- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty Trust (DLR): Exploring Valuation After Major Green Bond Issuance and Sustained Data Center Growth

Reviewed by Simply Wall St

Digital Realty Trust (DLR) is taking another step toward sustainability. The company announced the issuance and sale of €1.4 billion in green notes to support a range of eco-friendly projects and finance future initiatives.

See our latest analysis for Digital Realty Trust.

After last year's momentum, Digital Realty Trust has seen its share price cool off, with a 30-day share price return of -12.22% and a year-to-date return of -11.09%. However, the bigger picture shows the stock's three-year total shareholder return is an impressive 60.9%, highlighting long-term value despite recent volatility and occasional dips tied to broader market moves and company news.

If the renewed focus on sustainability has you rethinking what else is out there, now is the time to discover fast growing stocks with high insider ownership

With shares down this year and trading below analyst price targets, is Digital Realty Trust now undervalued or has the market already factored in its future growth? Is this a real buying opportunity or not?

Most Popular Narrative: 21% Undervalued

Digital Realty Trust last changed hands at $157.37, while the most-followed narrative suggests its true worth is $199.19. This sets up a compelling valuation gap driven by expectations for future growth and profitability.

“Digital Realty's record backlog of leases, which have not yet commenced, indicates strong future revenue potential and earnings growth due to steady demand for data center capacity, particularly from AI and cloud service providers. The successful formation of Digital Realty's first U.S. hyperscale fund is expected to fuel future growth with up to $10 billion in investments, leading to enhanced revenue and returns through fees, highlighting its significant potential impact on long-term earnings sustainability.”

Curious how a future shaped by giant pipeline deals and huge investments could create this much upside? The real story behind this narrative is a mix of surging industry demand, ambitious market expansion, and a bold earnings forecast. These details might surprise even seasoned investors. Ready to see which moving pieces drive the numbers? Dive into the full narrative to uncover the assumptions behind this valuation call.

Result: Fair Value of $199.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion in key U.S. markets or unexpected interest rate increases could put pressure on Digital Realty Trust’s future revenue growth and profitability.

Find out about the key risks to this Digital Realty Trust narrative.

Another View: What About Traditional Market Ratios?

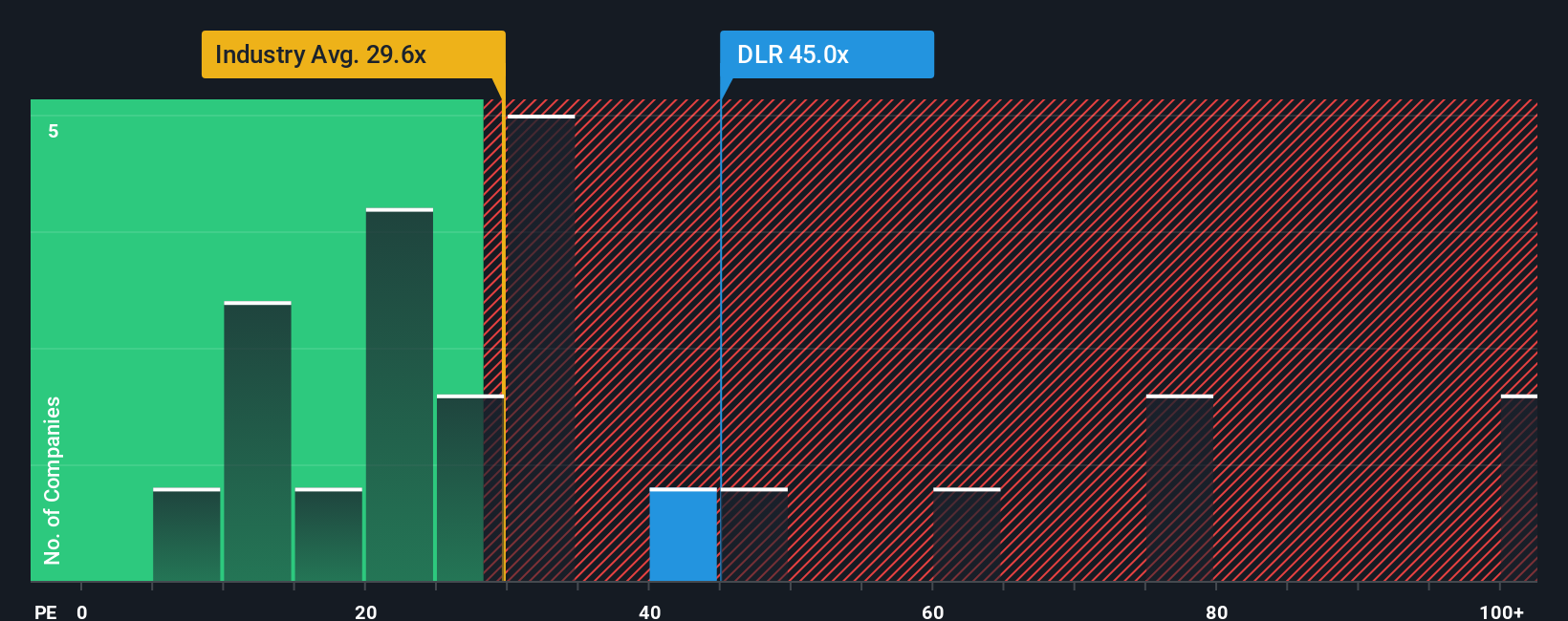

Looking at market ratios, Digital Realty Trust is trading at a price-to-earnings ratio of 39.8x, higher than both its industry average (28.3x) and its peer group (34.1x). The fair ratio implied by regression analysis is 28x. This suggests the current premium leaves less margin for error if growth falls short. Does this market confidence reflect real potential, or is there valuation risk lurking here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you think there’s more to the story, or want to see how your own research compares, you can build a personal take in just a few minutes. Do it your way

A great starting point for your Digital Realty Trust research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s opportunities slip by. Use the Simply Wall Street Screener to spot industries and companies reshaping tomorrow’s market. A smarter portfolio starts with smart choices.

- Unlock income potential and capital stability by reviewing these 14 dividend stocks with yields > 3% with robust yields exceeding 3%.

- Get ahead of AI innovation by evaluating these 26 AI penny stocks as these options are set to transform sectors through artificial intelligence leadership.

- Find exceptional value plays when you sift through these 925 undervalued stocks based on cash flows based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success