- United States

- /

- Office REITs

- /

- NYSE:ESRT

Empire State Realty Trust (ESRT): Assessing Valuation After Earnings, 2025 Guidance Reaffirmation, and Major Leasing Wins

Reviewed by Simply Wall St

Empire State Realty Trust (ESRT) delivered its third quarter results alongside guidance reaffirmation for 2025, while also announcing new marquee leases such as Rolex and upscale dining at flagship properties. This combination is getting investor attention.

See our latest analysis for Empire State Realty Trust.

While the share price has faced challenges this year, dropping 26.75% year-to-date, Empire State Realty Trust saw its stock edge up 2.19% after unveiling new leases with brands like Rolex and SORA, alongside reaffirmed 2025 earnings guidance. Total shareholder return over the past year sits at -30.36%, signaling that momentum remains cautious despite steady retail activity and management’s efforts to reinforce stability.

If news like the Rolex lease has you interested in what else is shaping the market, now is a perfect moment to broaden your view and discover fast growing stocks with high insider ownership

With the stock trading at around a 20% discount to analyst targets and recent leasing wins bolstering sentiment, is this a rare entry point for value-seekers or has the market already accounted for ESRT’s growth prospects?

Most Popular Narrative: 16.9% Undervalued

Empire State Realty Trust’s most-followed narrative places fair value at $8.97 per share, notably above its latest close of $7.45. The framework forecasts a sizable gap to the market that’s being closely watched.

Robust leasing momentum for modern, amenity-rich office space, evidenced by 16 consecutive quarters of positive leasing spreads, rising occupancy, and longer lease terms, positions ESRT to grow revenue and drive higher net operating income as companies continue to prioritize high-quality, sustainable urban workplaces.

Want to know why this valuation stands out from peers? There is a bold set of future margin assumptions and growth drivers beneath the surface. The model’s long-term earnings forecast and a striking profit multiple could upend your expectations. See the underlying moves that justify this price target.

Result: Fair Value of $8.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in international tourism or persistently rising operating costs could quickly undermine the current optimism surrounding Empire State Realty Trust's outlook.

Find out about the key risks to this Empire State Realty Trust narrative.

Another View: What Do Valuation Ratios Tell Us?

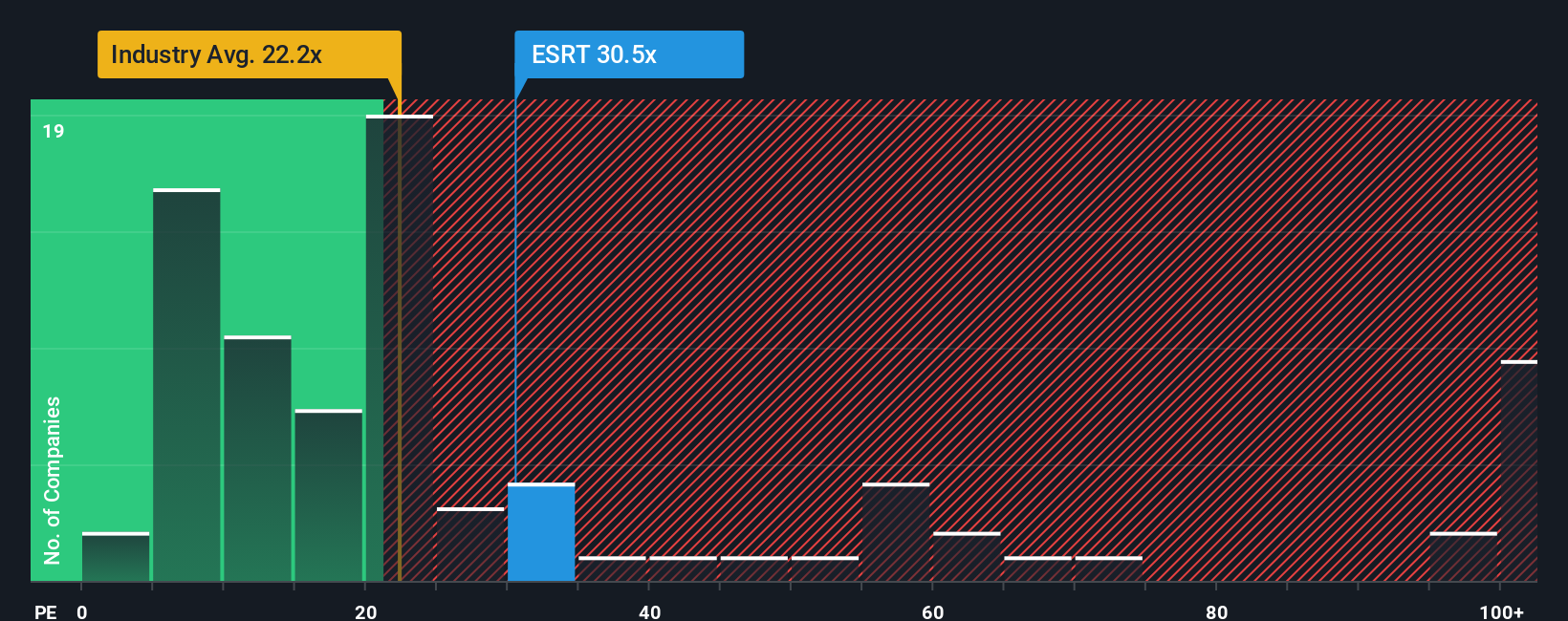

Stepping away from the narrative-led price target, let’s look at the numbers investors often rely on. Empire State Realty Trust trades at a price-to-earnings ratio of 36.3x, which is higher than the global Office REITs industry average of 22.4x. Compared to its own peers (average 55.4x), it looks more reasonably valued. However, it is still noticeably above the fair ratio of 23.4x estimated by our models.

This sizable premium signals potential risk if the market shifts toward the fair ratio. Will ESRT’s recent momentum be enough to sustain these multiples, or could a reversion pressure the stock? See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Empire State Realty Trust Narrative

If you see a different story in the data or want to reach your own conclusions, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Maximize your investing confidence by tapping into handpicked stock selections tailored to your interests, risk level, and goals. Don’t let the next big opportunity slip by. Take action today.

- Spot market bargains now by tapping into these 870 undervalued stocks based on cash flows that are priced below their intrinsic value and primed for future upside.

- Unlock the tech edge and ride the artificial intelligence wave with these 24 AI penny stocks poised for rapid growth in tomorrow’s economy.

- Boost your income strategy by targeting reliable payouts and stability with these 16 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives