- United States

- /

- Specialized REITs

- /

- NYSE:AMT

American Tower (AMT): Evaluating Valuation After Raised 2025 Outlook and Strong Q3 Performance

Reviewed by Simply Wall St

American Tower (AMT) caught attention after releasing its third-quarter results, which showed a clear uptick in sales and net income. The company also raised its 2025 earnings outlook, reflecting management’s confidence in the face of ongoing industry challenges.

See our latest analysis for American Tower.

While American Tower’s revenue and net income have climbed, the broader story for investors is more nuanced. Despite the upbeat earnings and a fresh round of share buybacks, the company’s share price has slipped 13.67% over the past three months and delivered a 1-year total shareholder return of -12.78%. That said, management’s raised guidance suggests they still see momentum building beneath the surface, even if the market hasn’t fully caught on yet.

If you’re interested in discovering what else the market has to offer, now’s a great time to broaden your perspective and explore fast growing stocks with high insider ownership

With shares now trading at a meaningful discount to analyst targets, investors face a key question: Is American Tower undervalued after recent declines, or has the market already factored in all future growth?

Price-to-Earnings of 28.7x: Is it justified?

American Tower is currently trading on a price-to-earnings ratio of 28.7x, which places it above the average for the US Specialized REITs sector. This premium valuation stands out, especially as the last closing price is meaningfully below analyst price targets.

The price-to-earnings (P/E) ratio is a standard benchmark in real estate investment trusts and highlights how much investors are willing to pay today for one dollar of current earnings. A higher ratio can sometimes reflect strong growth prospects or market confidence in steady income streams.

In American Tower’s case, the elevated P/E suggests that the market may be pricing in superior earnings quality, recent margin improvements, and management’s optimistic outlook. However, compared to industry peers with a P/E average of 25.9x, AMT’s valuation appears relatively expensive. Notably, the fair price-to-earnings ratio according to regression analysis is estimated to be 34.7x, which is even higher than its current figure and could provide some future upside as market perceptions shift.

Explore the SWS fair ratio for American Tower

Result: Price-to-Earnings of 28.7x (ABOUT RIGHT)

However, ongoing weakness in total returns and recent underperformance compared to sector peers could challenge the idea that American Tower is trading at a bargain.

Find out about the key risks to this American Tower narrative.

Another View: What Does the SWS DCF Model Say?

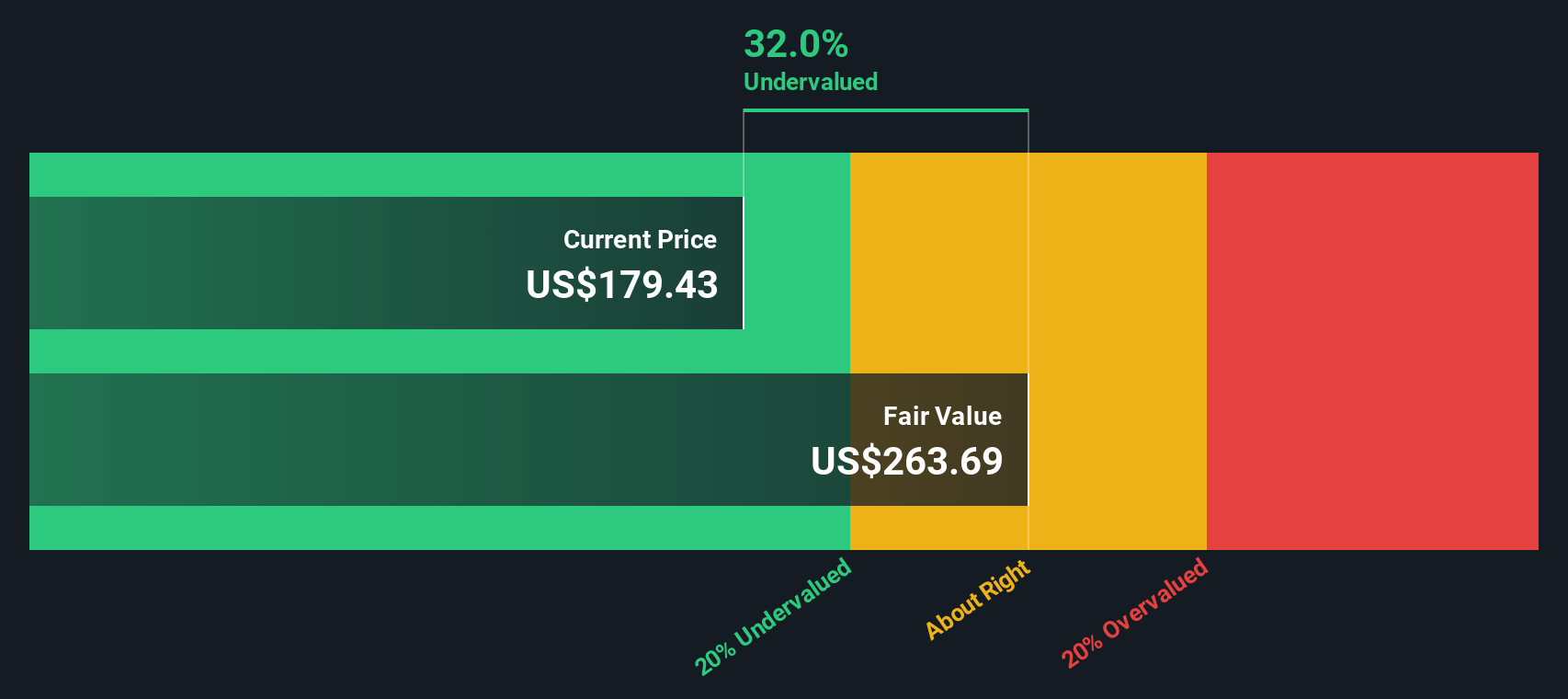

Taking a different approach, our SWS DCF model estimates American Tower’s fair value at $262.35, which is about 31% above the current price of $180.35. This suggests the stock may be undervalued and raises a new question: Is the market overlooking the company’s cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Tower for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Tower Narrative

If you have different insights or want to dig deeper on your own terms, you can build a personal view in just a few minutes. Do it your way

A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop waiting for the perfect moment and start finding your next great opportunity with handpicked investment themes. Uncover new growth and value possibilities that many overlook.

- Unleash your earning potential by targeting companies with exceptional yields through these 18 dividend stocks with yields > 3%.

- Tap into the future of medicine by searching for innovation leaders in artificial intelligence and healthcare with these 33 healthcare AI stocks.

- Amplify your portfolio with hidden gems that are trading below their cash flow value among these 841 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 149,000 communications sites and a highly interconnected footprint of U.S.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives