- United States

- /

- Office REITs

- /

- NYSE:CDP

What COPT Defense Properties (CDP)'s Upbeat Earnings and Defense Tenant Acquisition Mean For Shareholders

Reviewed by Sasha Jovanovic

- COPT Defense Properties recently reported higher third-quarter net income and raised its full-year earnings guidance, following the acquisition of a fully-leased, US$40.2 million Class A office building in Chantilly, VA.

- This expansion further deepens the company’s defense-focused portfolio with a long-term lease to a major U.S. defense contractor, emphasizing COPT’s commitment to mission-critical real estate.

- We'll examine how the improved earnings outlook and defense-tenant acquisition impact COPT Defense Properties’ broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

COPT Defense Properties Investment Narrative Recap

For investors in COPT Defense Properties, the central thesis hinges on continued strong U.S. defense spending and government contractor demand for highly secure, mission-critical facilities. The recent earnings beat and acquisition of a fully-leased office property deepen exposure to resilient defense clients and support near-term earnings visibility; however, this does not fundamentally reduce the risk tied to heavy regional and tenant concentration, which remains the most important factor to watch in the short term.

Among recent company announcements, the raised full-year earnings guidance stands out as especially relevant, reflecting management’s strengthened outlook following the addition of a long-term, defense-anchored asset. This supports the main catalyst, the multi-year runway created by increased federal defense and intelligence budgets, but it does not eliminate underlying exposure to potential shifts in government priorities.

In contrast, investors should remain aware that concentrated exposure to a small number of government and defense contractor tenants leaves revenue streams vulnerable if contract delays or cancellations arise...

Read the full narrative on COPT Defense Properties (it's free!)

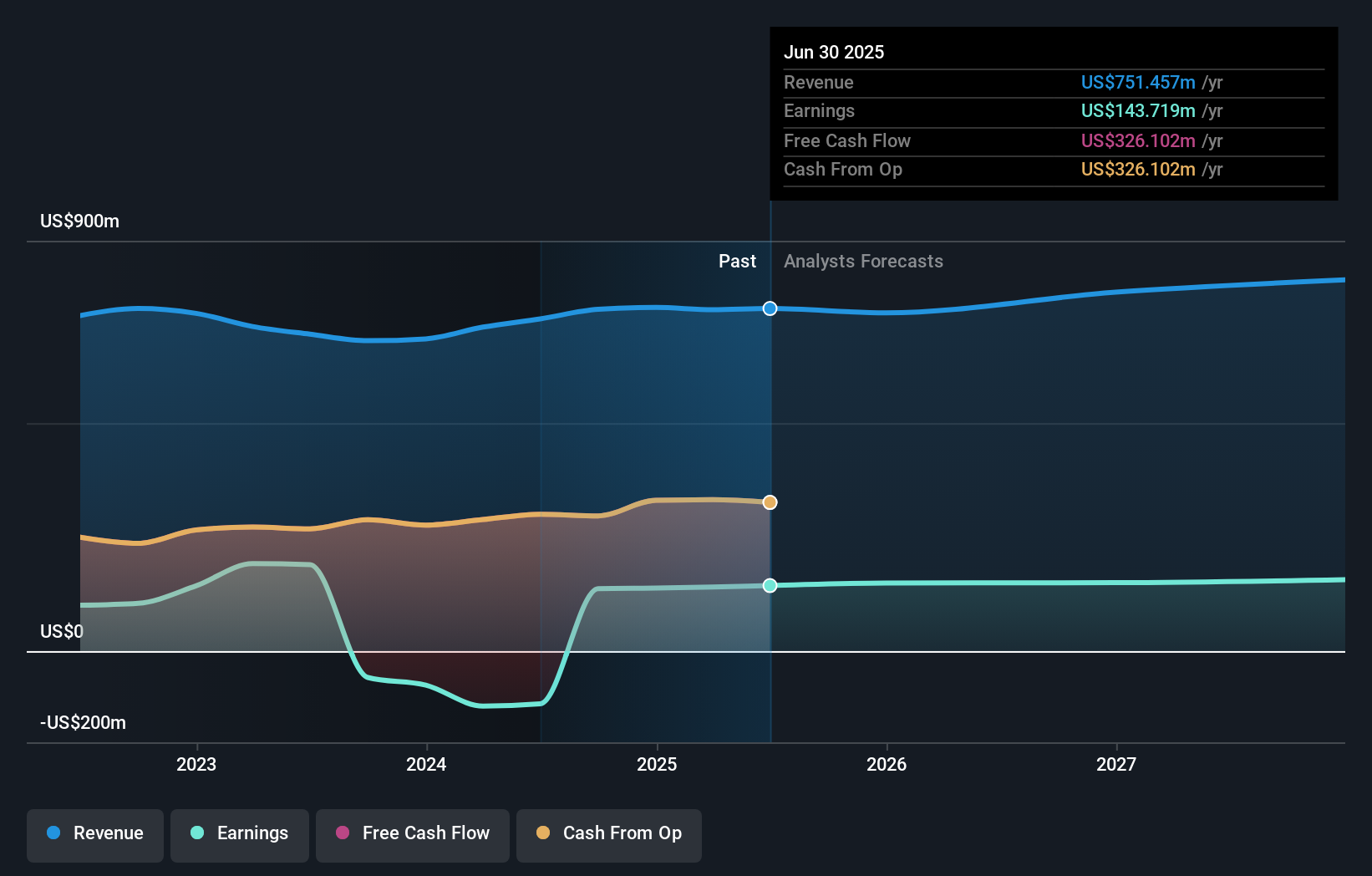

COPT Defense Properties' narrative projects $821.6 million revenue and $152.6 million earnings by 2028. This requires 3.0% yearly revenue growth and a $8.9 million earnings increase from $143.7 million.

Uncover how COPT Defense Properties' forecasts yield a $32.57 fair value, a 11% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate for COPT Defense Properties stands at US$43.36 per share, suggesting a substantial discount to today’s share price. While many are banking on increased government outlays as a tailwind, tenant concentration risk continues to pose broader questions about long-term resilience, be sure to consider a range of views on future performance.

Explore another fair value estimate on COPT Defense Properties - why the stock might be worth just $43.36!

Build Your Own COPT Defense Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your COPT Defense Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free COPT Defense Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate COPT Defense Properties' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDP

COPT Defense Properties

COPT Defense Properties (the “Company” or “COPT Defense”), an S&P MidCap 400 Company, is a self-managed real estate investment trust (“REIT”) focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives