- United States

- /

- Health Care REITs

- /

- NYSE:DOC

Will Healthpeak (DOC) Shift in Profitability and Share Buybacks Reveal a New Approach to Capital Allocation?

Reviewed by Sasha Jovanovic

- Healthpeak Properties recently reported earnings for the third quarter and nine months ended September 30, 2025, showing revenue growth to US$705.87 million year-over-year but shifting from a net income of US$85.87 million to a net loss of US$117.12 million in the latest quarter.

- Although no new shares were repurchased from July to September 2025, the company has completed a buyback of over 5 million shares, signaling a focus on capital allocation amid changing financial performance.

- With the company's latest results highlighting a swing from profit to loss, we’ll explore how this impacts Healthpeak’s broader investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Healthpeak Properties Investment Narrative Recap

To be a Healthpeak Properties shareholder, you’ll need to believe in the continued demand for high-acuity outpatient and life sciences real estate, backed by demographic trends and healthcare shifts. The recent swing to a net loss and flat sales introduces uncertainty but doesn’t materially affect the near-term catalyst of stable outpatient property demand; however, it draws attention to ongoing earnings risks tied to sector volatility and capital market access.

Of the recent announcements, the third quarter’s earnings report is the most relevant, highlighting a reversal from net income to net loss even as revenue was essentially flat. This development is particularly relevant for investors focused on earnings reliability, as near-term pressures on profitability and capital flexibility could now have a heightened impact on the company’s ability to fund new developments or maintain dividends.

By contrast, investors should keep an eye on how prolonged capital market weakness could limit Healthpeak’s ability to manage debt maturities and invest for growth...

Read the full narrative on Healthpeak Properties (it's free!)

Healthpeak Properties is projected to achieve $3.1 billion in revenue and $198.8 million in earnings by 2028. This outlook is based on a 3.0% annual revenue growth rate and calls for a $34.8 million earnings increase from the current $164.0 million.

Uncover how Healthpeak Properties' forecasts yield a $21.03 fair value, a 20% upside to its current price.

Exploring Other Perspectives

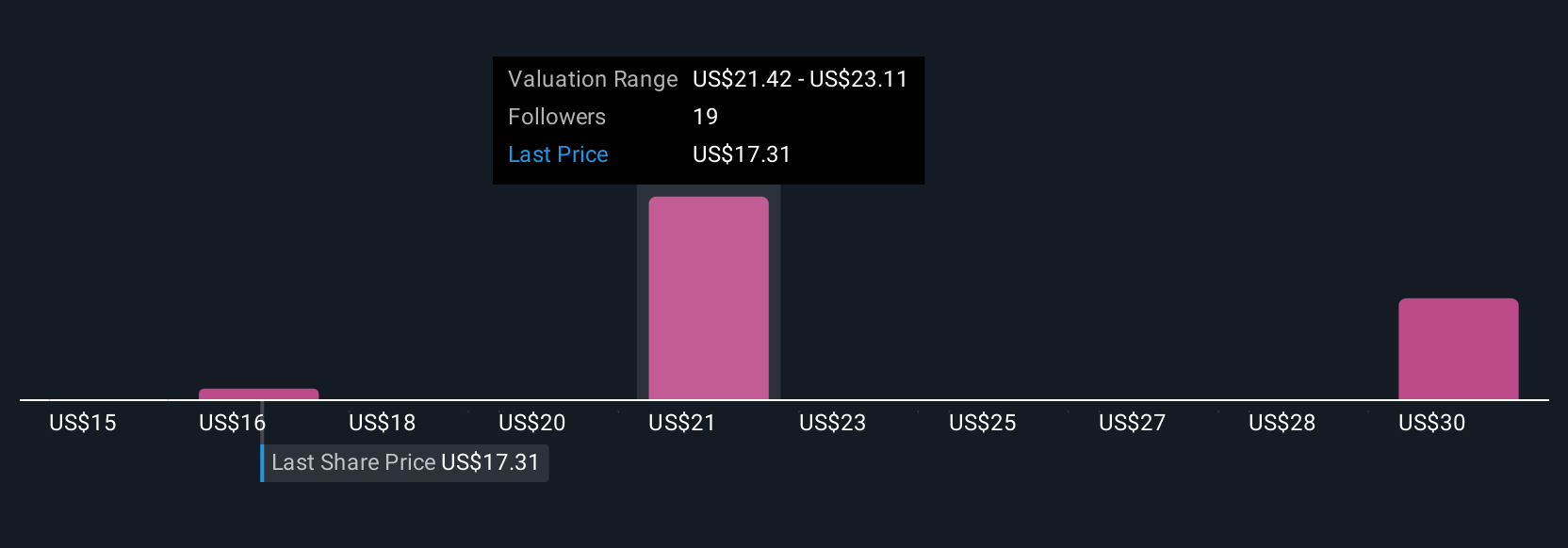

Six fair value estimates from the Simply Wall St Community range from US$14.63 to US$33.18 per share. With recent profitability pressures, you’ll find sharply contrasting views on future performance and can weigh several alternative viewpoints for yourself.

Explore 6 other fair value estimates on Healthpeak Properties - why the stock might be worth as much as 89% more than the current price!

Build Your Own Healthpeak Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Healthpeak Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Healthpeak Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Healthpeak Properties' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthpeak Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOC

Healthpeak Properties

A Standard & Poor’s (“S&P”) 500 company that owns, operates, and develops high-quality real estate focused on healthcare discovery and delivery in the United States (“U.S.”).

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives