- United States

- /

- Health Care REITs

- /

- NYSE:GMRE

Global Medical REIT (GMRE) Profitability Reinforces Bull Case, But $6.8M One-Off Gain Clouds Narrative

Reviewed by Simply Wall St

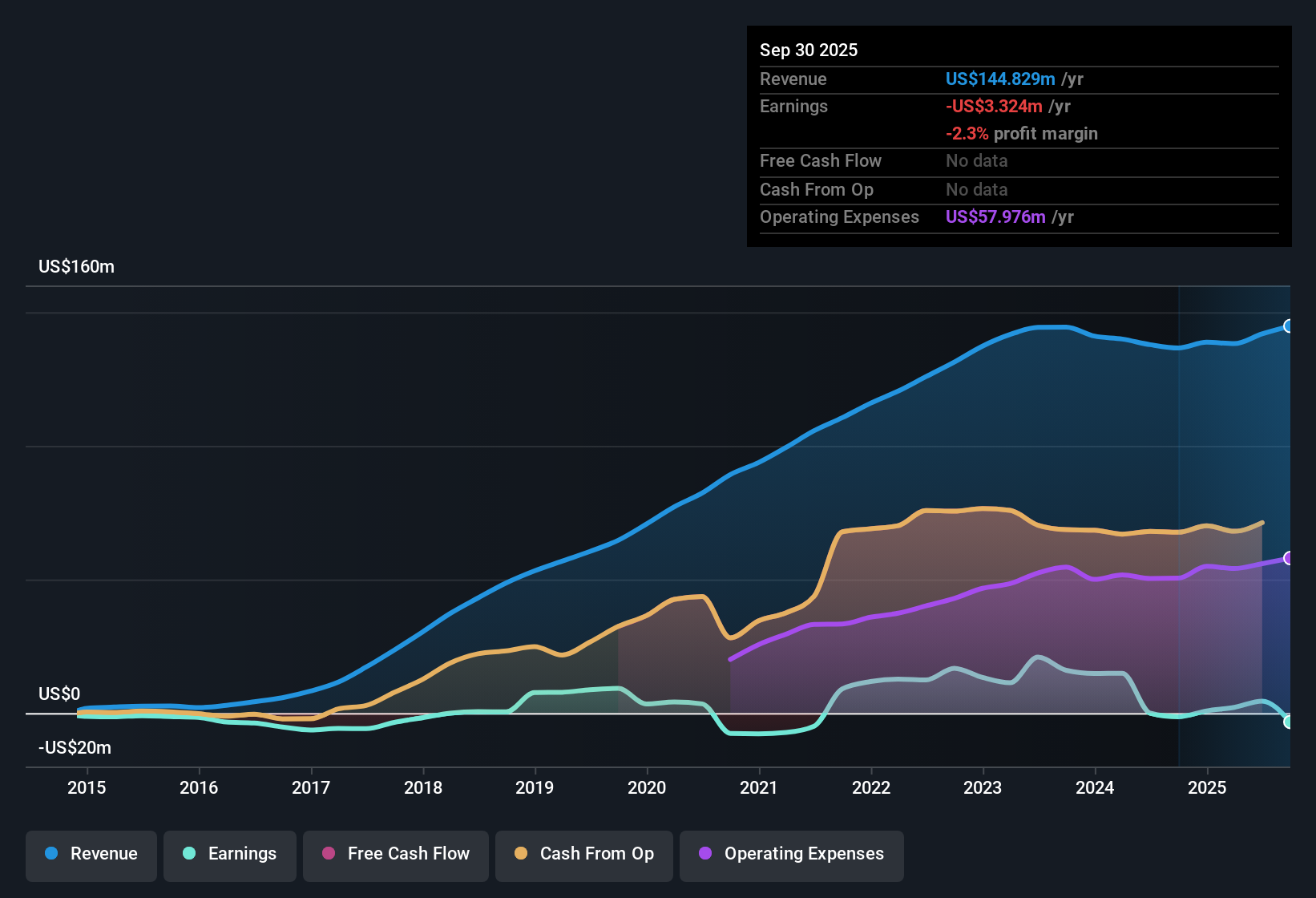

Global Medical REIT (GMRE) has posted a turnaround, moving into profitability as net profit margins improved and earnings climbed by an average of 16.9% per year over the past five years. Looking ahead, earnings are forecast to accelerate by 22.6% per year, outpacing the broader US market's expected 16% growth. However, projected revenue growth of 2.9% per year lags market averages. A one-off gain of $6.8 million played a notable role in the latest results, so investors will want to keep an eye on the quality and sustainability of future earnings.

See our full analysis for Global Medical REIT.Next up, we’ll put these headline numbers side by side with the dominant narratives to see which themes in the market get supported and which might be called into question.

See what the community is saying about Global Medical REIT

Dividend Slashed and Coverage Drops to 79%

- Dividend per share was cut from $0.21 to $0.15, with coverage slipping to 79% of funds available for distribution. This signals tighter cash flow and less room for shareholder payouts.

- Consensus narrative focuses on how reduced dividends and softer coverage ratios are direct responses to recent strains in occupancy and higher debt costs.

- Analysts observe that the shift from 110% to 79% dividend coverage reflects management’s move to safeguard cash in light of refinancing risks, including the $350 million term loan and revolving credit facility both coming due in 2026.

- While the consensus sees this as a prudent step for future stability, it also dampens near-term income appeal and puts greater emphasis on asset recycling and improved tenant performance to support returns.

P/E Ratio Remains Exceptionally High

- GMRE’s price-to-earnings ratio stands at 95.4x, significantly above the industry average of 24x and the broader peer median of 22.8x.

- Consensus narrative notes that while GMRE is trading below DCF fair value of 59.04, the outsized P/E ratio indicates skepticism around the sustainability and repeatability of earnings.

- Analysts highlight that to justify the current premium, future earnings growth and successful re-leasing must occur, or the valuation gap could close through a price correction instead of improved profits.

- This situation reflects a market caught between confidence in healthcare real estate’s long-term drivers and concerns about recent non-recurring windfalls inflating reported numbers.

Refinancing Risk as 2026 Debt Maturities Loom

- Both GMRE’s $350 million term loan and its revolving credit facility mature in 2026, exposing the company to higher borrowing costs if interest rates remain elevated.

- Consensus narrative underscores that these upcoming refinancing hurdles could squeeze net margins and limit future investment if market conditions are unfavorable.

- The risk is heightened by recent declines in occupancy rates, which slipped to 94.5 percent, with some tenants defaulting and potentially impacting both short-term cash flow and long-term property values.

- Analysts say that maintaining balance sheet flexibility through asset sales and capital recycling is important for navigating this debt wall without undermining growth ambitions.

Investors are watching for signs that GMRE can deliver rent growth and stable occupancy while managing refinancing risks and valuation pressures amid the shifting landscape for healthcare real estate. 📊 Read the full Global Medical REIT Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Global Medical REIT on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a different take on the figures? Share your perspective and craft a narrative of your own in just a few minutes. Do it your way

A great starting point for your Global Medical REIT research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Global Medical REIT faces concerns about dividend sustainability, high refinancing risk, and elevated valuation multiples. These factors indicate market doubt about future earnings quality.

If you’re searching for more reliable payout potential and stronger fundamentals, check out solid balance sheet and fundamentals stocks screener (1979 results) to target companies with healthier balance sheets and cash flow to support consistent dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMRE

Global Medical REIT

GMRE is a net-lease medical real estate investment trust (REIT) that acquires healthcare facilities and leases those facilities to physician groups and regional and national healthcare systems.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives