- United States

- /

- Health Care REITs

- /

- NYSE:AHR

American Healthcare REIT (AHR): Assessing Valuation After Analyst Upgrades and Senior Housing Growth Signals

Reviewed by Simply Wall St

American Healthcare REIT shares climbed to a new high after upbeat commentary on its growth in the senior housing sector and growing expectations that the company could move into profitability this year, as its real estate portfolio expands.

See our latest analysis for American Healthcare REIT.

Momentum is clearly building for American Healthcare REIT, with the stock posting a stellar year-to-date share price return of nearly 70% and an impressive 1-year total shareholder return of almost 93%. This surge follows upbeat signals around profitability and continued strength in its expanding portfolio, which is fueling optimism that recent gains could have staying power.

If American Healthcare REIT’s breakout run has you watching healthcare real estate closely, you might want to discover other leaders in the industry with our See the full list for free.

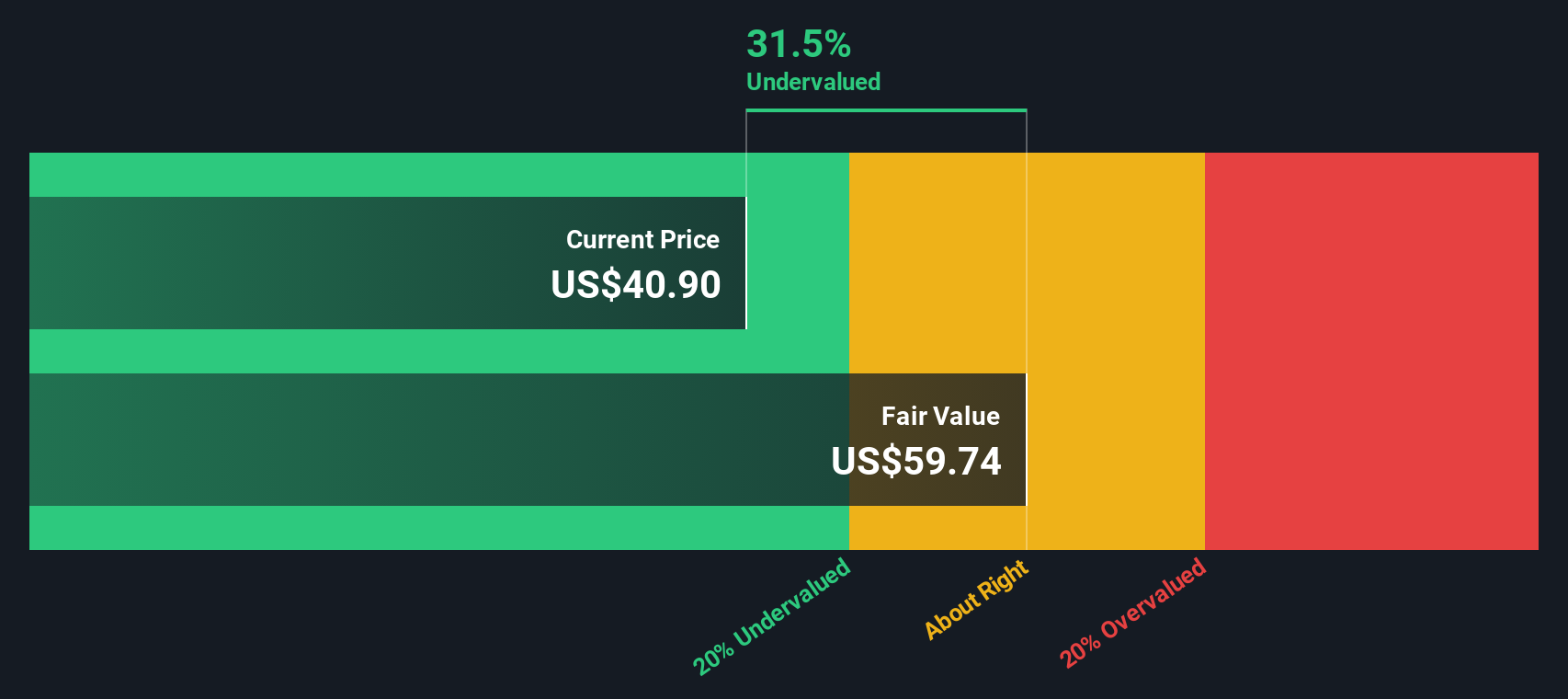

With analyst upgrades and soaring returns on the table, the key question for investors now is whether American Healthcare REIT is undervalued and poised for more upside or if the market is already pricing in the company’s future growth potential.

Most Popular Narrative: 0.4% Overvalued

With American Healthcare REIT’s fair value pegged almost identically to the current share price, the most widely followed narrative on the stock suggests it is priced nearly to perfection. Before drawing your own conclusions, consider one of the key assumptions that supports this view.

The combination of a rapidly growing 80+ demographic and a multi-year period of low new supply in senior housing and skilled nursing is expected to drive a persistent supply-demand imbalance. This is anticipated to fuel both occupancy gains and rent growth across American Healthcare REIT's portfolio. This dynamic is expected to support above-trend revenue and net operating income growth over the next decade.

Want to know why analysts see almost no upside left? This narrative relies heavily on bullish long-term growth expectations, but the financial forecasts supporting its target might surprise you. The numbers driving this valuation reflect some bold profit assumptions and margin shifts. Ready to see what’s behind the barely-overvalued label?

Result: Fair Value of $46.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, occupancy rates are nearing stabilization, and tougher year-over-year comparisons could limit growth momentum if key metrics start to plateau.

Find out about the key risks to this American Healthcare REIT narrative.

Another View: Discounted Cash Flow Offers a Different Angle

While traditional multiples suggest American Healthcare REIT is almost fully priced, our SWS DCF model presents a markedly different perspective. It indicates the stock is actually trading below its fair value, which may point to a potential undervaluation that is difficult to overlook. Could this be the hidden opportunity analysts are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Healthcare REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Healthcare REIT Narrative

If you have a different perspective or want to draw your own conclusions, you can easily build a data-driven American Healthcare REIT narrative in just a few minutes. Do it your way

A great starting point for your American Healthcare REIT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock when unique opportunities are just a click away. Boost your investing know-how and stay ahead of market moves with fresh ideas you can act on right now.

- Tap into stocks with strong, sustainable yields by checking out these 20 dividend stocks with yields > 3% to see which companies are rewarding shareholders while keeping risk in check.

- Uncover next-generation innovators driving breakthroughs in artificial intelligence with these 26 AI penny stocks and put tomorrow’s tech leaders on your radar today.

- Accelerate your search for value by screening for these 838 undervalued stocks based on cash flows and find stocks trading well below their true potential before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AHR

American Healthcare REIT

A Maryland-based self-managed REIT, owns and operates a diversified portfolio of clinical healthcare real estate across the U.S., U.K., and the Isle of Man.

Good value with adequate balance sheet.

Market Insights

Community Narratives