- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

How Investors Are Reacting To Innovative Industrial Properties (IIPR) Third-Quarter Revenue and Income Decline

Reviewed by Sasha Jovanovic

- Innovative Industrial Properties reported a year-over-year decrease in both revenue and net income for the third quarter and first nine months of 2025, with third-quarter sales at US$64.29 million and net income at US$29.31 million.

- The company’s earnings reflect ongoing challenges in the cannabis real estate sector and heightened tenant risk, which are partially offset by efforts to diversify into life sciences assets and maintain a robust balance sheet.

- We’ll explore how the pronounced drop in quarterly financial results shapes the company's investment narrative and future sector exposure.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Innovative Industrial Properties Investment Narrative Recap

To be a shareholder in Innovative Industrial Properties (IIPR), you need to believe that the company's approach to cannabis real estate and recent diversification into life sciences will outlast current tenant challenges and sector headwinds. The recent drop in revenue and net income underscores ongoing pressure on core tenants, but does not materially impact the biggest short-term catalyst, potential federal cannabis reform, nor the most significant risk: tenant financial distress and the sustainability of rental income.

Among the recent company actions, the closing of a US$100 million revolving credit facility in October 2025 stands out. This announcement is especially relevant amid declining earnings, as it enhances IIPR's liquidity and reinforces its ability to manage near-term disruptions, potentially supporting efforts to diversify income beyond cannabis properties if sector volatility continues.

However, it is important for investors to know that despite a stronger balance sheet, tenant concentration risk remains high and if more operators default or restructure, then…

Read the full narrative on Innovative Industrial Properties (it's free!)

Innovative Industrial Properties' outlook anticipates $257.0 million in revenue and $105.7 million in earnings by 2028. This is based on a 3.7% annual decline in revenue and a $26.2 million decrease in earnings from the current $131.9 million.

Uncover how Innovative Industrial Properties' forecasts yield a $57.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

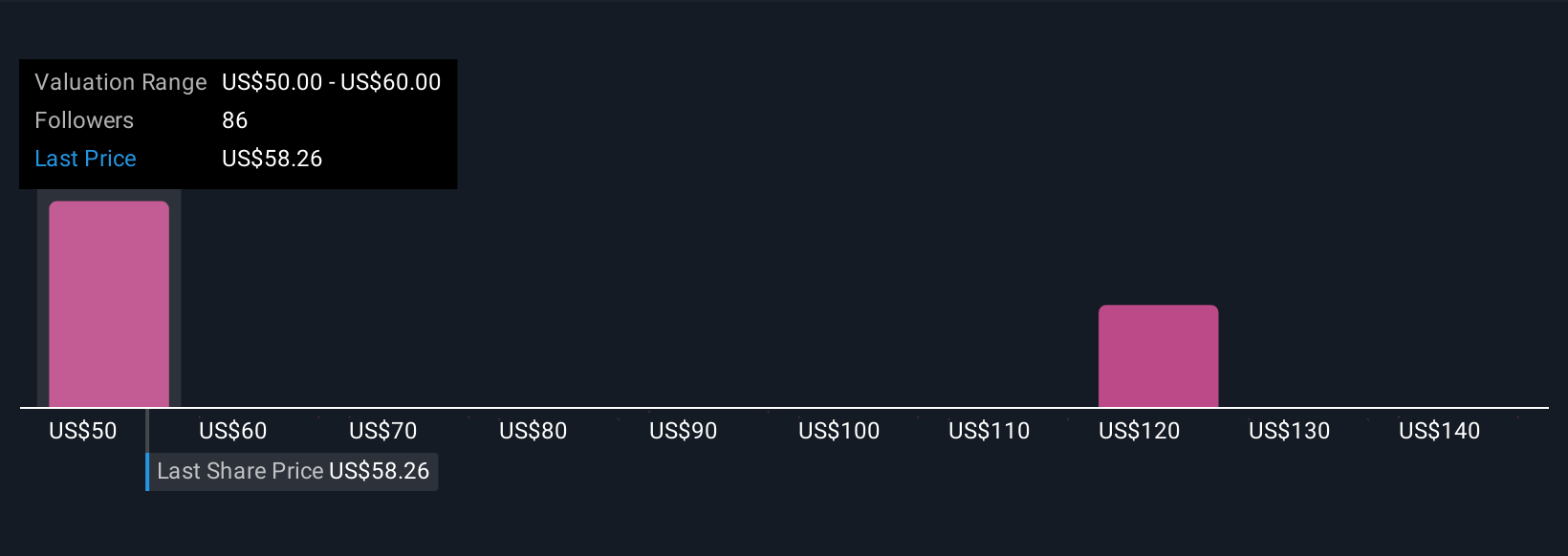

Ten individual fair value estimates from the Simply Wall St Community range widely between US$50 and US$120.84 per share. While opinions differ, concerns about ongoing tenant distress suggest close attention to rent collection and lease renewals may shape the company's future performance.

Explore 10 other fair value estimates on Innovative Industrial Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Innovative Industrial Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovative Industrial Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Innovative Industrial Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovative Industrial Properties' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IIPR

Innovative Industrial Properties

A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties and life science real estate.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives