- United States

- /

- Office REITs

- /

- NYSE:ESRT

Does ESRT’s New SORA and Rolex Leases Signal Enduring Demand for Prime Manhattan Properties?

Reviewed by Sasha Jovanovic

- Empire State Realty Trust recently announced its third-quarter 2025 earnings, reporting sales of US$158.41 million and new tenant leases for a 14,430 sq. ft. SORA fine dining venue at One Grand Central Place and a 3,709 sq. ft. Rolex retail store at North Sixth Street.

- Alongside reaffirmed earnings guidance for the year, these developments highlight ongoing tenant interest in its premium Manhattan properties during a period of shifting market conditions.

- We'll examine how the new high-profile retail and dining leases influence Empire State Realty Trust's overall investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Empire State Realty Trust Investment Narrative Recap

To be a shareholder in Empire State Realty Trust, you typically need to believe in the ongoing value and resilience of premier Manhattan office and retail real estate, especially during evolving market dynamics and changing tenant preferences. Recent leasing wins, like those for the Rolex store and SORA dining venue, reinforce the company’s leasing momentum but do not materially shift the short-term focus: demonstrating sustained rental growth remains the principal catalyst, while persistently rising operating expenses are the key risk to monitor.

The signing of the SORA lease at One Grand Central Place stands out this quarter, underlining ESRT’s strategy to attract high-end tenants that can draw steady traffic and supplement recurring rental income. This aligns directly with efforts to drive strong leasing performance in premium locations, a critical support against cyclical pressures in the office sector.

By contrast, investors should still be aware of how escalating maintenance and real estate costs could impact the company’s net margins if not offset by revenue growth...

Read the full narrative on Empire State Realty Trust (it's free!)

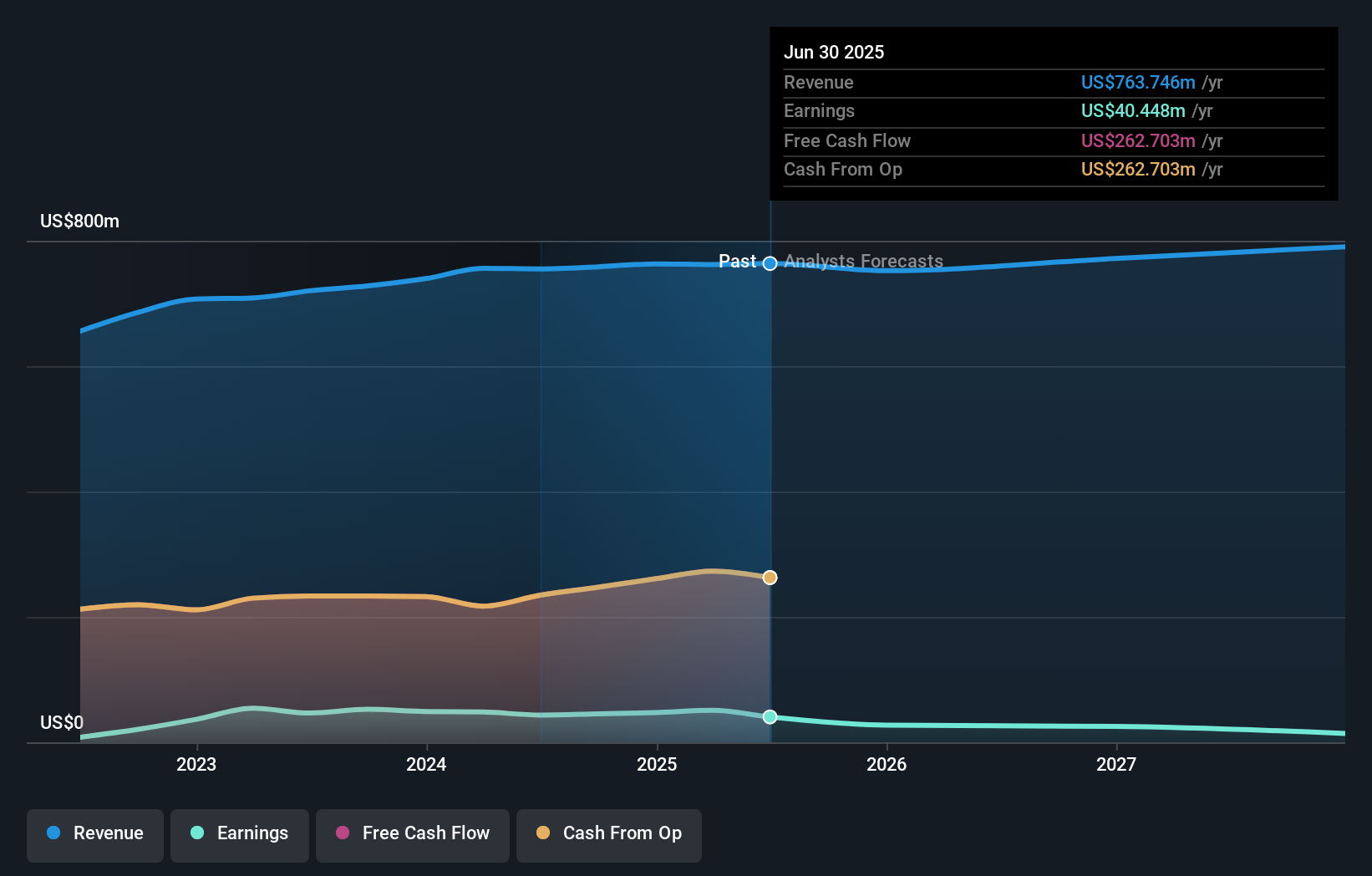

Empire State Realty Trust's narrative projects $797.6 million in revenue and $13.7 million in earnings by 2028. This requires 1.5% yearly revenue growth and a $26.7 million decrease in earnings from $40.4 million currently.

Uncover how Empire State Realty Trust's forecasts yield a $8.97 fair value, a 20% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community counted one fair value estimate for ESRT at US$8.97 per share. Against a backdrop of robust leasing momentum, consider how ongoing changes in tenant demand may further influence these valuations and future business results.

Explore another fair value estimate on Empire State Realty Trust - why the stock might be worth just $8.97!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives