- United States

- /

- Residential REITs

- /

- NYSE:AVB

How Investors May Respond To AvalonBay Communities (AVB) $500 Million Share Buyback Authorization and Earnings Update

Reviewed by Sasha Jovanovic

- In late October 2025, AvalonBay Communities reported third quarter earnings growth, updated its full-year guidance, and announced the completion of a prior US$337.66 million share buyback plan alongside the authorization of a new US$500 million repurchase program.

- The company's combination of continued apartment development, real estate acquisitions, and increased share repurchase initiatives highlights management's ongoing focus on both portfolio growth and capital returns.

- We'll examine how the launch of AvalonBay's new US$500 million share buyback plan may shape its ongoing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

AvalonBay Communities Investment Narrative Recap

To be an AvalonBay Communities shareholder means believing in resilient apartment demand and stable long-term growth in high-barrier U.S. markets. The announcement of a new US$500 million share repurchase plan does not materially change the most important near-term catalyst, successfully executing on new development deliveries to drive incremental net operating income, nor does it reduce ongoing risks tied to local job market weakness and regulatory headwinds.

Among recent updates, the company's full-year 2025 earnings guidance (projected EPS of US$7.35 to US$7.55) stands out as most relevant to assessing progress toward short-term growth objectives. This guidance comes as AvalonBay continues to expand its apartment portfolio and ramp capital returns, framing expectations as it enters the critical delivery phase for its development pipeline.

In contrast, investors should be aware that persistent regulatory challenges in coastal markets could still affect...

Read the full narrative on AvalonBay Communities (it's free!)

AvalonBay Communities is projected to reach $3.5 billion in revenue and $913.6 million in earnings by 2028. This scenario assumes 5.5% annual revenue growth, but a decrease in earnings of about $286 million from the current $1.2 billion.

Uncover how AvalonBay Communities' forecasts yield a $216.48 fair value, a 22% upside to its current price.

Exploring Other Perspectives

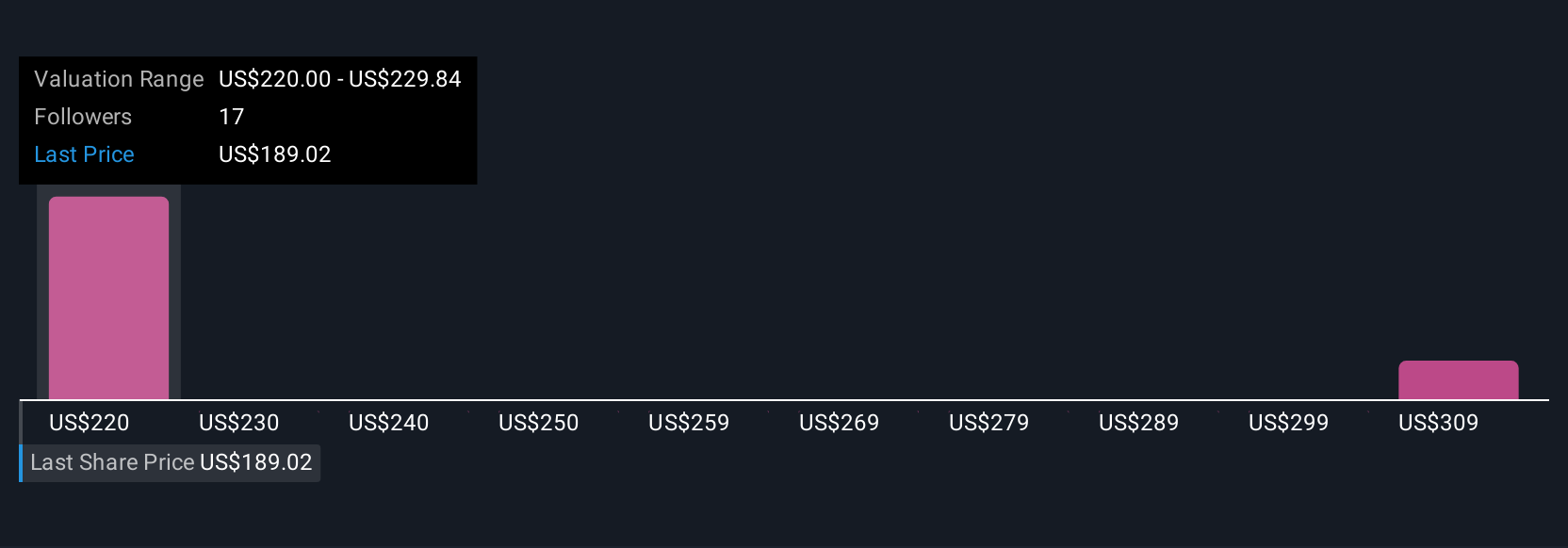

Four Simply Wall St Community members value AvalonBay between US$215 and US$321.82 per share, with wide separation between the highest and lowest outlooks. While the new US$500 million buyback plan grabs attention, ongoing regulatory risk in major markets may weigh on future earnings and investor confidence, underscoring why opinions can differ sharply, explore the full range of perspectives before making your decision.

Explore 4 other fair value estimates on AvalonBay Communities - why the stock might be worth as much as 81% more than the current price!

Build Your Own AvalonBay Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AvalonBay Communities research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AvalonBay Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AvalonBay Communities' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVB

AvalonBay Communities

A member of the S&P 500, is an equity REIT that develops, redevelops, acquires and manages apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives