- United States

- /

- Retail REITs

- /

- NYSE:BRX

How Investors May Respond To Brixmor Property Group (BRX) $400 Million Buyback and Dividend Hike

Reviewed by Sasha Jovanovic

- In late October 2025, Brixmor Property Group announced a US$400 million share repurchase program, introduced new shelf registrations for both common and preferred shares, executed a US$400 million follow-on equity offering, and approved a 7% increase in its quarterly dividend.

- These actions, alongside updated earnings guidance and reported impairment charges, reflect the company's active capital allocation and shareholder distribution strategies amid a changing retail REIT landscape.

- We’ll explore how the launch of a US$400 million buyback may influence Brixmor’s investment outlook and future earnings potential.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Brixmor Property Group Investment Narrative Recap

To hold shares of Brixmor Property Group, investors generally need to believe in the continuing strength of demand for grocery-anchored retail centers and the company’s ability to translate this demand into stable cash flows and rental growth. While the recent announcement of a US$400 million share buyback highlights management’s focus on shareholder returns, this move does not materially alter the principal short-term catalyst: attracting and retaining high-quality anchor tenants amid tight leasing conditions, nor does it alleviate the key risk of tenant disruptions and related occupancy volatility.

Among Brixmor’s latest updates, the 7% dividend increase stands out as most relevant for shareholders assessing total return, particularly at a time when broader retail REITs face margin pressures. This increase may be seen in the context of the company's ongoing efforts to allocate capital efficiently, but it does not directly address near-term disruptions from tenant turnover, which remain a central concern for stability in rental income.

However, investors should be aware that higher dividend payouts do not fully mitigate the impact of persistent tenant disruption risk, especially if...

Read the full narrative on Brixmor Property Group (it's free!)

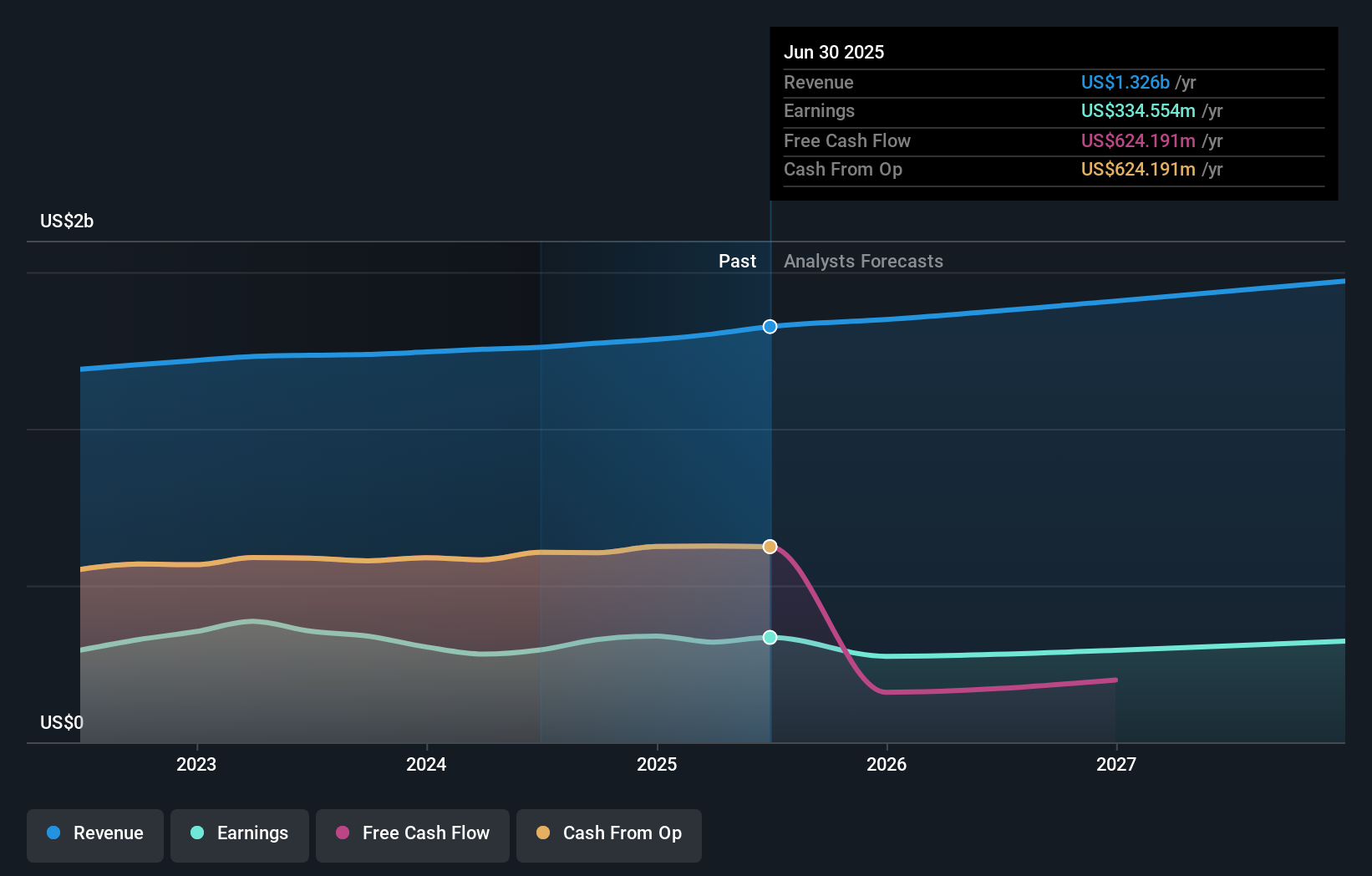

Brixmor Property Group's outlook anticipates revenue reaching $1.5 billion and earnings coming in at $310.2 million by 2028. This scenario assumes a 4.8% annual growth rate in revenue but forecasts a decrease in earnings of $24.4 million from the current $334.6 million.

Uncover how Brixmor Property Group's forecasts yield a $30.56 fair value, a 16% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted one fair value estimate for Brixmor, clustering at US$30.56 per share. While analysts highlight persistent tenant risk as a central issue, you’ll find other viewpoints that may shape your view on the company’s future.

Explore another fair value estimate on Brixmor Property Group - why the stock might be worth as much as 16% more than the current price!

Build Your Own Brixmor Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brixmor Property Group research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Brixmor Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brixmor Property Group's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brixmor Property Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRX

Brixmor Property Group

Brixmor (NYSE: BRX) is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives