- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Is Alexandria Real Estate Equities a Bargain After 42% Price Drop in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Alexandria Real Estate Equities might be a value play hiding in plain sight? You are not alone, as a lot of investors are looking for potential bargains right now.

- Recently, Alexandria’s share price has slumped, dropping a dramatic 26.7% in just the past week and now down over 42% for the year to date, which has plenty of people asking what the market is missing or newly worried about.

- Much of the selloff seems tied to sector-wide concerns about commercial real estate and shifting investor sentiment, fueled by headlines highlighting pressure on office space demand and rising interest rates impacting property REITs across the board.

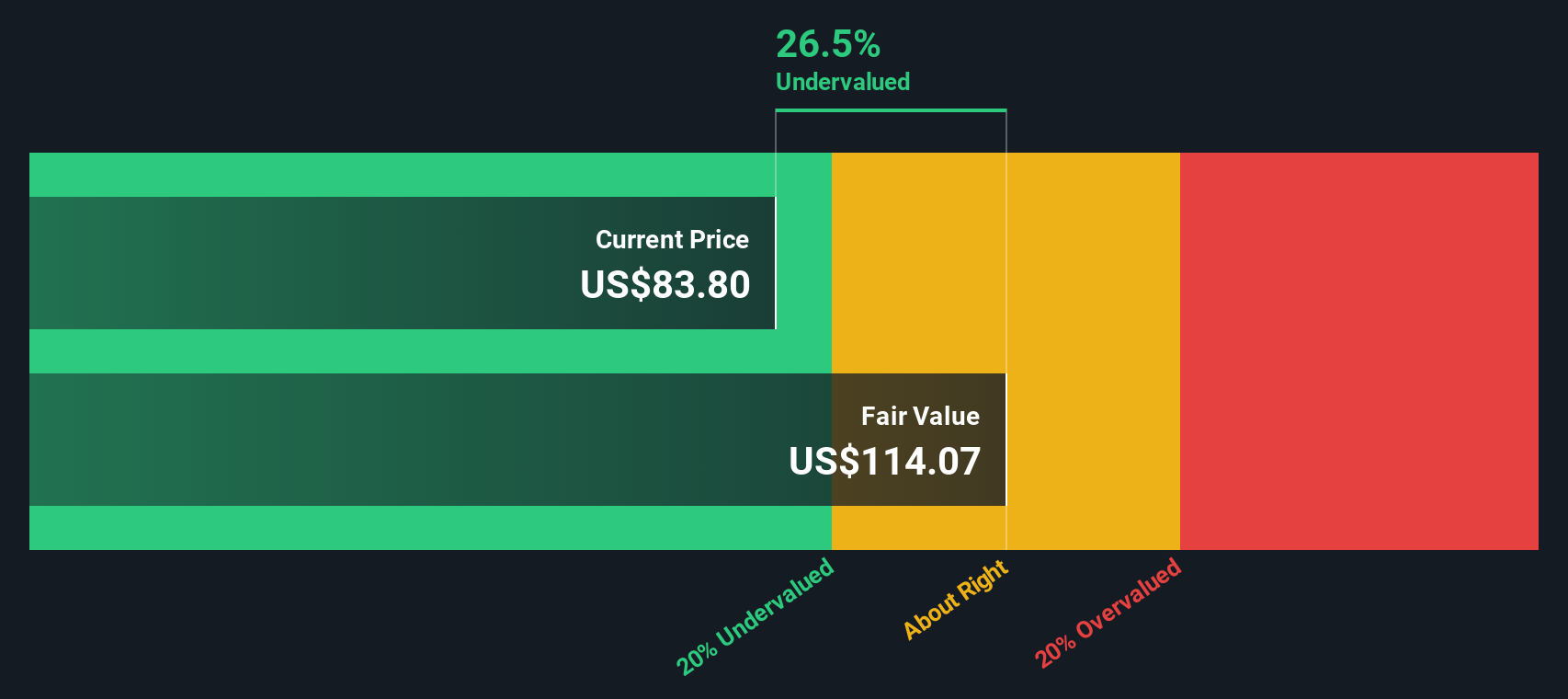

- Despite the turbulence, Alexandria’s valuation score is a notable 5 out of 6, suggesting it passes most of the major undervaluation checks. Next, let's break down those valuation approaches, and stay tuned as we circle back to an even deeper way of thinking about value by the end.

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and then discounting those back to today's dollars using an appropriate rate. In Alexandria Real Estate Equities' case, the analysis uses adjusted funds from operations to calculate free cash flow.

Currently, Alexandria generates Free Cash Flow of $1.63 Billion. Analysts have projected future cash flows for the next five years, with 2028's Free Cash Flow estimated at $1.21 Billion. For the years following, Simply Wall St extrapolates continued growth and projects $1.37 Billion in 2035.

Applying the two-stage DCF model to these data points yields an estimated fair value of $98.62 per share. With the recent sharp decline in Alexandria's share price, this valuation implies the stock is trading at a 42.8% discount to its intrinsic value. This suggests a significant margin of undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 42.8%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Alexandria Real Estate Equities Price vs Sales

The Price-to-Sales (PS) multiple is often considered a useful valuation tool, especially for companies that show steady revenue but may experience variability in earnings due to investments, depreciation, or interest expenses. For profitable and established companies like Alexandria Real Estate Equities, PS allows investors to assess how the market values each dollar of revenue, regardless of short-term fluctuations in profits.

The appropriate PS ratio, or the multiple investors are generally willing to pay for revenue, depends on the company’s growth prospects and its overall risk profile. In practice, higher expected growth or lower risk can justify paying a higher multiple. Conversely, if growth is slow or risks are high, a lower PS ratio is warranted.

Alexandria currently trades at a Price-to-Sales ratio of 3.19x. This stands notably below the Health Care REITs industry average of 6.19x and the peer average of 8.79x. However, Simply Wall St’s Fair Ratio model, which adjusts for factors specific to Alexandria such as its earnings growth, industry, profit margin, market capitalization, and risk, suggests a fair PS ratio of 4.63x.

Unlike industry or peer comparisons that rely primarily on broad groupings, the Fair Ratio approach offers a nuanced view tailored to Alexandria’s individual fundamentals. This makes it a more relevant benchmark for judging valuation.

Since Alexandria’s current PS ratio of 3.19x is meaningfully lower than its Fair Ratio of 4.63x, the stock appears undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

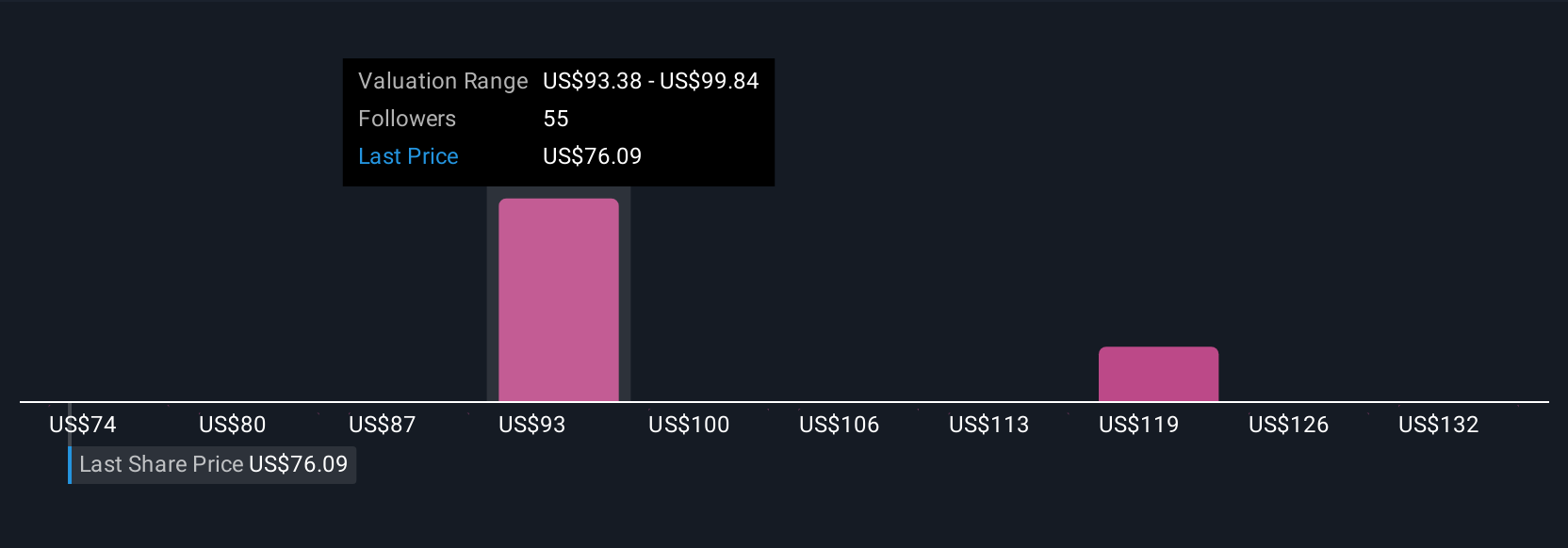

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple story or perspective that you create about a company, linking your personal view of its future revenue, profit margins, risks, and what you believe is a fair value. Instead of just looking at the numbers in isolation, Narratives connect the dots between how you see Alexandria's business evolving and what that means for its potential share price. This approach is made easy and accessible on Simply Wall St’s Community page, where millions of investors actively share and update their Narratives.

Narratives empower you to make buy or sell decisions by mapping your assumptions about the company’s future directly to a fair value, and then easily comparing it to the latest market price. Plus, as new information like quarterly earnings or major news breaks, Narratives automatically update so your outlook always reflects the latest developments.

For instance, some investors currently see Alexandria’s long-term rental strength in biotech clusters and forecast a fair value of $144.00 a share, while others are more cautious about occupancy and industry risks, valuing it as low as $71.00. Narratives let you transparently compare these different stories and use your own belief or the community's to guide smarter decisions.

Do you think there's more to the story for Alexandria Real Estate Equities? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives