- United States

- /

- Retail REITs

- /

- NYSE:GTY

Does Getty Realty’s Recent Slump Signal an Opportunity for 2025?

Reviewed by Bailey Pemberton

If you’re keeping an eye on Getty Realty, you’re probably wondering where the stock stands after a bumpy year. Shares recently closed at $25.79. The chart might look wobbly at first glance, with a 3.4% drop in the past week and an 8.7% dip for the last month. Year-to-date, Getty is down 12.8%, and it has shed 11.1% over the past year. But take a step back. With a 14.1% gain over three years and a notable 33.9% climb in five years, the long-term snapshot isn’t nearly as shaky.

There’s more than just numbers behind these moves. Getty, a real estate investment trust focused on convenience and auto-related properties, has felt the ripple effects of broader shifts in commercial real estate. This sector has its share of skeptics and optimists, and recent market sentiment has boosted volatility, swinging between cautious and opportunistic buying on the back of macro developments. While risk perceptions have changed, the fundamentals may tell a different story, especially when it comes to value.

Here’s where things get interesting. By standard valuation checks, Getty stands out as undervalued on every single measure we track. Out of a possible six, it scores a full 6 on our valuation scorecard, which isn’t easy to come by. That’s got our attention, and it should have yours too.

Let’s break down how Getty’s valuation score is calculated and see which methods point to opportunity or signal caution. If you want the most effective way to size up the real value here, stay tuned for what really matters at the end of this article.

Why Getty Realty is lagging behind its peers

Approach 1: Getty Realty Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the true worth of a company by extrapolating its future cash flows, in this case adjusted funds from operations, and discounting them back to today's value. This allows investors to look past market fluctuations and gain a grounded sense of intrinsic value.

For Getty Realty, the latest reported Free Cash Flow (FCF) is $127.41 million. Analysts forecast annual growth, with FCF expected to rise to $166 million by 2027. While expert estimates cover the next five years, further cash flow projections out to 2035 are based on trends and extrapolations. All cash flows reflected here are in US dollars, and all are well under the billion mark, so they are considered in millions.

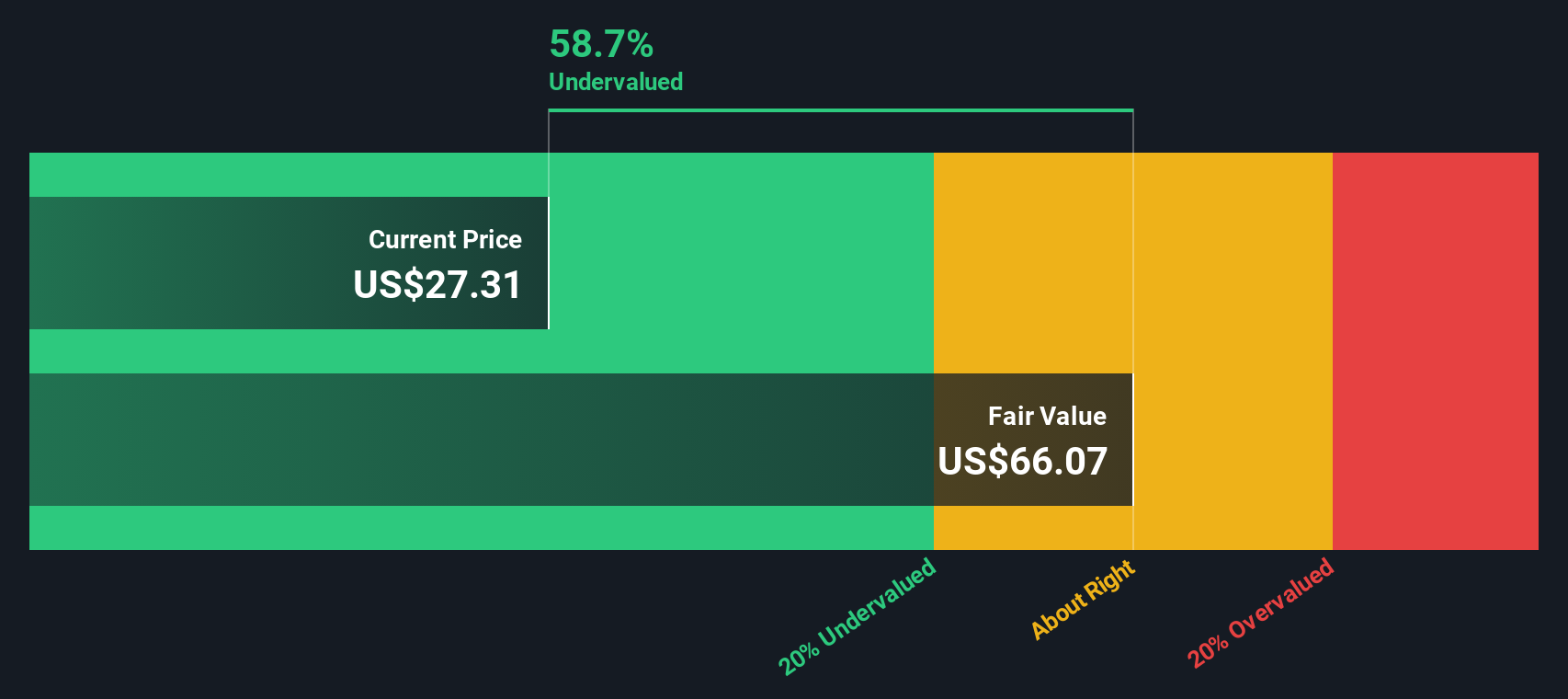

The DCF model used, a two-stage approach relying on adjusted funds from operations, calculates a fair intrinsic value of $59.60 per share. This is based on discounting Getty’s future estimated FCFs and is significantly higher than the current share price of $25.79. This suggests a substantial 56.7% intrinsic discount, indicating the stock is heavily undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Getty Realty is undervalued by 56.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Getty Realty Price vs Earnings

The Price-to-Earnings (PE) ratio is a staple valuation tool for profitable companies like Getty Realty because it directly relates a company’s share price to its per-share earnings. This ratio helps investors gauge how much they’re paying for every dollar of earnings, which is especially telling for businesses with stable and predictable profits.

What’s considered a “normal” or “fair” PE ratio depends on more than just company size. Expectations for future growth and the risks the company faces play big roles. High-growth firms or those with lower risk generally command higher PE ratios, while slower-growing or riskier companies might trade at lower multiples.

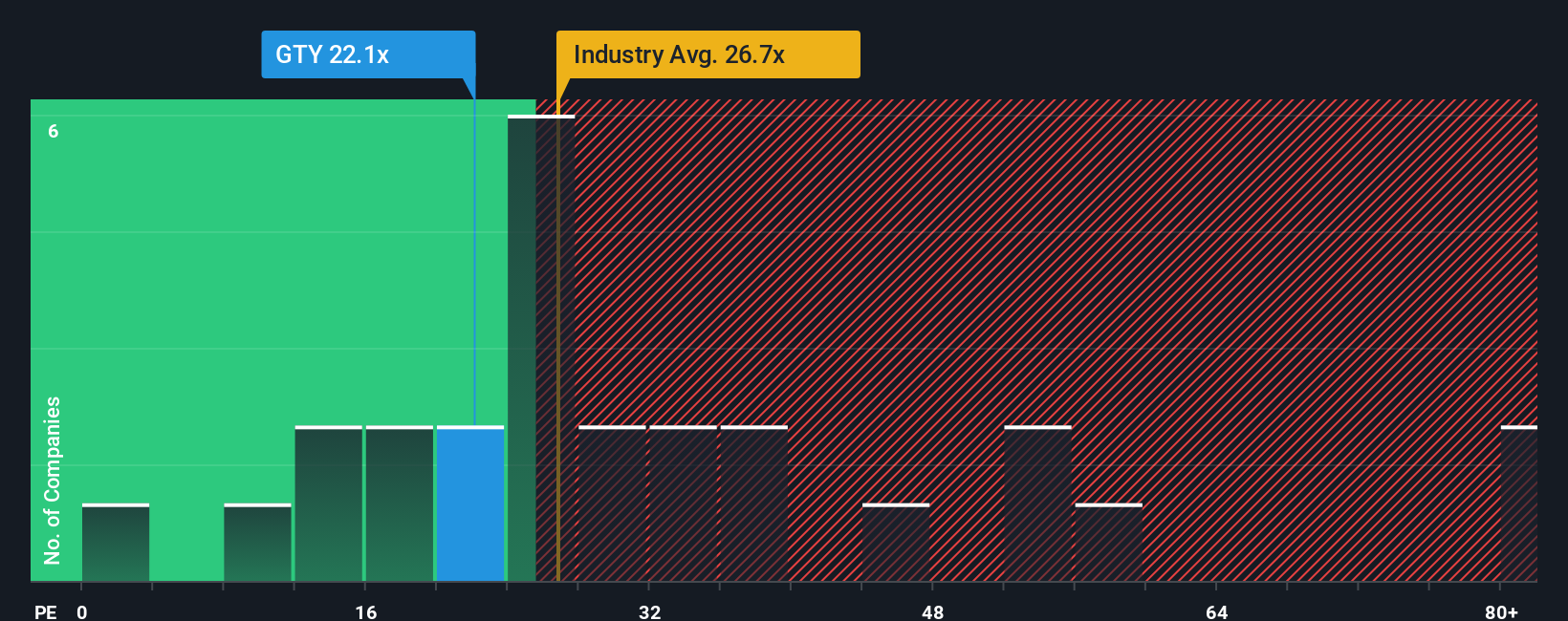

Getty Realty’s current PE ratio stands at 23x. This is below the peer average of 51x and just under the Retail REITs industry average of 25x. However, raw comparisons can be misleading without a deeper look at what the company truly deserves based on its own characteristics.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio for Getty is calculated at 36x, accounting for its unique blend of growth prospects, profit margins, industry factors and market capitalization. This approach surpasses the simplicity of matching against only peer or industry numbers and makes the Fair Ratio a stronger gauge of true value than standard benchmarks.

Since Getty’s actual PE ratio of 23x is significantly below its Fair Ratio of 36x, this points to a clear conclusion: the stock appears undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Getty Realty Narrative

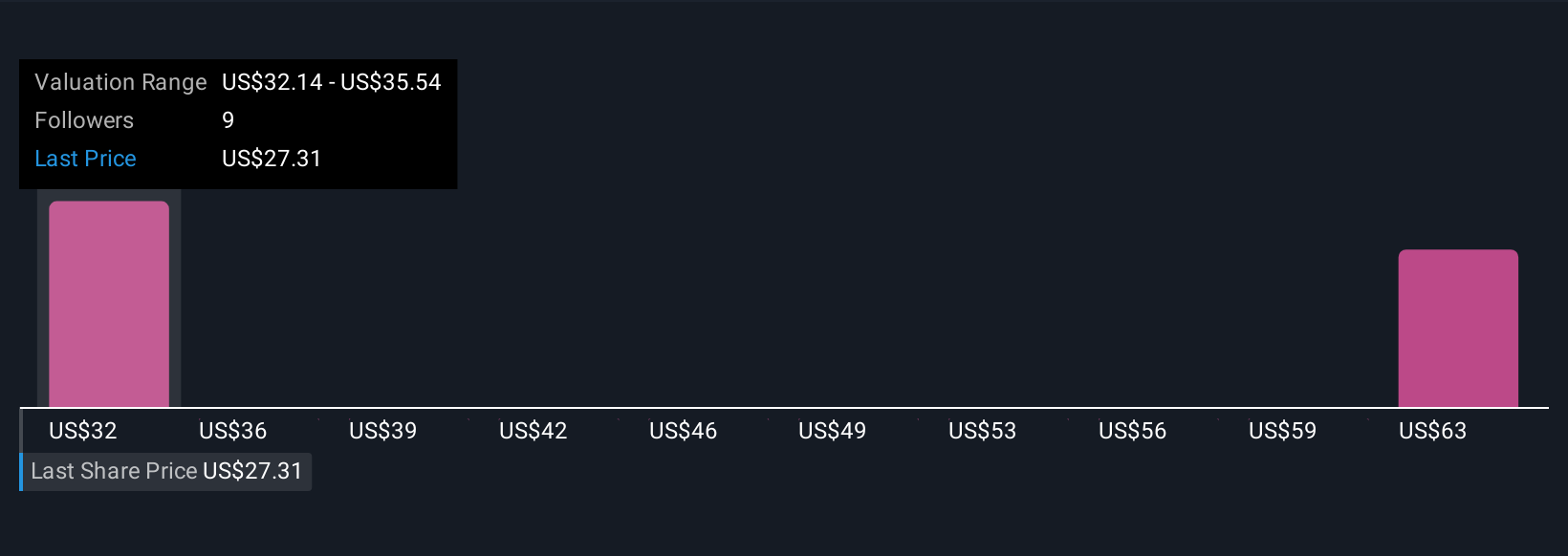

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company. It blends your expectations for its future revenue, earnings, and margins into one big picture, explaining why you think the stock is worth a certain amount. Narratives are powerful because they connect what you believe about Getty Realty’s business to real numbers and a fair value estimate, giving you a clear bridge from story, to forecast, to a decision on buying or selling.

Thanks to Simply Wall St's Community page, creating or viewing Narratives is accessible to everyone and already used by millions of investors. These Narratives help you weigh whether Getty is a buy or a sell by directly comparing your projected fair value with today’s share price. What makes them so effective is that Narratives update dynamically as fresh news and earnings come in, so you always have the latest big picture. For example, the most optimistic Getty Narrative forecasts catalyst-driven rent and earnings growth pushing fair value as high as $32.14 per share, while the lowest expectation sees fair value down nearer $28.63, reflecting caution around industry risks and future margins.

Do you think there's more to the story for Getty Realty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTY

Getty Realty

A publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives