- United States

- /

- Residential REITs

- /

- NYSE:AMH

Analyzing American Homes 4 Rent Amid Recent Stock Slide and Rising Interest Rate Concerns

Reviewed by Bailey Pemberton

Thinking about your next move with American Homes 4 Rent? You are not alone. The real estate sector has kept investors guessing lately, and American Homes 4 Rent has seen its fair share of ups and downs. Over the past week, the stock held steady with a slight 0.1% bump, but the 30-day drop of 6.3% and a year-to-date slide of 11.2% might be giving some pause. Long-term holders have still netted a gain, with more than 22% over five years, but recent dips have many wondering whether there is real value here or if greater risks are on the horizon.

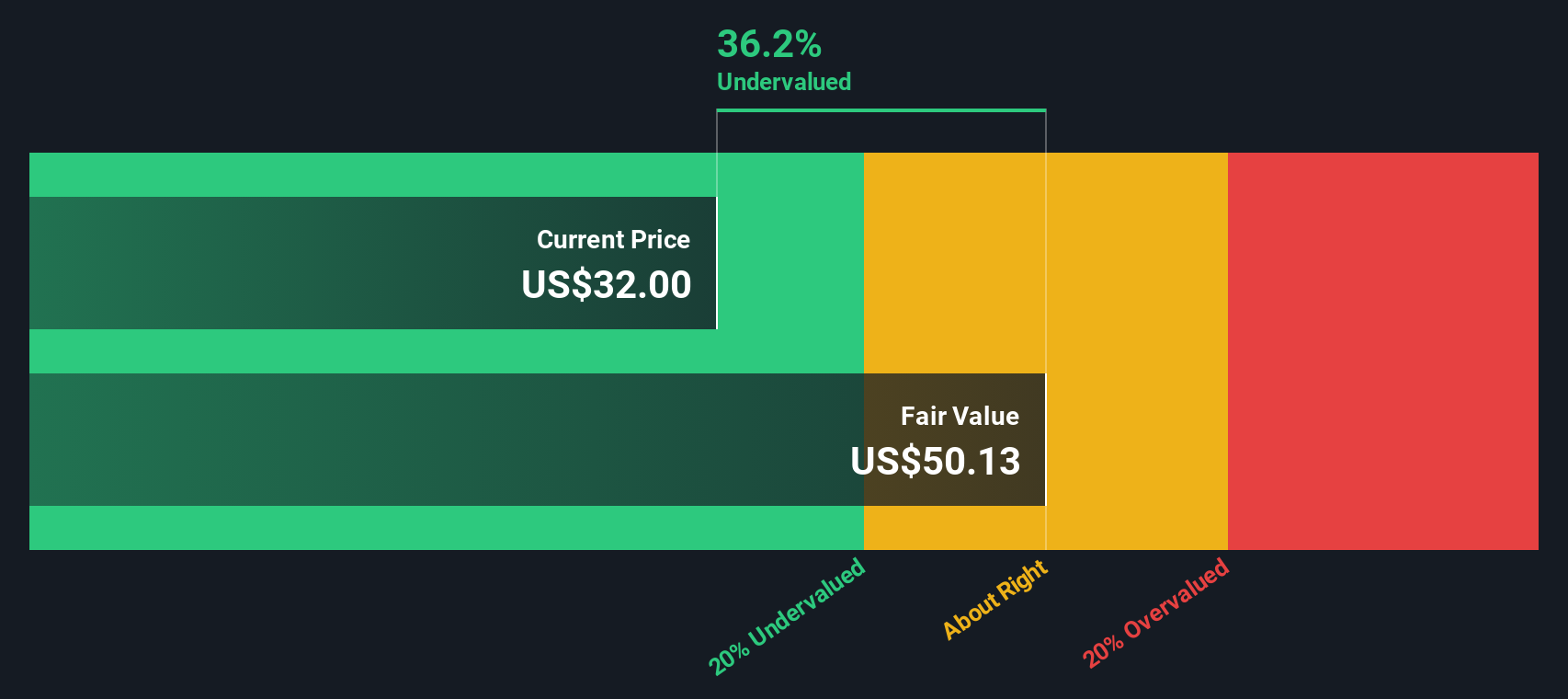

These moves come as broader market shifts and evolving investor sentiment toward residential real estate have raised new questions about fair value and long-term potential. With headlines swirling around interest rates and sector headwinds, the mood has shifted. Yet, valuation can offer clarity amid the noise. American Homes 4 Rent currently scores a 4 out of 6 on our valuation check, which may be an encouraging sign that it is trading below its true worth on several key metrics.

If you are weighing whether to buy, hold, or wait for a rebound, understanding the stock’s valuation is absolutely crucial. Next, we will break down the main valuation approaches, before exploring a more nuanced way to gauge true value that savvy investors will not want to miss.

Why American Homes 4 Rent is lagging behind its peers

Approach 1: American Homes 4 Rent Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows, specifically adjusted funds from operations in this case, and discounting them back to their value today. This technique helps investors judge whether a stock is trading above, below, or near its underlying worth, based on long-term, real-world earnings.

For American Homes 4 Rent, the latest twelve months' Free Cash Flow (FCF) came in at $663.3 Million. Analysts project this figure to continue growing, with FCF forecast to reach $846.9 Million by 2028. The DCF model, which relies on expert forecasts for up to five years before extending those trends further, predicts continuing momentum. By 2035, FCF is projected to surpass $1.1 Billion, but all these numbers are converted into present-day terms to produce a valid estimate.

The result is that the DCF analysis gives an estimated intrinsic value of $48.24 per share. Based on this calculation, American Homes 4 Rent's stock appears to be trading at a notable 32.3% discount, meaning it is significantly undervalued relative to its cash-generating potential. This provides a strong signal for investors looking for value in a sector facing uncertainty.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Homes 4 Rent is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: American Homes 4 Rent Price vs Earnings (PE Ratio)

Evaluating American Homes 4 Rent with its Price-to-Earnings (PE) ratio makes sense because the company is profitable and earnings provide a straightforward snapshot of what investors are paying for each dollar of profit. Profitability allows PE to be a meaningful metric for comparison, especially in industries with established earnings streams such as Residential REITs.

A company’s expected growth and risk profile play a big part in what a "normal" or "fair" PE should look like. Higher growth typically justifies a higher PE, while greater risk tends to bring the fair range down. For context, American Homes 4 Rent currently trades at a PE of 29.4x. This is noticeably higher than the industry average PE of 20.5x, but remains much lower than the peer average of 69.5x. This reflects a conservative pricing within a competitive group.

Simply Wall St's proprietary "Fair Ratio" considers more than just raw comparisons and one-size-fits-all averages. It combines insights from earnings growth, profit margins, industry outlook, company size, and risk factors to form a more tailored benchmark. For American Homes 4 Rent, the Fair PE Ratio is calculated at 27.4x. This approach is more reliable than a simple industry or peer check because it takes into account the company's unique qualities and environment.

Comparing the actual PE of 29.4x with the Fair Ratio of 27.4x, the difference is only 2x. This suggests the stock is roughly in line with its intrinsic value on a price-to-earnings basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

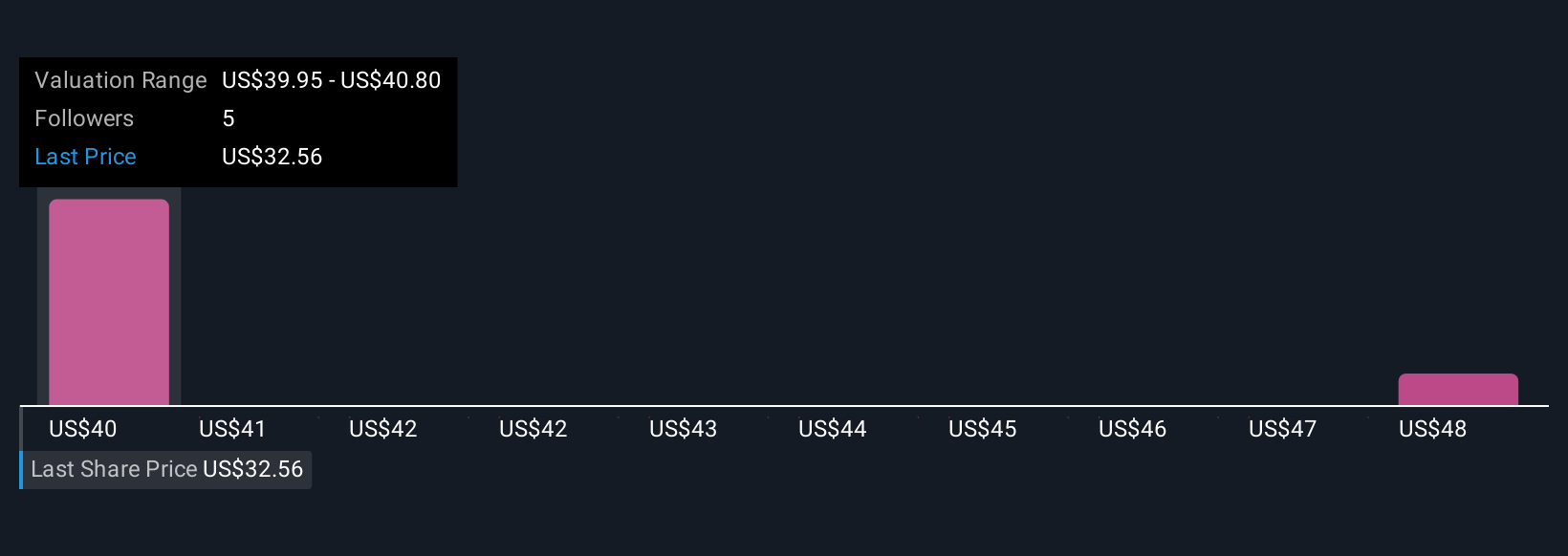

Upgrade Your Decision Making: Choose your American Homes 4 Rent Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Put simply, a Narrative is your personal story or perspective about a company that connects its latest business developments and financial forecasts to your own estimate of what it is truly worth. Narratives let you make sense of American Homes 4 Rent's numbers by wrapping them in a framework that starts with your assumptions about fair value, future revenue, earnings, and margins. This approach links the company's story to hard financials and a practical estimate of current value.

With Simply Wall St, Narratives are an easy tool available to everyone via the Community page, helping millions of investors see not just the numbers behind a stock, but the reasons driving them. Narratives empower you to make more informed buy or sell decisions by comparing your Fair Value to the market Price, automatically updating whenever new earnings reports or news headlines emerge. For example, one American Homes 4 Rent Narrative sees upside if its unique development program continues to outpace rising expenses, while another flags margin risk if costs run ahead of rent growth. These are two very different stories, backed by equally different numbers, all in one place so you can choose which outlook fits your beliefs.

Do you think there's more to the story for American Homes 4 Rent? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMH

American Homes 4 Rent

AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives