- United States

- /

- Health Care REITs

- /

- NYSE:HR

Healthcare Realty Trust (HR): Evaluating Value After $500 Million Buyback and New Earnings Guidance

Reviewed by Simply Wall St

Healthcare Realty Trust (HR) just launched a $500 million share buyback program, along with its latest quarterly earnings report. Investors are watching closely as the firm also lowered its 2025 earnings guidance.

See our latest analysis for Healthcare Realty Trust.

Healthcare Realty Trust’s latest quarter saw a mix of cautious optimism and strategic moves. The firm announced a fresh $500 million share repurchase program and continued its regular dividend. Management also lowered earnings guidance for next year following a dip in sales and narrowing net losses. Despite these headline events, the stock’s recent 1-year total shareholder return of 12.5% reflects some regained momentum after a tougher stretch over the last five years. Investors are weighing the new buyback and adjusted earnings outlook as signals for where the company heads next.

If this quarter’s capital moves got your attention, now is a smart time to explore other healthcare stocks with improving fundamentals by checking out See the full list for free.

With shares trading at a discount to analyst targets and new buybacks underway, the big question is whether Healthcare Realty Trust is now undervalued or if the market has already accounted for all the company’s future growth.

Most Popular Narrative: 5.1% Undervalued

With the current fair value estimate at $18.90, just above the last close of $17.93, analysts see modest room for upside if recent momentum holds. This framing sets the stage for what’s driving the model’s calculation.

Sustained demographic tailwinds from the aging U.S. population and persistent growth in healthcare spending are driving long-term, inelastic demand for outpatient medical services, supporting durable occupancy rates and stable rental growth, which is likely to lift Healthcare Realty Trust's revenue and NOI over time.

Curious about the math behind this valuation? The backbone of this forecast is a potent mix of profit margin expansion and industry-defying assumptions about future operating efficiency. Want to know more? See exactly which numbers and strategic shifts are fueling the bullish price target in the full narrative.

Result: Fair Value of $18.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from organizational restructuring and higher leverage could delay operational improvements and constrain Healthcare Realty Trust’s projected margin gains.

Find out about the key risks to this Healthcare Realty Trust narrative.

Another View: Testing the Story with Multiples

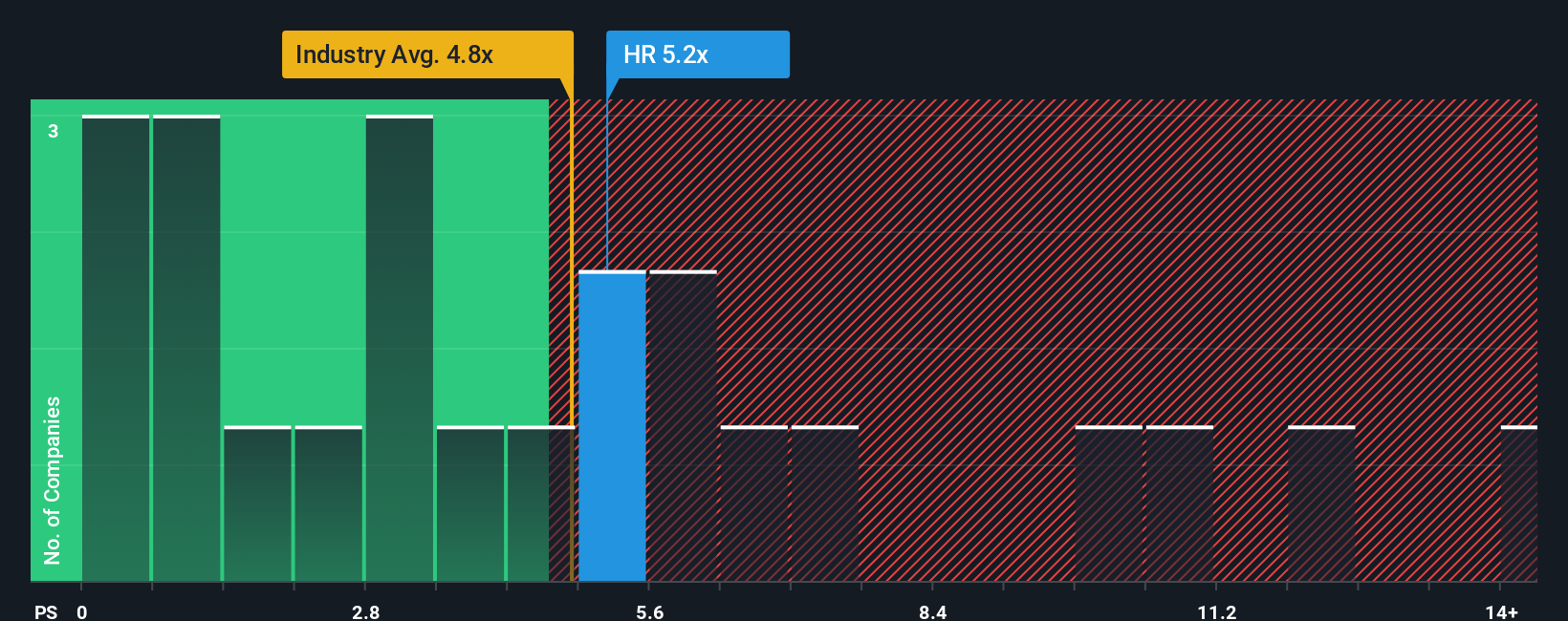

While the fair value model points to undervaluation, looking at the price-to-sales ratio reveals a different angle. Healthcare Realty Trust trades at 5.2x sales, slightly higher than both the US Health Care REIT industry average of 4.7x and its peer average of 5.3x. This suggests that, depending on how the market values this group, HR could face valuation pressure if growth stalls or risks materialize. Does this premium reflect hidden strengths, or signal caution for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Healthcare Realty Trust Narrative

If you think the story could unfold differently or enjoy digging into the numbers yourself, you can build your own perspective in under three minutes and Do it your way

A great starting point for your Healthcare Realty Trust research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investment approach with strategies you might not have considered. Often, the smartest opportunities are just out of sight. Take action now so you don't miss out:

- Unlock long-term income by targeting stable payers through these 20 dividend stocks with yields > 3% delivering yields above market averages, which can be effective for building resilient cash flow.

- Capitalize on breakthrough growth by tapping into these 25 AI penny stocks, where advanced technology is reshaping industries and setting the pace for tomorrow.

- Catalyze your portfolio with hidden value via these 845 undervalued stocks based on cash flows, which the market has not fully priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HR

Healthcare Realty Trust

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives