- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Should Investors Reassess Alexandria Real Estate After Shares Drop 12% in the Past Month?

Reviewed by Bailey Pemberton

Thinking about what to do with Alexandria Real Estate Equities after the latest slide in its share price? You are not alone. The stock has been on a tough ride recently, dropping 11.8% over the past week, sliding 12.0% in the last 30 days, and shares are now down more than 44% from their five-year highs. It is a steep drop that catches any investor’s eye and naturally raises the question of whether this is opportunity knocking or a red flag for caution.

The recent pullback is partly a reflection of investor nerves around the whole real estate sector, especially as higher interest rates recalibrate what is considered a fair value for properties specializing in laboratory, tech, and life sciences space like Alexandria’s. Yet, for some, this type of uncertainty can surface overlooked potential, especially if the fundamentals remain sound even as the headlines look daunting.

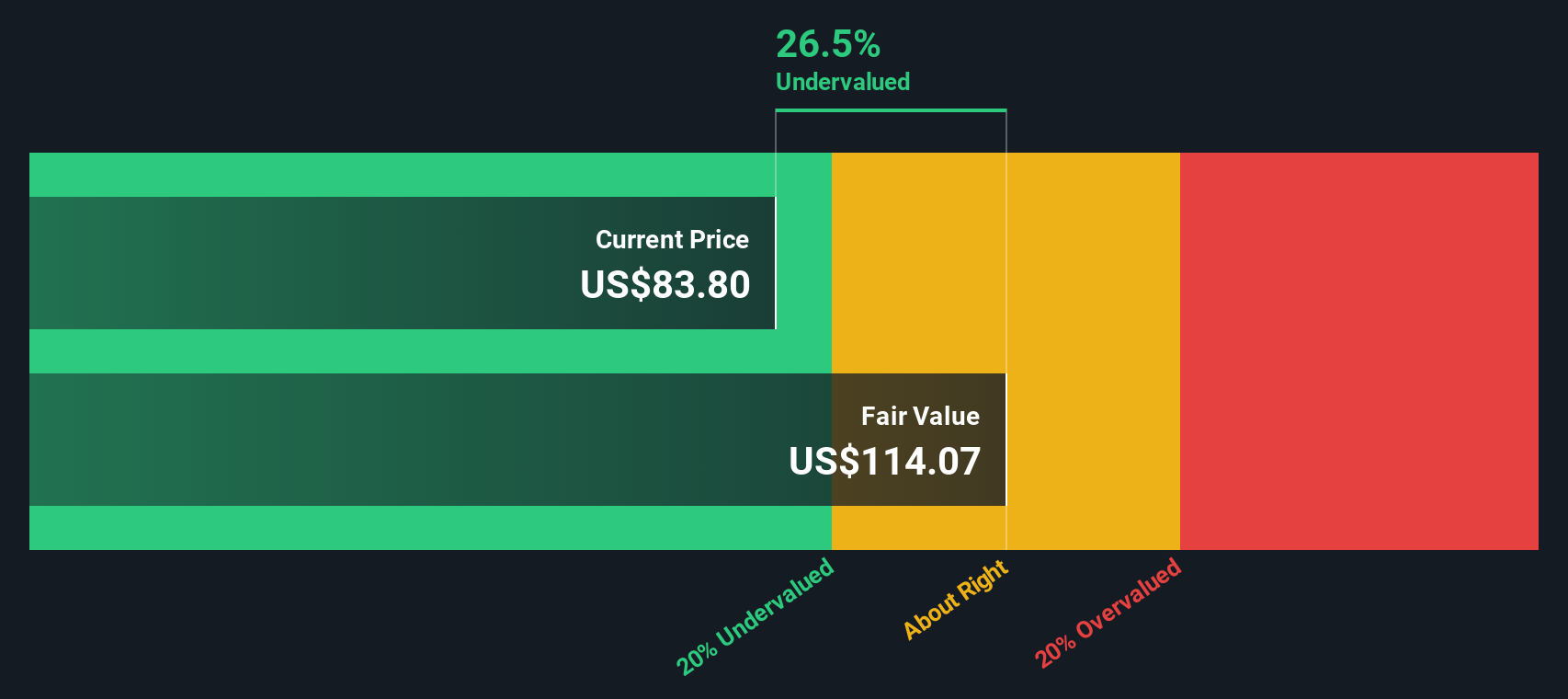

Weighing up Alexandria’s valuation is more relevant than ever. By one widely used set of metrics, the company lands a value score of 5 out of 6, meaning it is considered undervalued in nearly every major way analysts check. That is the kind of signal that can hint at future reward if the risks are manageable and the market view is overly pessimistic.

If you are curious about what this value score really means, or how Alexandria looks under different valuation methods, keep reading. Up next, we will break down how analysts determine whether a stock is undervalued or not. And stay tuned, because we will also share an even smarter way to think about valuation before you make your next move.

Why Alexandria Real Estate Equities is lagging behind its peers

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future adjusted funds from operations, then discounting those future cash flows back to their present value. For Alexandria Real Estate Equities, this model starts by looking at its latest free cash flow, which stands at $1.63 billion. Analysts supply cash flow projections for up to five years, and after that, Simply Wall St extrapolates the numbers to create a ten-year view.

Looking ahead, Alexandria's free cash flow is expected to reach $1.22 billion by 2028, with further gradual growth estimated in the subsequent years. These steady projections are all denominated in USD, making comparison straightforward. After aggregating and discounting these future cash flows, the DCF model estimates Alexandria Real Estate Equities' fair value at around $109.68 per share.

Right now, the model shows the stock trades at a significant discount, about 32.6% below its intrinsic value as calculated by the DCF approach. This suggests that, based on the current outlook for future cash flows, the stock appears notably undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 32.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alexandria Real Estate Equities Price vs Sales

The Price-to-Sales (P/S) ratio is a practical valuation tool, especially for real estate companies like Alexandria Real Estate Equities that may have lumpy or negative earnings due to non-cash charges or industry cycles. By comparing the share price to the company’s revenue, this metric offers investors a direct sense of how much the market is willing to pay for each dollar of sales. This makes it a solid go-to for evaluating profitability and growth when profits can be volatile or temporarily suppressed.

Estimating what a “normal” or “fair” P/S multiple should be depends on expectations for growth, profit margins, and risk. Companies seen as proven growth plays or with above-average margins often command higher ratios, while those with lower growth or more risks tend to trade at a discount. Alexandria’s current P/S ratio stands at 4.13x, notably below the Health Care REITs industry average of 6.38x and its peer group average of 5.79x.

To refine this, Simply Wall St uses the “Fair Ratio”, which adjusts the benchmark for Alexandria by factoring in its specific growth outlook, risks, profitability, market size, and sector dynamics. Unlike a simple industry or peer comparison, this approach tailors the valuation expectation to Alexandria’s unique situation. With a Fair Ratio of 5.60x, Alexandria’s current P/S ratio of 4.13x suggests that investors are paying less than what would be expected for a business with its profile, based on a more holistic assessment of value drivers.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

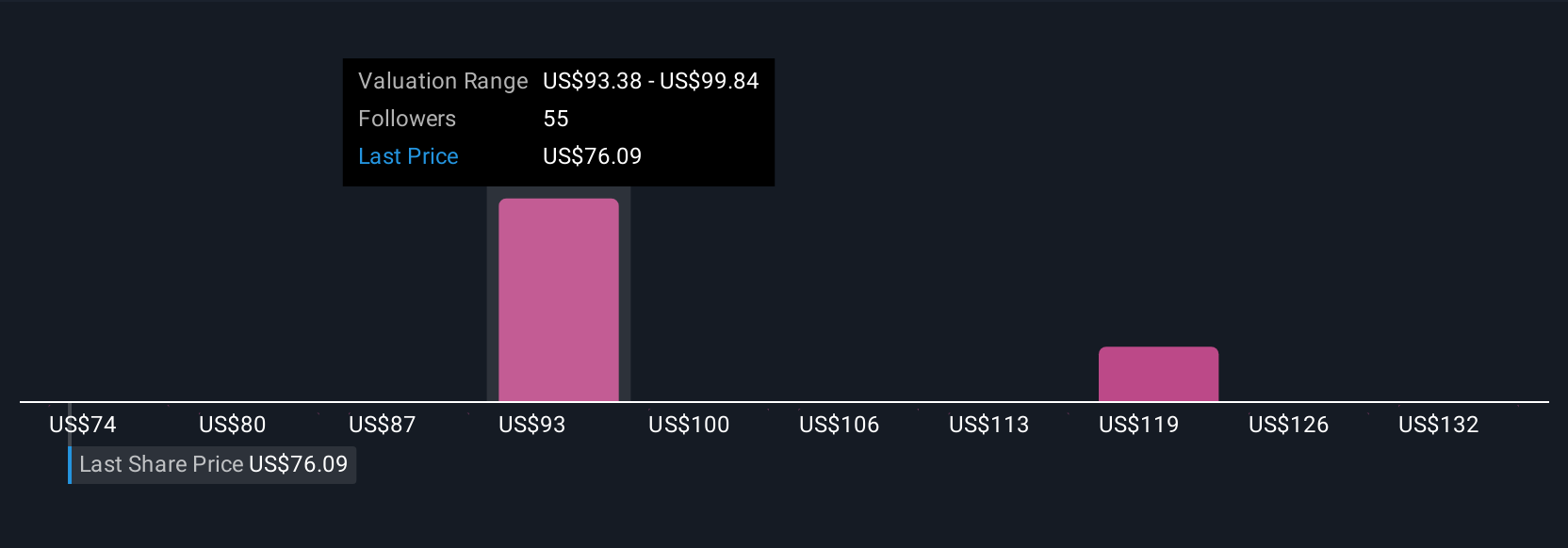

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, story-driven perspective on a company, combining what you believe about Alexandria Real Estate Equities’ future with your own estimates of fair value, revenue, earnings, and margins. Unlike static formulas, Narratives connect what’s happening in the business (such as industry trends or new deals) to a financial forecast, then link that to a clear, quantifiable fair value. This approach makes your reasoning both transparent and actionable.

Available to everyone on Simply Wall St’s Community page, Narratives are an easy, accessible tool used by millions of investors. They help you make better buy or sell decisions by automatically comparing your chosen Fair Value to the current Price, so you see exactly where your story and the market disagree. Narratives dynamically update whenever fresh news or earnings are released, keeping your analysis relevant in real time.

For example, some investors may build a highly optimistic Narrative for Alexandria, setting fair value close to $144 if they believe aging demographics and science demand will drive rapid, sustained growth. More cautious users might base their Narrative around tougher capital conditions or slower leasing, landing as low as $71. Whichever you choose, Narratives let you act confidently on your convictions, with every assumption out in the open.

Do you think there's more to the story for Alexandria Real Estate Equities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives