- United States

- /

- Health Care REITs

- /

- NYSE:HR

Is Cohen & Steers’ Recent Stake Reduction Shifting Long-Term Priorities for Healthcare Realty Trust (HR)?

Reviewed by Sasha Jovanovic

- In the past week, COHEN & STEERS, INC. reduced its holdings in Healthcare Realty Trust Incorporated (NYSE: HR) by over 3.5 million shares as part of a portfolio adjustment, though the company remains a core position in their portfolio.

- This significant repositioning by a major institutional investor could impact market sentiment and highlights ongoing reassessment within the healthcare real estate sector.

- Let's explore how COHEN & STEERS' large stake reduction may influence Healthcare Realty Trust's investment outlook and key business drivers.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Healthcare Realty Trust Investment Narrative Recap

To be a Healthcare Realty Trust shareholder today, you need to believe in the resilient demand for outpatient medical facilities, benefiting from population aging and healthcare spending growth. The recent reduction in COHEN & STEERS' stake, while significant, does not materially affect the primary short-term catalyst: the company’s progress in re-leasing and capitalizing on its lease-up portfolio. The most pressing risk remains execution challenges from ongoing operational shifts, especially as integration and efficiency improvements are still underway.

Among recent announcements, the company’s October 2025 update on a new US$500,000,000 share repurchase program stands out as a response to shifting investor sentiment. While this buyback move could offer price support, success still ties closely to the company’s ability to deliver on cost savings and operating margin goals amid recent downsizing actions and ongoing losses.

However, for investors, it’s also important to consider how unresolved operational hurdles and delayed integration efforts could…

Read the full narrative on Healthcare Realty Trust (it's free!)

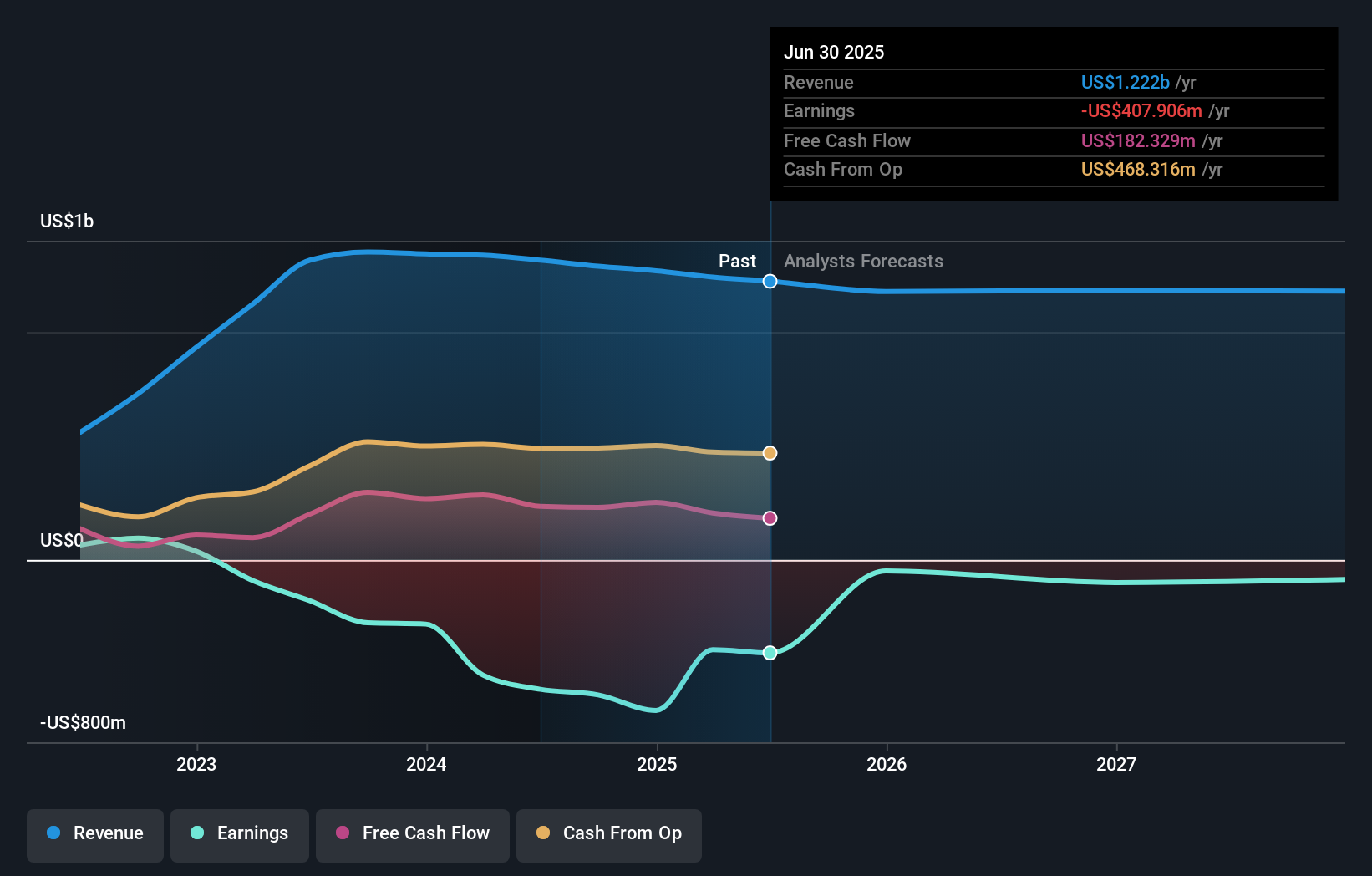

Healthcare Realty Trust's outlook anticipates $1.2 billion in revenue and $275.4 million in earnings by 2028. This projection implies a yearly revenue decline of 1.2% and a $683.3 million increase in earnings from the current figure of -$407.9 million.

Uncover how Healthcare Realty Trust's forecasts yield a $19.30 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two community members on Simply Wall St span US$19.30 to US$25.05 per share, highlighting wide-ranging opinions. Contrast this with existing operational and integration risks that could influence whether expectations for margin improvement and earnings turnaround are fully met.

Explore 2 other fair value estimates on Healthcare Realty Trust - why the stock might be worth as much as 40% more than the current price!

Build Your Own Healthcare Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Healthcare Realty Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Healthcare Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Healthcare Realty Trust's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HR

Healthcare Realty Trust

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives