- United States

- /

- Office REITs

- /

- NYSE:HIW

Does Highwoods Properties’ (HIW) Accelerated Leasing and Asset Recycling Strategy Reinforce Its Long-Term Case?

Reviewed by Sasha Jovanovic

- Highwoods Properties recently reported robust third quarter results, including signing over 1 million square feet in second-generation leases, increased financial guidance, and the pursuit of additional acquisitions in core markets.

- A unique insight is the company’s focus on asset recycling, using proceeds from selling noncore properties to fund targeted acquisitions, which aims to further strengthen portfolio quality and future cash flow.

- We'll examine how Highwoods Properties' accelerated leasing momentum and raised financial outlook could affect its long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Highwoods Properties Investment Narrative Recap

To invest in Highwoods Properties, you need to believe in the ongoing recovery and resilience of modern office demand in key Sunbelt markets, where the company concentrates its portfolio and pursues steady asset recycling. While the recent ramp-up in acquisitions and over 1 million square feet of new leases bolster confidence in embedded growth, the biggest near-term catalyst remains sustained leasing momentum, with the persistent risk of structural office demand changes from remote work still looming; the latest news does not materially shift these critical drivers for now.

The most relevant recent announcement is the company's decision to seek acquisitions exclusively in current markets, paired with plans to sell noncore properties. This asset recycling strategy aims to improve overall portfolio quality and enhance potential long-term cash flow, directly supporting the short-term need for higher quality occupancy and cash generation.

But as headline numbers improve, investors should be aware that the structural shift toward remote work could...

Read the full narrative on Highwoods Properties (it's free!)

Highwoods Properties is projected to reach $903.7 million in revenue and $69.7 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 3.5%, but earnings are expected to decrease by $56.8 million from the current $126.5 million.

Uncover how Highwoods Properties' forecasts yield a $31.70 fair value, a 11% upside to its current price.

Exploring Other Perspectives

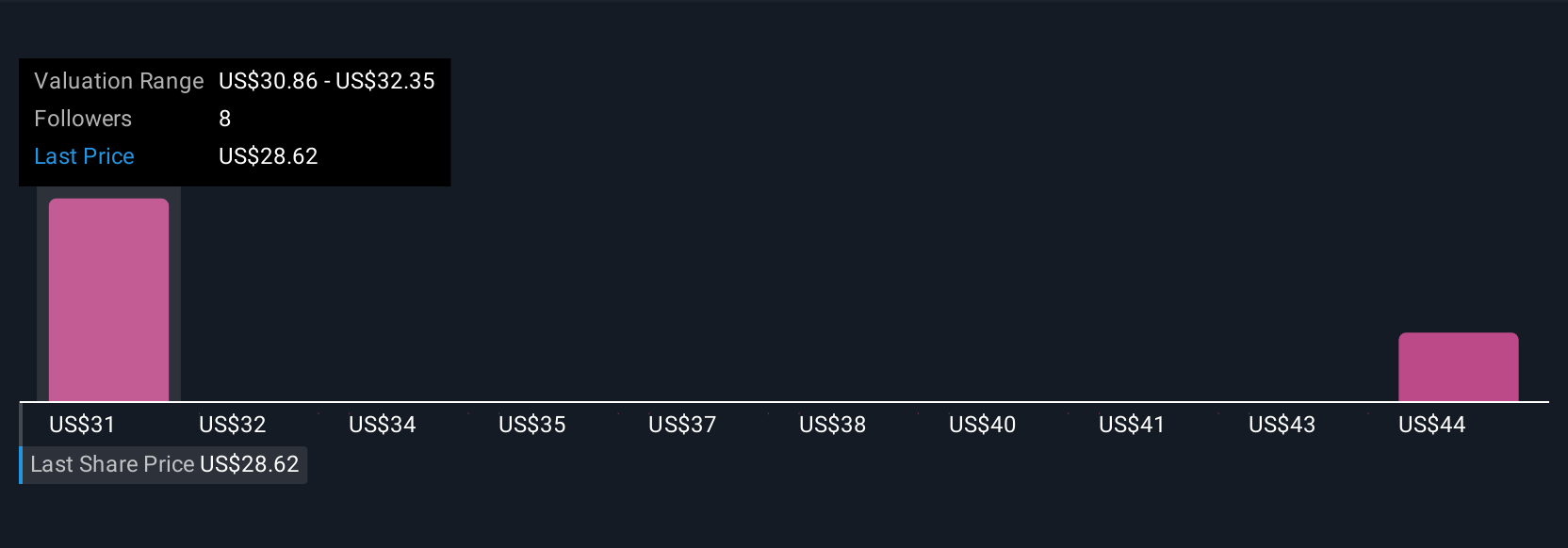

The Simply Wall St Community values Highwoods Properties between US$31.70 and US$41.06, reflecting a wide gap across just two independent analyses. With remote work presenting an ongoing risk to traditional office demand, you can explore many differing viewpoints on Highwoods’ future by digging deeper into the community estimates.

Explore 2 other fair value estimates on Highwoods Properties - why the stock might be worth as much as 43% more than the current price!

Build Your Own Highwoods Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Highwoods Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Highwoods Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Highwoods Properties' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwoods Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIW

Highwoods Properties

Highwoods Properties, Inc., headquartered in Raleigh, is a publicly-traded (NYSE:HIW), fully-integrated office real estate investment trust ("REIT") that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives