- United States

- /

- Specialized REITs

- /

- NasdaqGS:LAMR

Lamar Advertising (LAMR): Assessing Valuation After Accelerated Revenue Growth and Acquisitions

Reviewed by Simply Wall St

Lamar Advertising (LAMR) just released its latest quarterly results, showing faster acquisition-adjusted revenue growth. The company’s digital and programmatic segments, as well as airport and logo signage, all contributed to this momentum.

See our latest analysis for Lamar Advertising.

Lamar Advertising’s share price has responded positively to its recent momentum, jumping 5.3% in a single day after earnings and contributing to a solid 9.4% 90-day share price return. While recent headlines reflect expansion and digital growth, the real story is a sustained uptrend. The total shareholder return sits at an impressive 54% over the past three years, signaling investor confidence in both the company’s strategy and long-term prospects.

If you’re curious what other fast-growing, innovative companies with high insider ownership are making moves right now, take the next step and discover fast growing stocks with high insider ownership

Given the company’s solid performance, rapid acquisitions, and a recent surge in share price, the key question is whether Lamar Advertising remains attractively valued or if the market has already priced in all that future growth. Could this still be a buying opportunity, or has optimism run ahead of fundamentals?

Most Popular Narrative: 3% Undervalued

Lamar Advertising’s latest close was just below the widely-followed narrative’s fair value estimate, suggesting modest upside potential as calculated by consensus expectations. The narrative’s methodology combines a range of future growth assumptions and sector dynamics to arrive at this figure.

Accelerating expansion of Lamar's digital billboard portfolio, evidenced by the addition of 325-350 new digital units expected this year and a strengthening second-half outlook, positions the company to capitalize on rising demand for dynamic, high-impact ad solutions and supports both revenue growth and net margin expansion through premium inventory and dynamic pricing.

What critical financial leap makes this valuation tick? The narrative’s entire case hinges on a trajectory of growth and margin expansion that is more bold than many expect. Dive in to see why analysts project these specific numbers and what assumption flips the script on the fair value calculation.

Result: Fair Value of $130.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer revenue guidance and contract risks could challenge the growth story. These factors may serve as potential catalysts that might alter analyst expectations ahead.

Find out about the key risks to this Lamar Advertising narrative.

Another View: Market Ratios Raise Questions

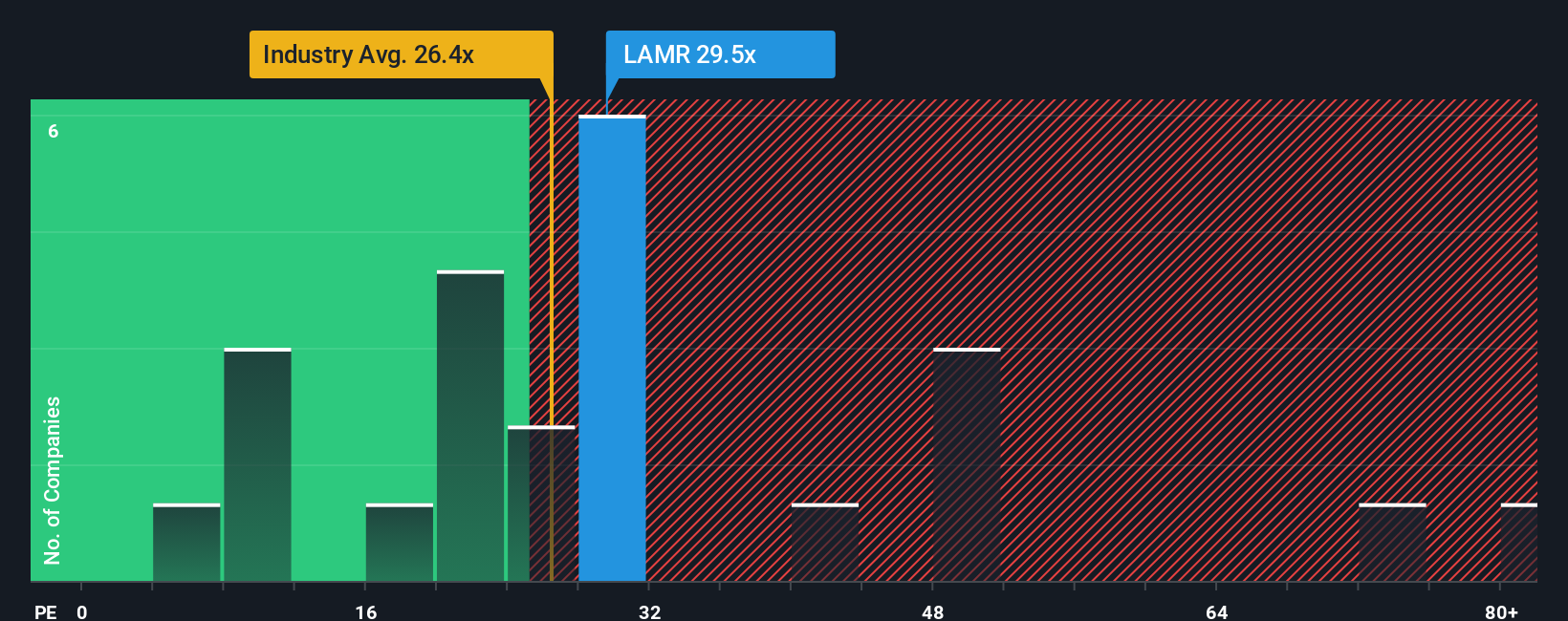

Looking at the numbers from another angle, Lamar Advertising’s price-to-earnings ratio stands at 29.5x. This makes it appear expensive compared to the US Specialized REITs industry average of 26x and its peer average of 19.8x. Even if the fair ratio is higher at 37.6x, the premium price suggests investors may be paying up for future growth that is not guaranteed. Does this premium signal confidence, or are risks being underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamar Advertising Narrative

If you think differently or want to see what the numbers say first-hand, you can craft your own take on Lamar Advertising in just a few minutes using the available data. Do it your way

A great starting point for your Lamar Advertising research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let the next big winner slip through your fingers. Take action now and strengthen your portfolio by targeting rising opportunities in the market.

- Unlock higher potential returns by targeting overlooked assets among these 876 undervalued stocks based on cash flows with strong fundamentals and compelling long-term trajectories.

- Capture the explosive advancements transforming healthcare by focusing on these 32 healthcare AI stocks, where artificial intelligence is driving innovation and new medical frontiers.

- Capitalize on the next wave of digital finance by directing your research to these 82 cryptocurrency and blockchain stocks, highlighting companies pioneering blockchain technology and cryptocurrency growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAMR

Lamar Advertising

Operates as an outdoor advertising company in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives