensus narrative highlights that cost control and active capital recycling are supporting current margin levels, but margin pressure is set to continue as revenue growth lags the broader US market (2.1% forecast vs 10.5% market average).

- Analysts note asset-light expansion and operating model efficiencies are helping. However, persistent declines in RevPAR and ADR during recent quarters challenge the upside from these actions.

- Consensus narrative argues that limited new hotel supply will keep occupancy and pricing higher. Actual figures show that ongoing demand volatility and a shift towards lower-rated demand have kept margins under pressure, tempering the expected benefit.

- Risk of increased earnings volatility remains as the company faces shortened booking windows and softness in key demand segments. This contradicts the margin expansion case.

- While consensus sees margin improvement as achievable, weak revenue and pricing continue to limit bottom-line recovery.

- Interestingly, analysts’ consensus anticipates that margin expansion may only materialize if the company can avoid further declines in demand for premium segments and sustain recent cost reductions.

- Until top-line momentum returns, reliance on cost discipline and non-core asset sales is expected to drive near-term performance. This reflects a cautious consensus view on fundamental earnings recovery.

- If weakness persists, long-term margins could be further threatened, even as strategic moves in Sun Belt and urban markets are expected to help.

Bold calls from consensus analysts suggest cost controls are stabilizing margins, but persistent demand shifts make further improvement an uphill climb. 📊 Read the full Summit Hotel Properties Consensus Narrative.

Dividend Remains Unsustainable Amidst Slow Growth

- The company’s dividend, flagged as unsustainable in the filings, sits alongside a projected annual revenue growth of just 2.1%, both well below industry norms.

- Consensus narrative draws attention to the company’s poor financial position as a red flag, suggesting that relying on expense management and share repurchases is unlikely to offset weak top-line expansion in the longer run.

- Ongoing asset sales, a shrinking core portfolio, and capital redeployment uncertainties raise the risk of further dividend reductions or suspensions, as both cash flow and future growth remain structurally challenged.

- Consensus perspective underscores that meaningful demand declines (over 20% in government-related bookings and 18% in international inbound travel) are making it harder for the company to sustain dividends or drive portfolio-level growth, even as management recycles capital from non-core sales.

- Analysts warn the current financial strategy is defensive, and ongoing pressure on key demand categories could further weaken the long-term payout profile.

- While new market investment provides some hope, the dividend remains at risk as underlying fundamentals lag sector leaders.

Valuation Discount Persists but Faces Key Tests

- Summit Hotel Properties trades at $5.27, a sharp 70% discount to the DCF fair value of $17.75 and also below the $6.00 analyst price target. Consensus narrative frames this as a potential draw for value investors but warns the discount is justified only if investor expectations around future profitability pan out.

- The company’s Price-to-Sales Ratio of 0.8x appears favorable relative to the global hotel and resort REIT average of 3.8x, yet sits higher than its immediate peers at 0.7x. This raises doubts about whether the valuation discount is as attractive as it first appears.

- Consensus analysts suggest the 13.9% upside to $6.00 relies on meaningful profit margin gains and a return to industry-average earnings. These figures are not yet visible in current performance, especially as sustained unprofitability persists.

- Despite a headline discount, consensus narrative notes the gap between current

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Summit Hotel Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotted a different trend or outcome in the numbers? Share your take and craft your own narrative in just a few minutes: Do it your way

A great starting point for your Summit Hotel Properties research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Summit Hotel Properties struggles with unsustainable dividends, persistent bottom-line pressure, and weak revenue growth that remains far below industry standards.

If you’re frustrated by unreliable payouts and stagnating results, compare opportunities with these 1980 dividend stocks with yields > 3% designed specifically to spotlight companies delivering strong, dependable yields and healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INN

Summit Hotel Properties

A publicly traded real estate investment trust focused on owning premium-branded lodging facilities with efficient operating models primarily in the upscale segment of the lodging industry.

Good value average dividend payer.

Market Insights

Community Narratives