- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Why Alexandria Real Estate (ARE) Is Down 24.8 Percent After Large Q3 Loss and 2025 Guidance Cut

Reviewed by Sasha Jovanovic

- Alexandria Real Estate Equities, Inc. recently reported a significant third quarter net loss of US$232.75 million, driven by a real estate impairment charge of US$323.9 million and a reduction in both sales and revenue compared to the prior year.

- The company also lowered its earnings guidance for 2025, reflecting sector pressures, declining occupancy rates, and ongoing challenges in portfolio performance.

- We’ll examine how Alexandria’s elevated real estate impairments impact its investment narrative amid sector-wide uncertainty and shifting tenant demand.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alexandria Real Estate Equities Investment Narrative Recap

To be a shareholder in Alexandria Real Estate Equities right now, you need conviction in the long-term demand for life science properties and a belief that the company’s core innovation-cluster assets can weather near-term industry headwinds. The recent sizable real estate impairment charge and guidance downgrade directly impact the visibility around earnings stabilization, which heightens the importance of occupancy trends as the most immediate catalyst, while persistent pressure on leasing and property values remains the central business risk.

Most relevant to the current disruption is Alexandria's lowered 2025 earnings guidance, reflecting fallout from the hefty Q3 impairment and ongoing sector challenges. The reduction not only casts doubt on profit recovery but also underscores the tight link between property values, occupancy, and future returns for investors focused on near-term performance.

However, investors should also be aware that pressure on same property NOI due to elevated vacancy and lease expirations may create additional headwinds as...

Read the full narrative on Alexandria Real Estate Equities (it's free!)

Alexandria Real Estate Equities is projected to reach $3.2 billion in revenue and $288.1 million in earnings by 2028. This scenario assumes a yearly revenue decline of 0.7% and a $309.6 million increase in earnings from the current level of -$21.5 million.

Uncover how Alexandria Real Estate Equities' forecasts yield a $96.07 fair value, a 65% upside to its current price.

Exploring Other Perspectives

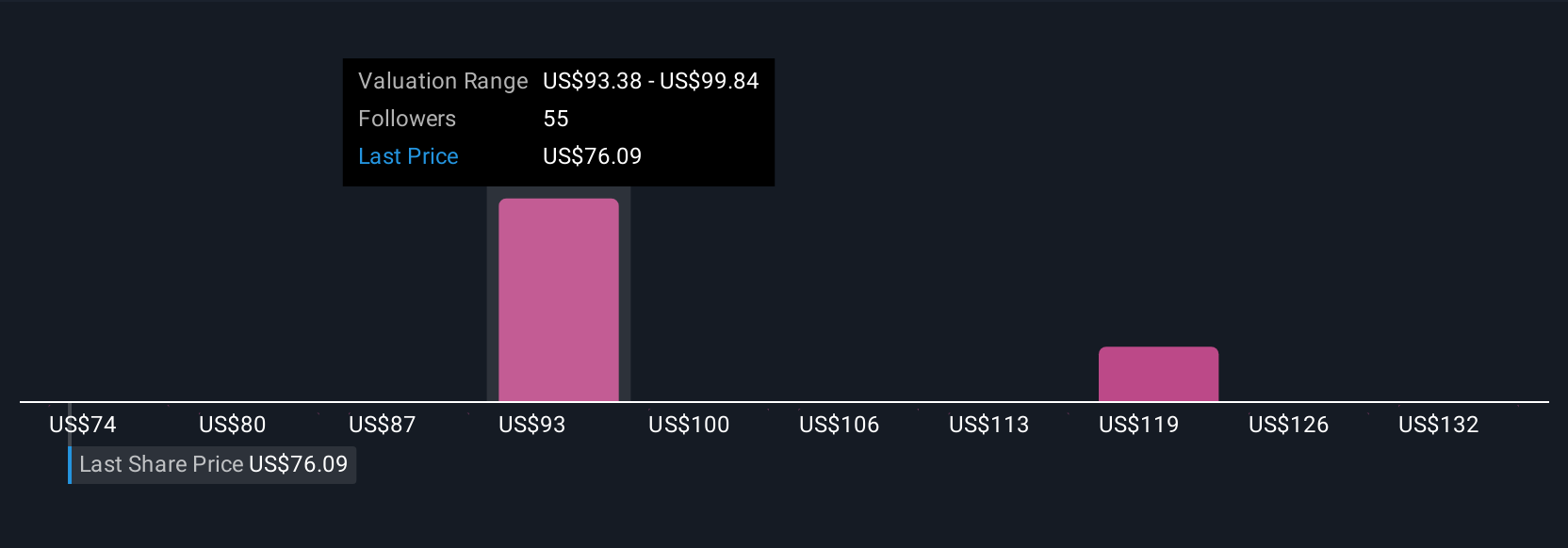

Nine members of the Simply Wall St Community estimate Alexandria’s fair value between US$71 and US$136.20 a share. With falling earnings and property impairments in play, your outlook on sector recovery shapes how you weigh these wide-ranging views.

Explore 9 other fair value estimates on Alexandria Real Estate Equities - why the stock might be worth just $71.00!

Build Your Own Alexandria Real Estate Equities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alexandria Real Estate Equities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexandria Real Estate Equities' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives