- United States

- /

- Residential REITs

- /

- NYSE:ESS

Does Essex's Strong Q3 Results and Raised Guidance Reshape the Bull Case for ESS?

Reviewed by Sasha Jovanovic

- Essex Property Trust reported third quarter 2025 results with total revenue of US$473.3 million and net income of US$164.62 million, alongside raising its full-year earnings guidance to US$10.53–US$10.63 per diluted share.

- This reflects both a significant year-over-year increase in profitability and management's increased confidence in operational performance for the remainder of 2025.

- We’ll now examine how this guidance raise and strong quarterly performance may influence Essex Property Trust’s investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Essex Property Trust Investment Narrative Recap

At its core, investing in Essex Property Trust means believing in resilient demand for high-quality multifamily housing in tightly supplied West Coast markets, along with the company's disciplined capital allocation. The latest earnings beat and raised guidance reinforce this narrative, but do not materially alter the biggest short-term catalyst: declining new supply in key markets. The principal risk remains Essex's geographic concentration, especially in Southern California, which continues to present economic and regulatory challenges that could disrupt steady income growth.

The recent increase in full-year earnings guidance following strong third quarter results is the most relevant announcement. This demonstrates the company’s improving profitability, but it does not shift the risk that demand softness and elevated concessions in Southern California could pressure future revenue. Investors watching Essex’s operational outperformance should also be aware that...

Read the full narrative on Essex Property Trust (it's free!)

Essex Property Trust is projected to reach $2.1 billion in revenue and $437.0 million in earnings by 2028. This outlook assumes 3.4% annual revenue growth, but a significant earnings decrease of $363.3 million from current earnings of $800.3 million.

Uncover how Essex Property Trust's forecasts yield a $291.70 fair value, a 12% upside to its current price.

Exploring Other Perspectives

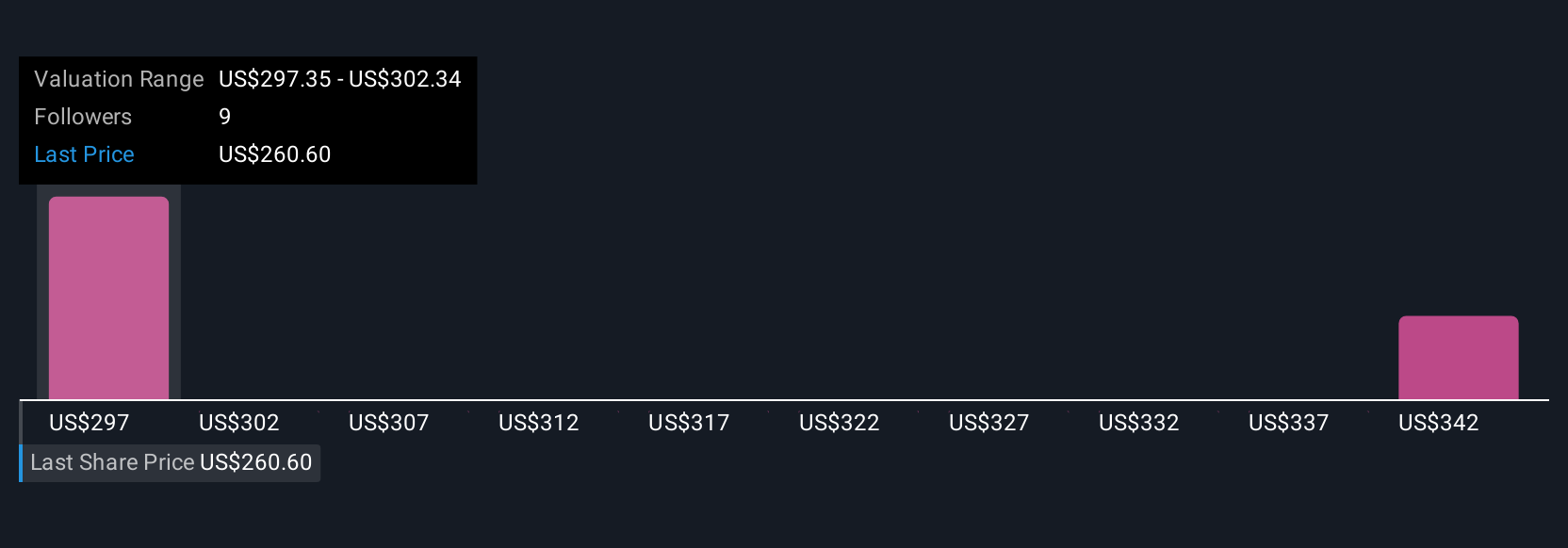

Simply Wall St Community members provided three fair value estimates for Essex Property Trust before the recent news, ranging from US$197.42 to US$404.42. While some see significant upside, Essex’s ongoing exposure to Southern California’s regulatory risks remains a concern for many.

Explore 3 other fair value estimates on Essex Property Trust - why the stock might be worth 24% less than the current price!

Build Your Own Essex Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essex Property Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Essex Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essex Property Trust's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives