- United States

- /

- Office REITs

- /

- NYSE:BXP

Does BXP’s Leasing Surge and Institutional Support Reinforce the Bull Case for BXP (BXP)?

Reviewed by Sasha Jovanovic

- BXP, Inc. recently reported its third-quarter 2025 results, surpassing revenue and FFO per share expectations and signing over 1.5 million square feet of leases with a 7.9-year average term, reflecting strong leasing momentum.

- An increased stake by COHEN & STEERS, INC. signals heightened institutional confidence in BXP’s business model and role within the US office REIT sector.

- We’ll examine how BXP’s strong leasing activity and financial outperformance may influence its long-term investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

BXP Investment Narrative Recap

To be a BXP shareholder, you need to believe that the company’s high-quality, centrally located office assets will attract steady tenant demand despite headwinds facing the US office REIT sector. While the recent surge in leasing activity and outperformance on revenue and FFO are positives, the main short-term catalyst remains the ability to stabilize occupancy as new developments hit the market, and the biggest risk is still uneven rent growth and challenges in backfilling vacancies, neither of which appear materially resolved by this quarter’s results.

Among recent developments, BXP’s move to cut its quarterly dividend from US$0.98 to US$0.70 stands out. This reduction reflects management’s caution around capital demand and ongoing pressures on earnings, signaling that even solid leasing wins may not offset the pressure from lower headline occupancy and capital allocation needs in the immediate term.

By contrast, investors should be aware that persistent weakness in rent spreads and limited demand for certain assets could still...

Read the full narrative on BXP (it's free!)

BXP's outlook anticipates $3.7 billion in revenue and $368.8 million in earnings by 2028. This is based on a projected 2.5% annual revenue growth, and a substantial increase in earnings of $363.9 million from the current $4.9 million.

Uncover how BXP's forecasts yield a $79.80 fair value, a 14% upside to its current price.

Exploring Other Perspectives

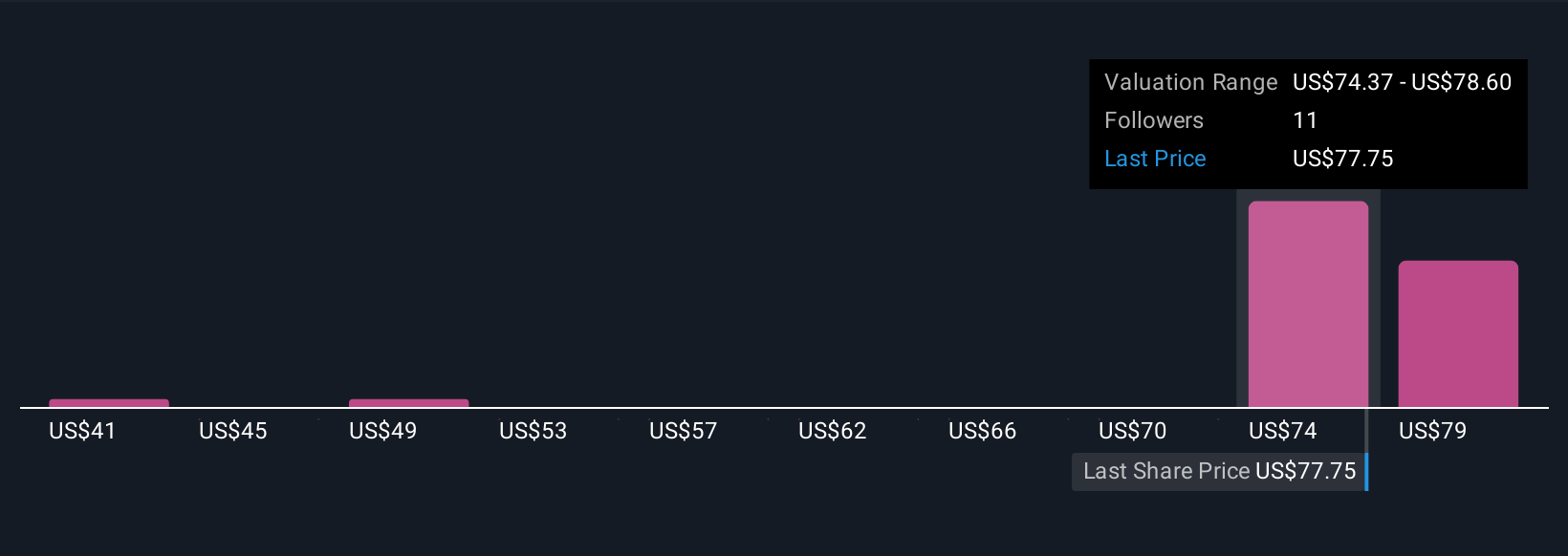

Four community-driven fair value estimates for BXP range widely from US$40.50 to US$90.50, highlighting vastly different outlooks among Simply Wall St Community analysts. With ongoing uncertainty in rent growth and tenant demand, it’s useful to explore how your own expectations fit against this broad spectrum of views.

Explore 4 other fair value estimates on BXP - why the stock might be worth 42% less than the current price!

Build Your Own BXP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BXP research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BXP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BXP's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives