- United States

- /

- Specialized REITs

- /

- NasdaqGS:GLPI

Is GLPI’s Latest Acquisitions and Strong Q3 Results Shifting Its Investment Outlook?

Reviewed by Sasha Jovanovic

- Gaming and Leisure Properties, Inc. recently reported strong third quarter 2025 results, with US$397.61 million in revenue and a US$241.19 million net income, as well as announcing several acquisitions and development commitments, including the purchase of Sunland Park Racetrack & Casino and land for the future Live! Casino and Hotel Virginia in Petersburg, VA.

- These developments highlight GLPI's focus on expanding its real estate portfolio through diversified tenant relationships and innovative funding solutions, reinforcing income visibility and growth prospects in the evolving gaming real estate sector.

- We'll examine how the combination of raised full-year guidance and major new investments influences Gaming and Leisure Properties' investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Gaming and Leisure Properties Investment Narrative Recap

To be a shareholder in Gaming and Leisure Properties, Inc. (GLPI), you need to believe in the continued appeal of brick-and-mortar casino real estate and the company’s disciplined expansion strategy. The recent strong third-quarter results and guidance hike reinforce short-term confidence, though tenant concentration risk with Bally's remains the biggest challenge to sustained predictable income; this news does not materially alter that risk for now.

Among recent announcements, GLPI’s agreement to acquire real estate for the upcoming Live! Casino and Hotel Virginia stands out. This commitment to fund a new integrated resort further advances one of the key catalysts for the business: expanding the portfolio beyond legacy gaming assets and into new markets that can diversify rental streams and support long-term cash flow.

But, while the latest acquisition broadens GLPI’s footprint, investors should also be watching for signs of...

Read the full narrative on Gaming and Leisure Properties (it's free!)

Gaming and Leisure Properties' outlook forecasts $2.0 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes 9.0% annual revenue growth and a $382 million increase in earnings from the current $717.9 million.

Uncover how Gaming and Leisure Properties' forecasts yield a $54.07 fair value, a 21% upside to its current price.

Exploring Other Perspectives

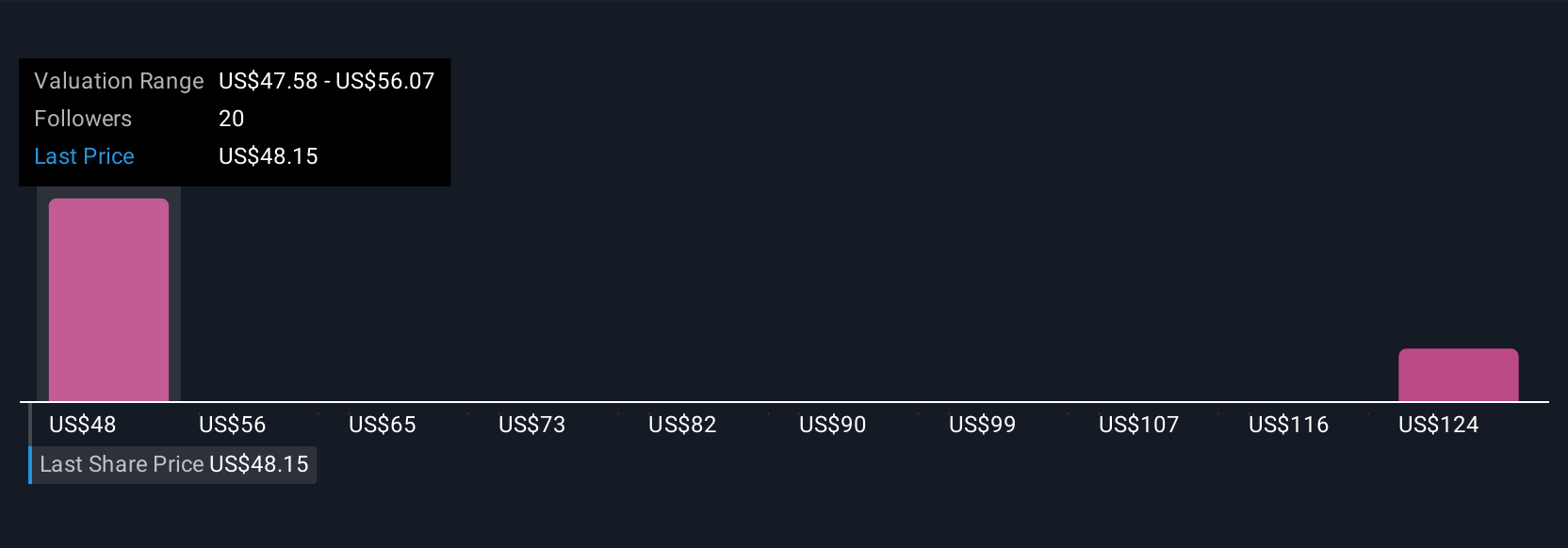

Three fair value estimates from the Simply Wall St Community span US$47.58 to US$128.86 per share, underscoring a wide range of opinions. With upcoming capital heavily committed to large projects like Bally's Chicago, investors are weighing the potential opportunity against elevated project execution risks.

Explore 3 other fair value estimates on Gaming and Leisure Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Gaming and Leisure Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaming and Leisure Properties research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gaming and Leisure Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gaming and Leisure Properties' overall financial health at a glance.

No Opportunity In Gaming and Leisure Properties?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLPI

Gaming and Leisure Properties

GLPI is engaged in the business of acquiring, financing, and owning real estate property to be leased to gaming operators in triple-net lease arrangements, pursuant to which the tenant is responsible for all facility maintenance, insurance required in connection with the leased properties and the business conducted on the leased properties, taxes levied on or with respect to the leased properties and all utilities and other services necessary or appropriate for the leased properties and the business conducted on the leased properties.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives