- United States

- /

- Specialized REITs

- /

- NasdaqGS:LAMR

Will Lamar Advertising's (LAMR) Rising Sales and Lower Quarterly Profit Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Lamar Advertising Company recently reported its third quarter 2025 results, with sales rising to US$585.54 million from US$564.14 million a year earlier, while net income decreased to US$141.75 million from US$147.48 million.

- For the first nine months of 2025, the company saw higher sales and a significant year-over-year increase in net income and earnings per share, underscoring the impact of ongoing operational initiatives.

- With continued top-line growth reported in the recent quarter, we'll assess how this development may influence Lamar Advertising's investment narrative moving forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Lamar Advertising Investment Narrative Recap

To be a shareholder in Lamar Advertising, you have to believe in the strength of out-of-home advertising, particularly its ability to drive steady revenue through local and digital expansion even during mixed economic signals. The latest quarterly results, showing rising sales but a dip in net income, do not materially shift the biggest near-term catalyst: growth in the digital billboard portfolio, while risks tied to contract losses and slower margin improvement remain close at hand.

The company’s recent partnership with OptimizeRx is especially relevant, as it demonstrates Lamar's focus on targeting high-value advertiser segments through enhanced geographic precision, directly supporting efforts to grow premium digital inventory. This move aligns with the catalyst of expanding digital billboard adoption, which is expected to support both revenue growth and margin expansion, buffering the company against slower gains in traditional ad categories even as top-line trends ebb and flow.

However, in contrast to the positive signals from digital initiatives, investors should be mindful of the ongoing risk of contract renewals and their influence on...

Read the full narrative on Lamar Advertising (it's free!)

Lamar Advertising's narrative projects $2.5 billion revenue and $723.9 million earnings by 2028. This requires 3.7% yearly revenue growth and a $284.9 million earnings increase from $439.0 million.

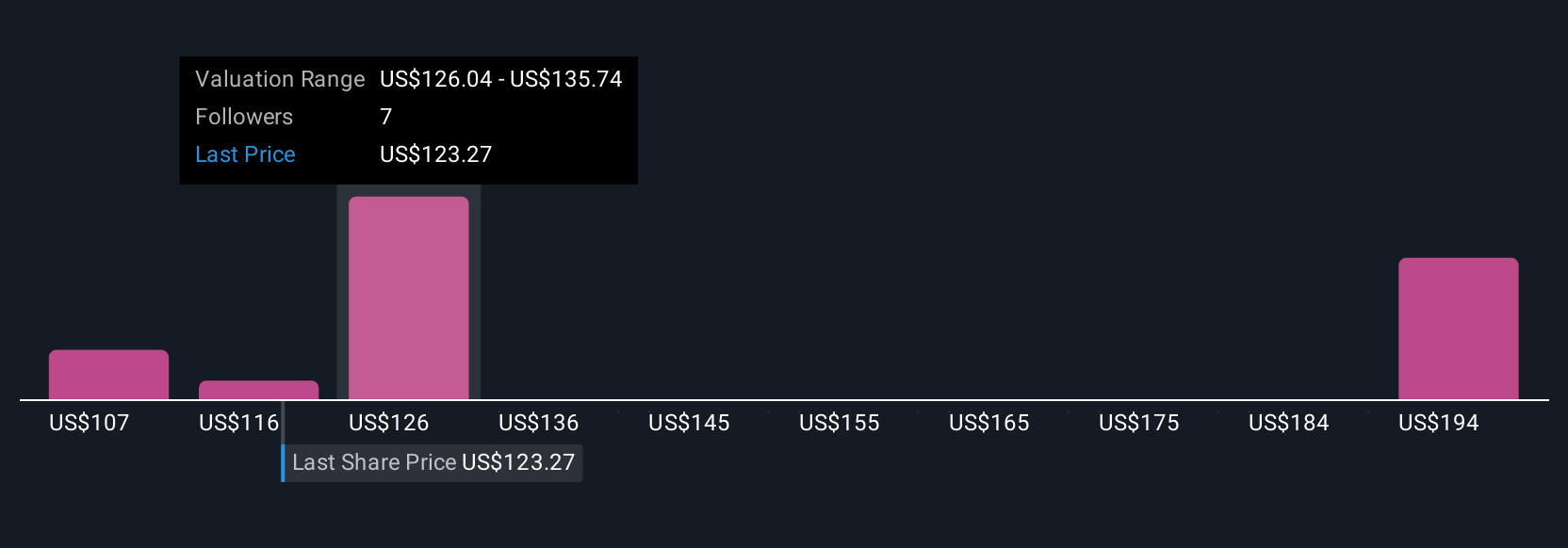

Uncover how Lamar Advertising's forecasts yield a $130.20 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put forward four fair value estimates for Lamar Advertising, with targets stretching from US$106.64 up to US$189.70. At the same time, reported top-line growth and ongoing digital rollouts continue to influence expectations for both revenue and margin outlooks, reminding you to weigh different perspectives when considering the company's evolving story.

Explore 4 other fair value estimates on Lamar Advertising - why the stock might be worth 11% less than the current price!

Build Your Own Lamar Advertising Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lamar Advertising research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lamar Advertising research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lamar Advertising's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAMR

Lamar Advertising

Operates as an outdoor advertising company in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives