- United States

- /

- Office REITs

- /

- NYSE:HIW

Highwoods Properties (HIW): Exploring Valuation Opportunities After Recent Share Price Uptick

Reviewed by Simply Wall St

Highwoods Properties (HIW) has seen its stock edge slightly higher recently, with shares moving up around 1% in the latest session. Investors appear to be weighing current market performance in addition to the company’s fundamentals and recent financial trends.

See our latest analysis for Highwoods Properties.

Over the past year, Highwoods Properties has faced a modest 4.45% total shareholder return decline, reflecting cautious sentiment even as the broader real estate sector adjusts to shifting economic factors. Short-term momentum has been muted; however, its three-year total return sits at a respectable 21.8%, suggesting that long-term investors have still seen meaningful gains despite recent bumps.

If you’re interested in what other stocks are attracting insider confidence and growth potential, now is an ideal time to explore fast growing stocks with high insider ownership.

As valuation metrics show Highwoods trading well below analyst targets and at a notable intrinsic discount, it raises a key question for investors. Is there hidden value yet to be realized, or is the market accurately pricing in future prospects?

Most Popular Narrative: 11% Undervalued

Highwoods Properties' most-followed valuation narrative puts fair value at $31.70 per share, compared to the recent market price around $28.08. This gap hints at material upside potential, with market pricing trailing analyst consensus on both future earnings strength and sector resilience.

The company's strategic focus on high-quality, Sunbelt business districts—markets benefiting from robust population and job growth as well as limited new supply—positions Highwoods to capitalize on secular migration trends. This is expected to drive above-average demand and rental rate increases, thus improving net operating income (NOI).

Want to see what’s powering that bullish fair value? Behind this narrative are bold assumptions about future earnings, shrinking margins, and an ambitious valuation multiple. Curious about the precise growth path and the math supporting this target? Unpack the calculation and spot what most investors are missing.

Result: Fair Value of $31.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a surge in office demand or successful asset recycling could quickly boost rental income and margins, which would challenge the more cautious outlook.

Find out about the key risks to this Highwoods Properties narrative.

Another View: Are Shares Really Trading at a Discount?

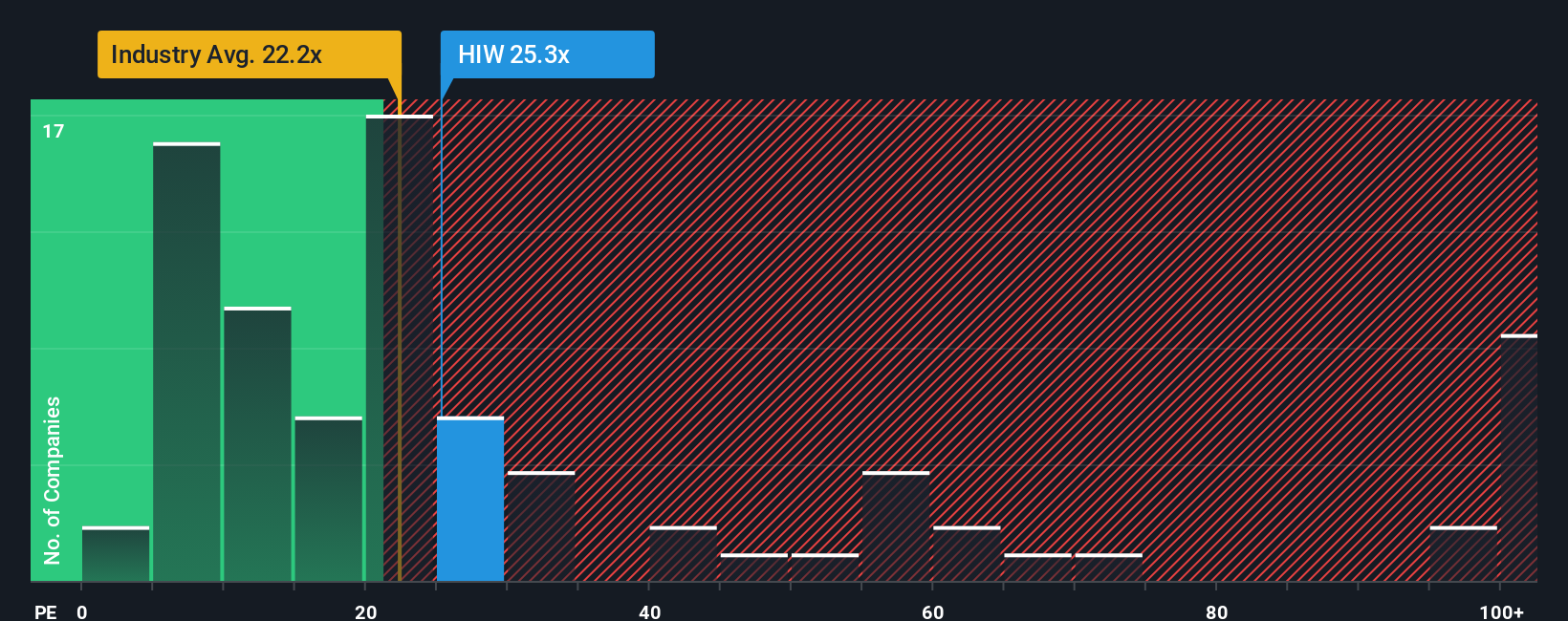

Looking at market price-to-earnings, Highwoods trades at 24.7 times earnings, which is above the broader office REITs industry average of 22.2, but well below the average for its direct peers at 51. The fair ratio signals 23, suggesting the current price may be a bit elevated relative to what the market could eventually settle on. This raises the question: is there hidden upside, or could markets start to price in more risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Highwoods Properties Narrative

Keep in mind, if you see things differently or want to dig into the numbers yourself, you can craft your own story in just a few minutes. Do it your way.

A great starting point for your Highwoods Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and open the door to fresh investment angles that most will overlook. You could be ahead of the crowd by exploring smart opportunities today.

- Boost your income with dependable payouts by checking out these 18 dividend stocks with yields > 3%, which offers strong yields above 3% for greater portfolio stability.

- Capitalize on the power of AI technology by seeing which innovators are moving the market with these 27 AI penny stocks and position yourself for the next big thing.

- Seize undervalued gems based on robust cash flow metrics using these 908 undervalued stocks based on cash flows before these potential winners catch everyone else's attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE:HIW), fully-integrated office real estate investment trust ("REIT") that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives