- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Is Alexandria Real Estate Equities Attractive After a 49.5% Share Price Drop?

Reviewed by Bailey Pemberton

- Ever wondered whether Alexandria Real Estate Equities is finally at a bargain price or if the risks still outweigh the rewards? You are not alone, as questions about its value are popping up across the market right now.

- While the stock climbed in recent months, it has taken a sharp turn with a 7.9% drop in the last week and a dramatic 49.5% fall over the past year, putting growth potential and market sentiment under the spotlight.

- Much of this price volatility has been driven by renewed debates over commercial real estate demand and wider market anxieties around office properties. Recent headlines have spotlighted the company’s high-quality lab spaces, ongoing portfolio expansion, and sector resilience even in tough times.

- According to our valuation framework, Alexandria scores 5 out of 6 on undervaluation checks, suggesting there may be hidden value waiting to be unlocked. Let’s unpack the main valuation approaches investors use for Alexandria, and at the end, I will share a far more comprehensive way to understand where its real worth might lie.

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by forecasting its future cash flows, then discounting those projections back to today's value. This approach relies on Adjusted Funds From Operations, which is especially relevant for real estate investment trusts like Alexandria Real Estate Equities.

Alexandria currently generates Free Cash Flow of $1.63 billion. Analysts supply estimates for the next several years, after which further projections, up to ten years out, are extrapolated. For instance, by 2028, the company is expected to produce $1.12 billion in annual Free Cash Flow. This reflects expectations for sustained growth despite recent sector headwinds. Across the full projection period, cash flows generally trend higher, with the model drawing from both analyst forecasts and calculated extrapolations.

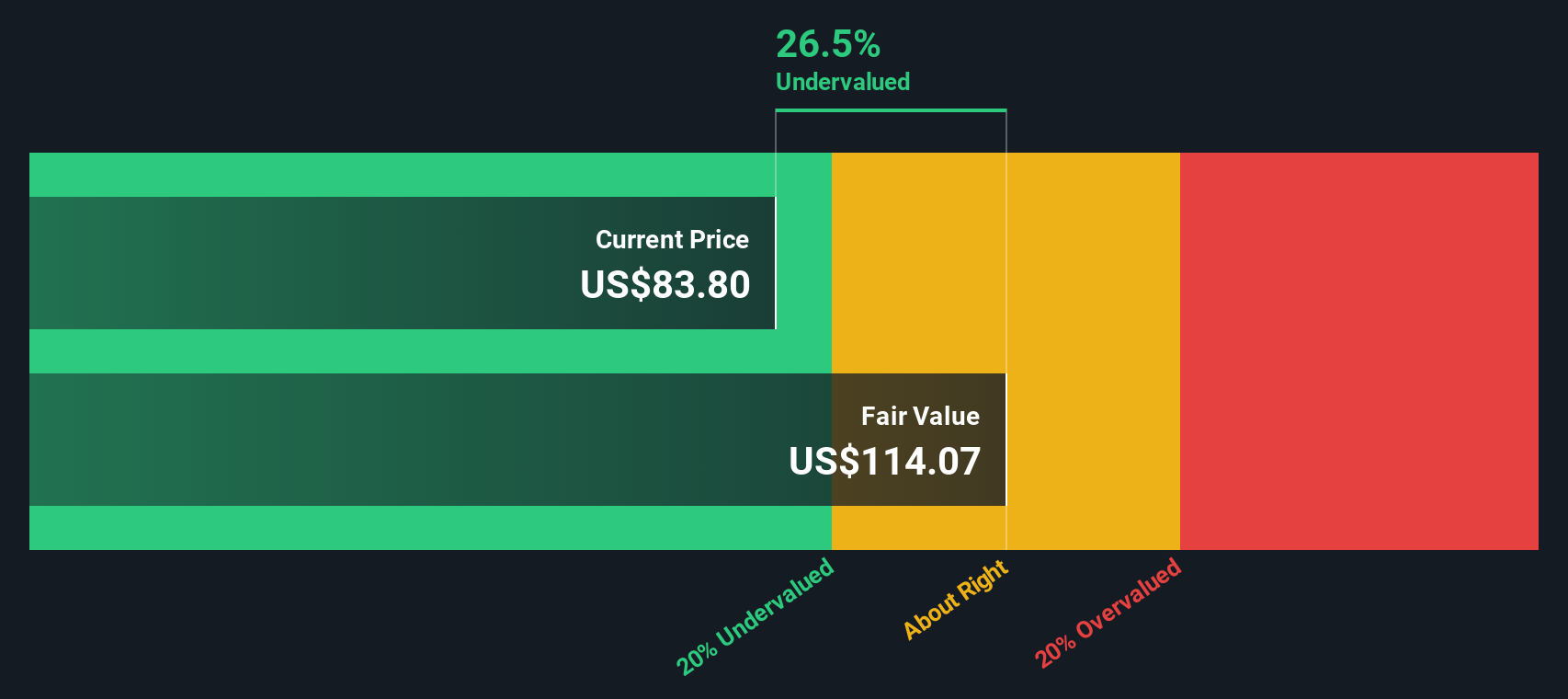

According to this process, Alexandria’s estimated intrinsic value sits at $103.16 per share, using the 2 Stage Free Cash Flow to Equity approach. Compared to the latest share price, this implies the stock is trading at a notable 52.0% discount. This suggests that current market pessimism might be overdone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 52.0%. Track this in your watchlist or portfolio, or discover 898 more undervalued stocks based on cash flows.

Approach 2: Alexandria Real Estate Equities Price vs Sales

The Price-to-Sales (P/S) ratio is a favored valuation tool for profitable companies like Alexandria Real Estate Equities because it allows investors to gauge how much they are paying for each dollar of revenue generated by the business. This metric is particularly insightful for real estate investment trusts, where revenue streams can be more stable and less impacted by accounting methods than reported earnings.

A company’s fair P/S ratio is influenced by both its growth prospects and perceived risk. Higher expected growth generally justifies a higher multiple, as investors anticipate stronger future cash flows. Higher risk pushes that “normal” multiple down to compensate for uncertainty.

At present, Alexandria trades at a P/S ratio of 2.8x. This is markedly lower than the Health Care REITs industry average of 6.4x and also below the average for its close peers at 6.0x. On face value, the stock appears cheap by several key benchmarks.

However, instead of relying solely on these comparables, Simply Wall St’s proprietary “Fair Ratio” model determines a benchmark multiple of 4.4x for Alexandria. This fair ratio stands out because it synthesizes the company’s earnings growth outlook, industry nuances, profit margins, market capitalization, and the range of risks it faces, offering a more complete and personalized perspective than industry averages alone.

Comparing Alexandria’s actual P/S of 2.8x to the fair ratio of 4.4x indicates it is trading well below what would reasonably be expected given its fundamentals. This suggests a significant undervaluation at current levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

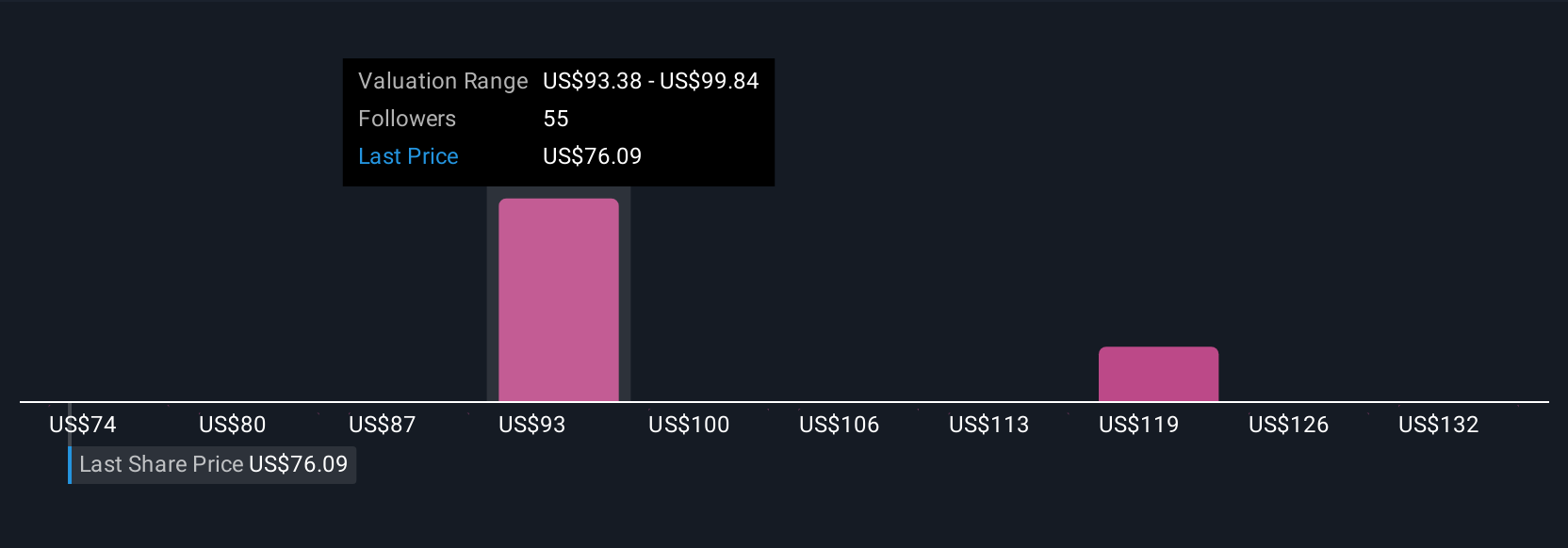

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are Simply Wall St’s approachable investment tool that helps you put a story behind the numbers by combining your view of Alexandria’s business, including what you believe about its future revenue, margins, and risks, with your fair value calculation, all within a single, easy-to-use forecast.

With Narratives, you connect the company’s outlook to a set of financial assumptions and see in real time whether the stock appears attractive or not, based on how your fair value compares to today’s share price. The best part is that Narratives live on the Community page, are used by millions of investors, and update automatically whenever important news or earnings are released, keeping your investment thinking fresh and relevant.

For example, right now some investors are optimistic about Alexandria’s biotech expansion and set a fair value as high as $144.00, while others focus on persistent sector risks and assign a lower value, down near $71.00. Narratives put these perspectives side by side, empowering you to weigh different stories, challenge your assumptions, and find the confidence to make the investment decisions that are right for you.

Do you think there's more to the story for Alexandria Real Estate Equities? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives