- United States

- /

- Office REITs

- /

- NYSE:DEA

Is Now the Moment to Reassess Easterly Government Properties After 25% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Easterly Government Properties is a hidden bargain or just a value trap? We are about to break down what really matters when weighing up this stock's price.

- The share price has not painted a rosy picture recently, slipping by 0.3% in the last week and down a significant 25.2% so far this year.

- Recent news has put the company in the spotlight as market sentiment shifts around government-backed REITs. Developments tied to federal property leasing and broader commercial real estate concerns have sparked debate about the outlook for stable income and risk in this specialized sector.

- The current valuation score for Easterly Government Properties is 2 out of 6, so there is room for improvement. Next, we will examine the common methods for judging value. Stay tuned, as we will share a better perspective on the company's worth by the end of this article.

Easterly Government Properties scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Easterly Government Properties Discounted Cash Flow (DCF) Analysis

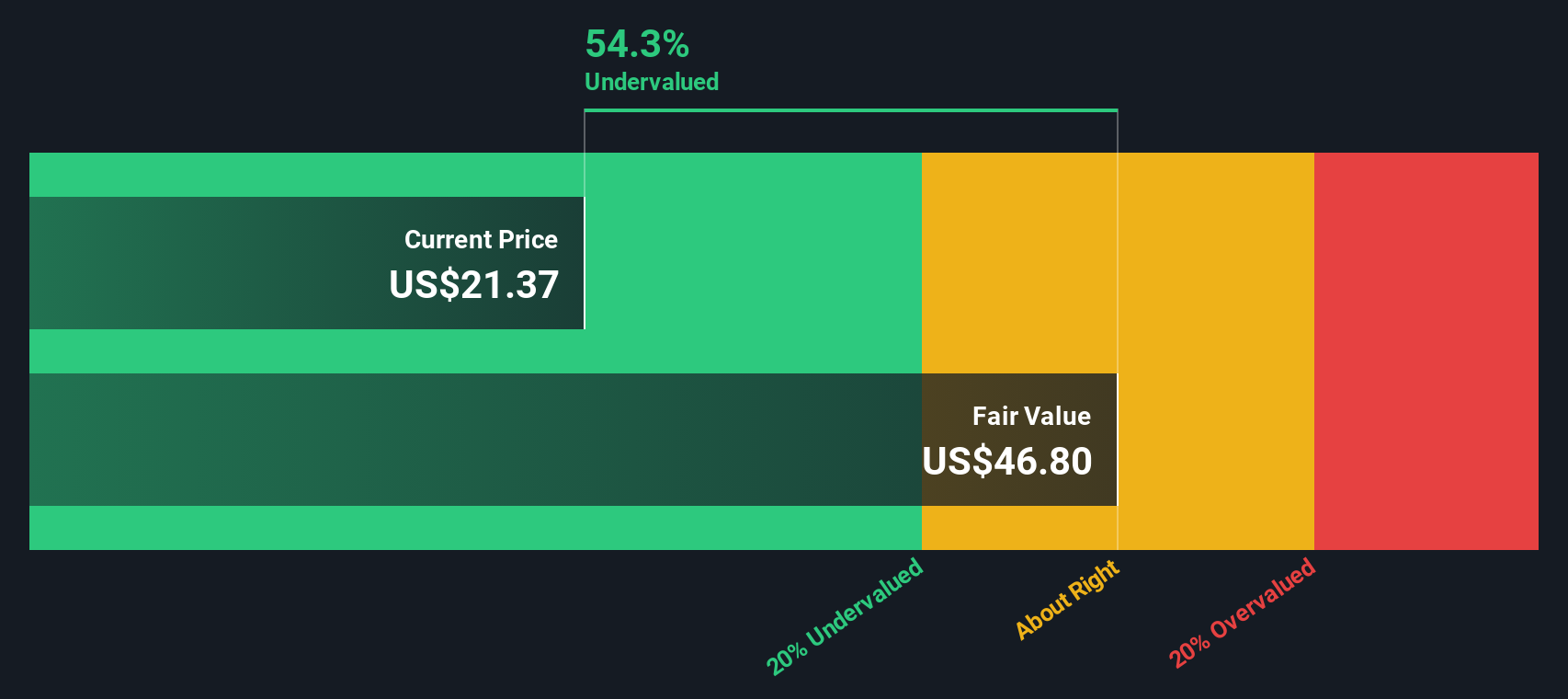

The Discounted Cash Flow (DCF) model estimates the true worth of a business by projecting its future cash flows, here using adjusted funds from operations, and discounting those payments back to today's value. This approach provides a clearer sense of long-term value than relying solely on reported earnings or accounting ratios.

For Easterly Government Properties, the DCF analysis starts with its latest annual free cash flow of $124 million. Analyst estimates project this figure to grow steadily, reaching about $145 million in 2029. For years beyond the analyst forecast window, industry-standard growth rates are applied to continue the projections out for a full decade. All future values are discounted back to their present value in dollars, considering both expected growth and the time value of money.

The result of this comprehensive DCF study is an intrinsic fair value of $47.73 per share. Compared to the current market price, this implies the stock is trading at a 55.1% discount, and therefore appears significantly undervalued according to the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Easterly Government Properties is undervalued by 55.1%. Track this in your watchlist or portfolio, or discover 860 more undervalued stocks based on cash flows.

Approach 2: Easterly Government Properties Price vs Earnings

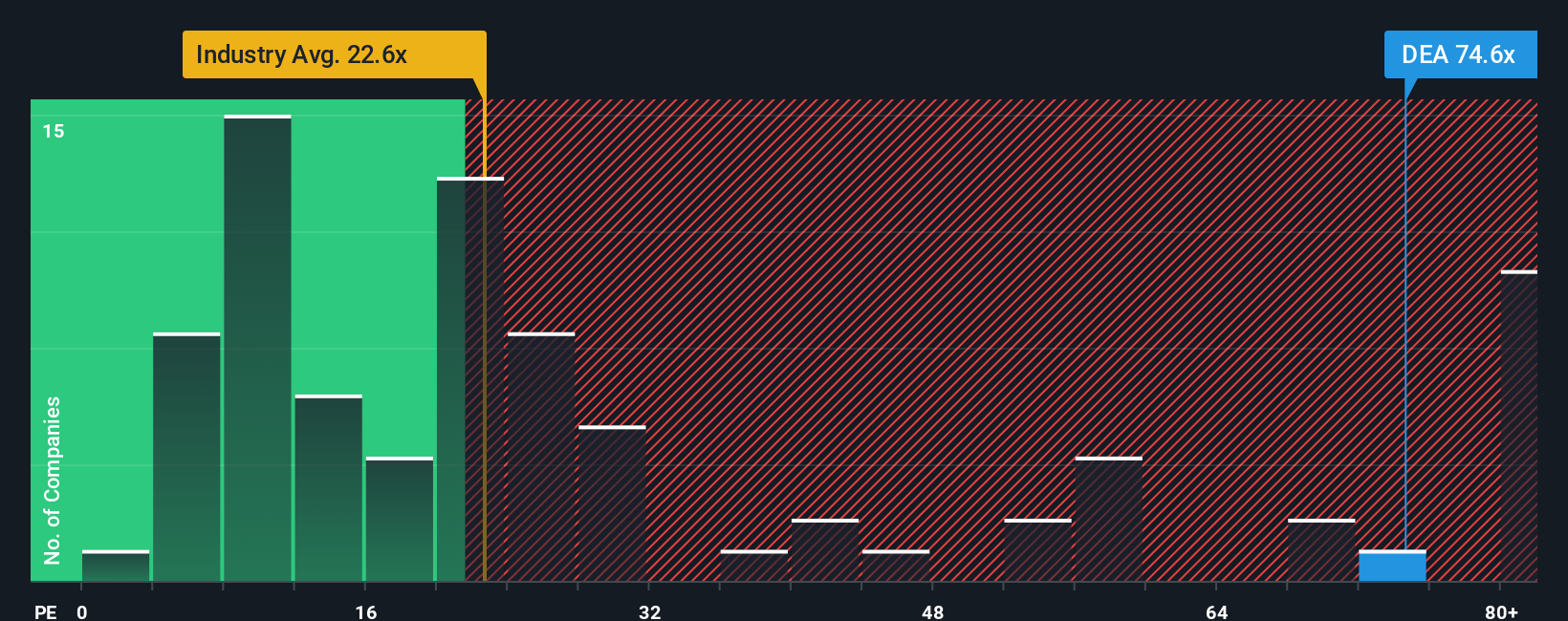

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it measures how much investors are willing to pay for each dollar of a company's earnings. For businesses like Easterly Government Properties that consistently generate profits, the PE ratio serves as a quick snapshot of market sentiment and value relative to performance.

It's important to remember that growth prospects and risk play a big role in what constitutes a “normal” or “fair” PE ratio. Companies expected to grow faster or with more predictable earnings tend to justify higher PE multiples, while riskier or slower-growing companies generally trade at lower ratios.

Currently, Easterly Government Properties trades at a PE ratio of 74.56x. This is well above the Office REITs industry average of 22.44x and also exceeds the peer average of 44.68x. At first glance, this suggests the stock may be trading at a premium to its sector.

However, rather than relying solely on market or industry averages, Simply Wall St's "Fair Ratio" offers a more tailored benchmark. The Fair Ratio incorporates not just industry trends, but also factors such as Easterly's earnings growth outlook, profit margins, market size, and unique risks. For Easterly, this proprietary Fair Ratio works out to 34.92x, providing a deeper perspective on what the stock should reasonably be valued at right now.

Comparing this Fair Ratio of 34.92x to the actual multiple of 74.56x reveals the stock is trading at a premium well above what its fundamentals suggest is fair.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

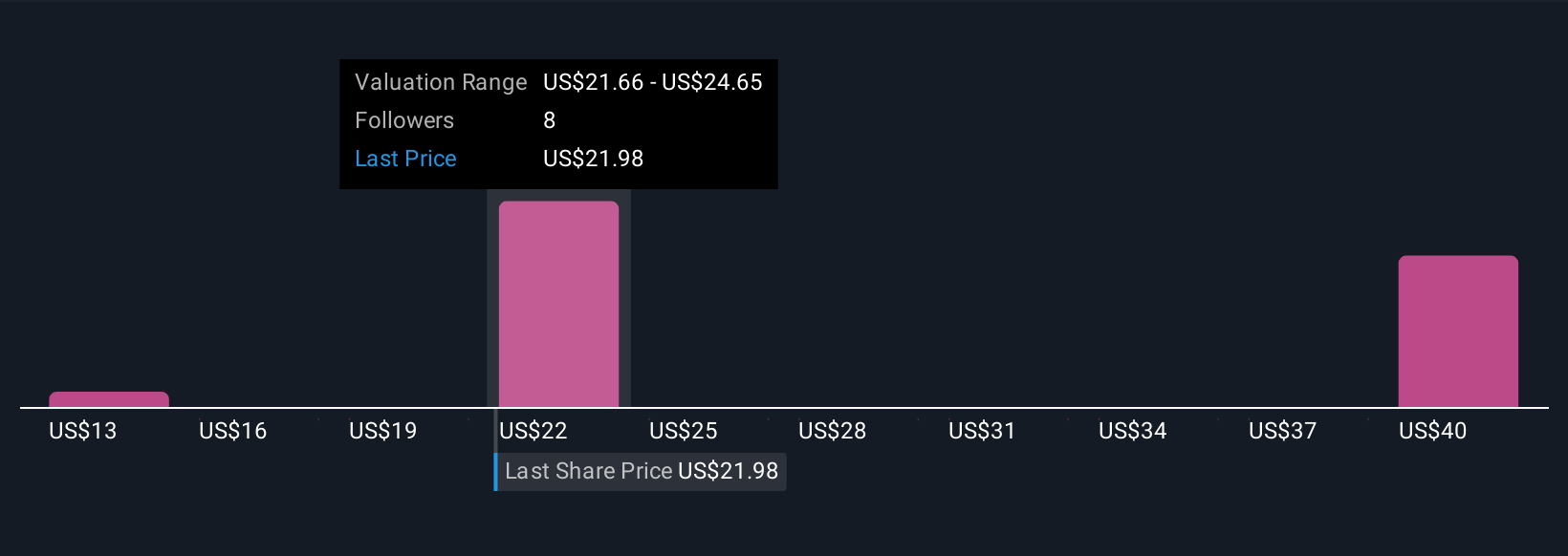

Upgrade Your Decision Making: Choose your Easterly Government Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, bringing together your beliefs about Easterly Government Properties' future growth, profit margins, and market outlook to form a clear, numbers-backed estimate of its fair value.

This approach links the company’s real business story directly to financial forecasts and then translates that into a fair value, making your investment thesis visible and actionable. Narratives are easy to use and available in the Community section of Simply Wall St’s platform, where millions of investors share and refine their perspectives.

By comparing the Fair Value from your chosen Narrative to the current market Price, you can make more confident buy or sell decisions based on information that truly matters to you. Narratives on Simply Wall St update dynamically whenever new data, news, or financial results are released, meaning your view always reflects the latest situation.

For example, some Easterly Government Properties Narratives believe federal lease renewals and defensive income streams will drive the stock to fair value as high as $24.08, while others expect headwinds like rising capital costs and slower growth to justify targets closer to $16.90. This demonstrates how different viewpoints lead to different conclusions and investment decisions.

Do you think there's more to the story for Easterly Government Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Easterly Government Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEA

Easterly Government Properties

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives