- United States

- /

- Retail REITs

- /

- NYSE:CBL

CBL & Associates Properties (CBL) Is Up 7.6% After New $25M Buyback and Strong Q3 Results – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

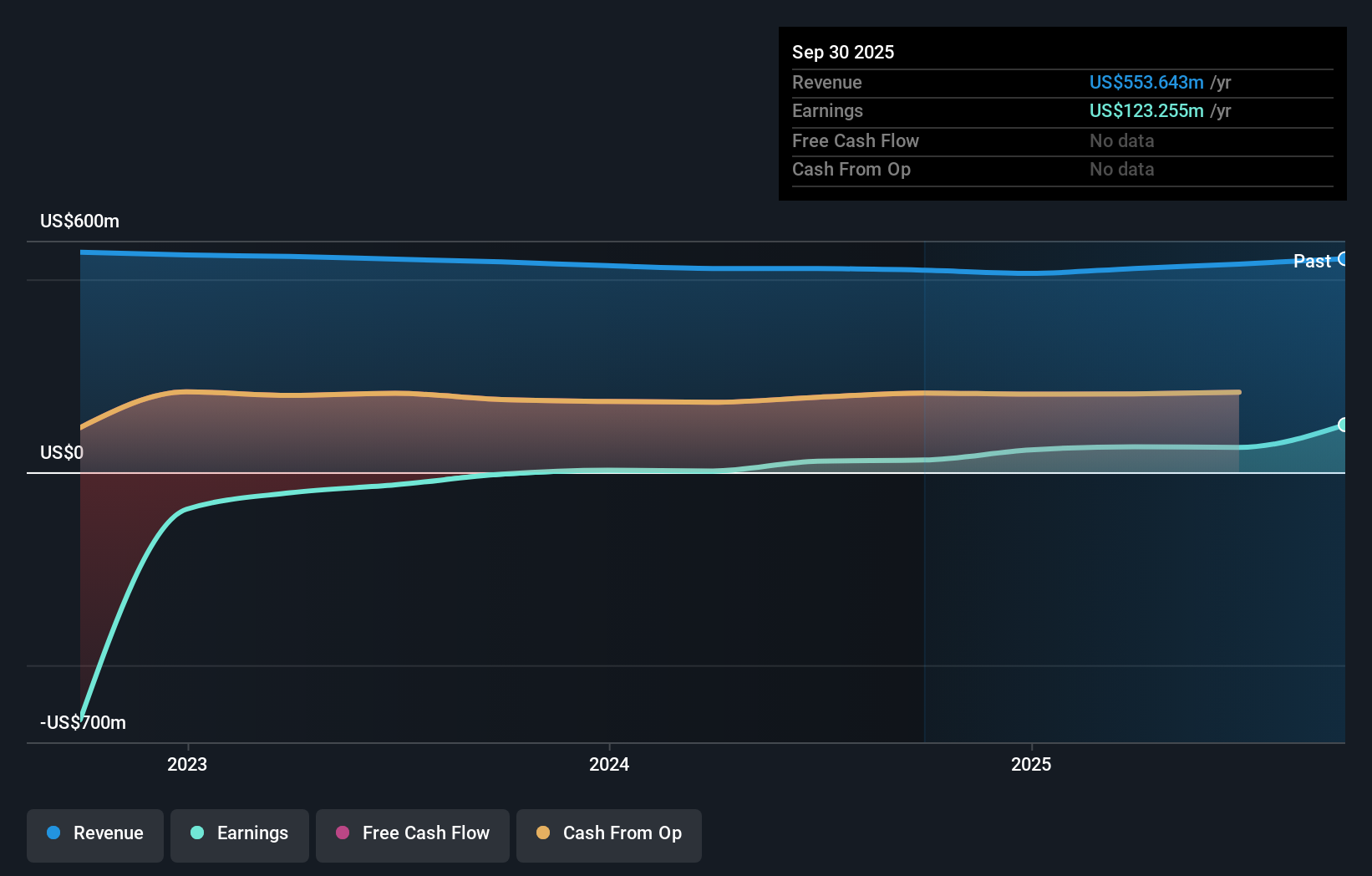

- CBL & Associates Properties recently authorized a new US$25 million stock repurchase program, replacing its previous plan, and reported third-quarter results with significant increases in revenue and net income.

- This combination of capital returns and improved operational performance highlights CBL's focus on maximizing shareholder value while strengthening its retail property portfolio.

- We'll explore what these developments mean for CBL's investment narrative, especially as management signals confidence with its expanded buyback initiative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is CBL & Associates Properties' Investment Narrative?

To be a shareholder in CBL & Associates Properties today requires confidence in its ability to turn operational improvements and capital returns into sustainable value. The company’s recent news, a new US$25 million stock repurchase program following a stretch of strong quarterly earnings, robust net income, and an expanding portfolio, speaks to active management and a clear commitment to rewarding shareholders. While these announcements can reinforce short-term investor optimism, the impact on the investment thesis is nuanced. The new buyback may support the share price in the near term and signal management’s belief in undervaluation, but it doesn’t meaningfully change the fundamental risks, such as high debt loads and reliance on one-off gains that have shaped results. In the bigger picture, the most important short-term catalysts remain execution on property upgrades, maintaining tenant demand, and managing financing costs. However, the risk profile still includes exposure to rising borrowing costs and potential operational setbacks, which investors should continue to monitor closely.

But while buybacks and recent results can fuel optimism, debt costs remain a risk investors should understand.

CBL & Associates Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CBL & Associates Properties - why the stock might be worth as much as 12% more than the current price!

Build Your Own CBL & Associates Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBL & Associates Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CBL & Associates Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBL & Associates Properties' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBL

CBL & Associates Properties

Headquartered in Chattanooga, TN, CBL Properties owns and manages a national portfolio of market-dominant properties located in dynamic and growing communities.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives