- United States

- /

- Industrial REITs

- /

- NYSE:EGP

Third-Quarter Earnings Beat Could Be a Game Changer for EastGroup Properties (EGP)

Reviewed by Sasha Jovanovic

- On November 5, 2025, EastGroup Properties reported third-quarter results that exceeded analyst forecasts, posting earnings per share of US$1.26 and revenue of US$182.14 million.

- This strong financial performance was followed by ongoing optimism from analysts, highlighting growing confidence in the company's fundamentals and future prospects.

- We'll explore how EastGroup's outperformance on quarterly earnings influences its investment outlook and growth expectations moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

EastGroup Properties Investment Narrative Recap

To be comfortable owning EastGroup Properties, shareholders need to believe in the continued strength of Sunbelt and high-growth markets, as well as the durability of logistics and e-commerce trends supporting industrial properties. While the company’s recent earnings beat is a positive development and boosts optimism, it does not materially alter the key near-term catalyst, securing robust leasing in supply-constrained, high-demand regions, or the biggest risk, which remains pressure on rental growth and margins in challenged markets like Southern California.

The most relevant recent announcement is the company’s third-quarter 2025 results, which showed not only a beat on analyst expectations but also year-over-year increases in both revenue and net income. This performance supports the narrative of strong fundamentals, yet investors continue to weigh these gains against market-specific risks and persistent macroeconomic uncertainties.

Yet, even amid these tailwinds, investors should be aware of how prolonged tenant uncertainty in core markets could still challenge...

Read the full narrative on EastGroup Properties (it's free!)

EastGroup Properties' narrative projects $921.3 million in revenue and $339.7 million in earnings by 2028. This requires 10.8% yearly revenue growth and a $103.2 million earnings increase from $236.5 million currently.

Uncover how EastGroup Properties' forecasts yield a $192.21 fair value, a 7% upside to its current price.

Exploring Other Perspectives

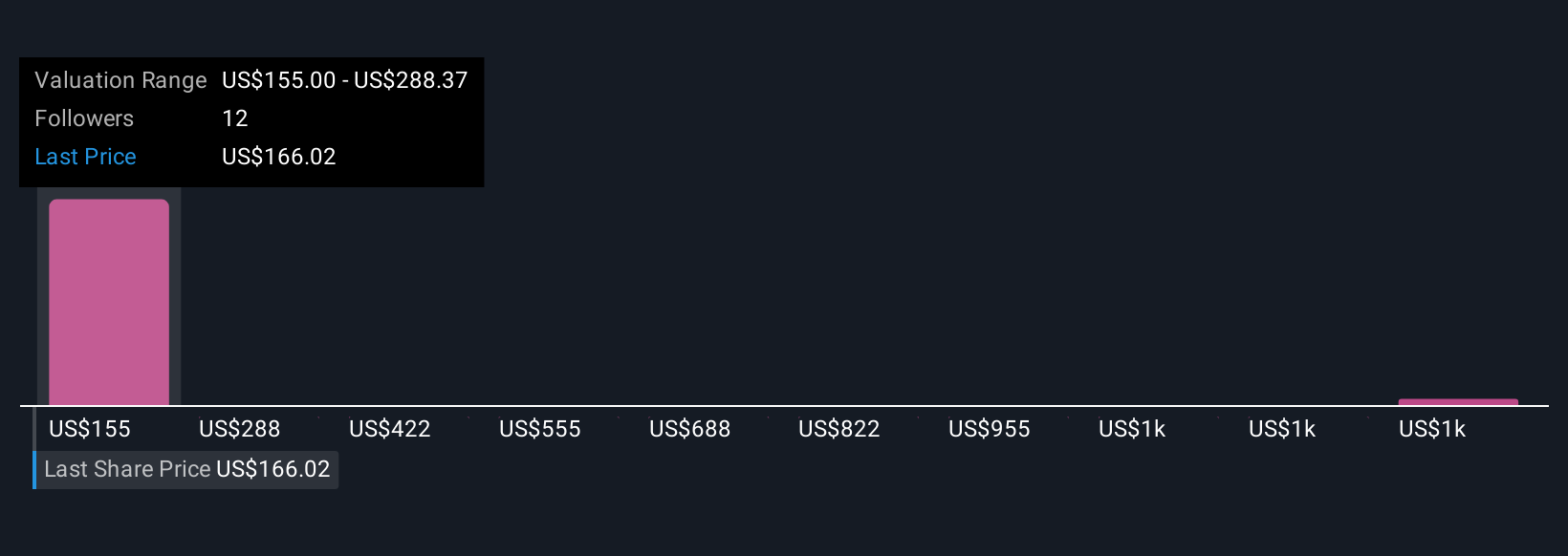

Five members of the Simply Wall St Community offered fair value estimates of EastGroup Properties, ranging from US$155 to US$1,488.67 per share. With ongoing concerns about rent growth and margins in key regions, your view on regional risk factors could strongly influence your outlook.

Explore 5 other fair value estimates on EastGroup Properties - why the stock might be worth 14% less than the current price!

Build Your Own EastGroup Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EastGroup Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EastGroup Properties' overall financial health at a glance.

No Opportunity In EastGroup Properties?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives