- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Should Equinix’s (EQIX) AI Leadership and C$700M Notes Issue Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Earlier this month, Equinix appointed Dr. Yang Song as SVP, Chief Data Science and AI Officer, and issued C$700 million in 4.000% Senior Notes due 2032 through its wholly-owned subsidiary, fully guaranteed by Equinix, Inc.

- The combination of executive leadership in AI and enhanced financial flexibility positions Equinix to accelerate its digital innovation and support future growth initiatives.

- We'll explore how Equinix’s expanded financial capacity from the new note issuance could influence its investment outlook and growth strategy.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Equinix Investment Narrative Recap

To be an Equinix shareholder, you need to believe in the ongoing shift toward digital infrastructure, particularly the long-term demand for AI, cloud, and interconnection services fueling the need for global data center capacity. The recent appointment of Dr. Yang Song to lead data science and AI initiatives, combined with the C$700 million debt issuance, adds depth to Equinix’s innovation capabilities but does not fundamentally alter the most immediate catalyst, enterprise AI demand, or the key risk of high leverage and interest rate exposure in the short term.

Of the recent announcements, the issuance of C$700 million in 4.000% Senior Notes stands out for its relevance, providing Equinix with added capital flexibility. This financial move boosts the company’s ability to fund expansion and respond to evolving market opportunities, important considerations given how much Equinix’s investment cycle depends on access to capital.

However, investors should keep in mind that, despite these steps, Equinix’s high leverage means that if capital markets tighten or interest rates remain elevated …

Read the full narrative on Equinix (it's free!)

Equinix's outlook projects $11.4 billion in revenue and $1.7 billion in earnings by 2028. This requires 8.5% annual revenue growth and a $706 million increase in earnings from the current $994 million.

Uncover how Equinix's forecasts yield a $965.56 fair value, a 29% upside to its current price.

Exploring Other Perspectives

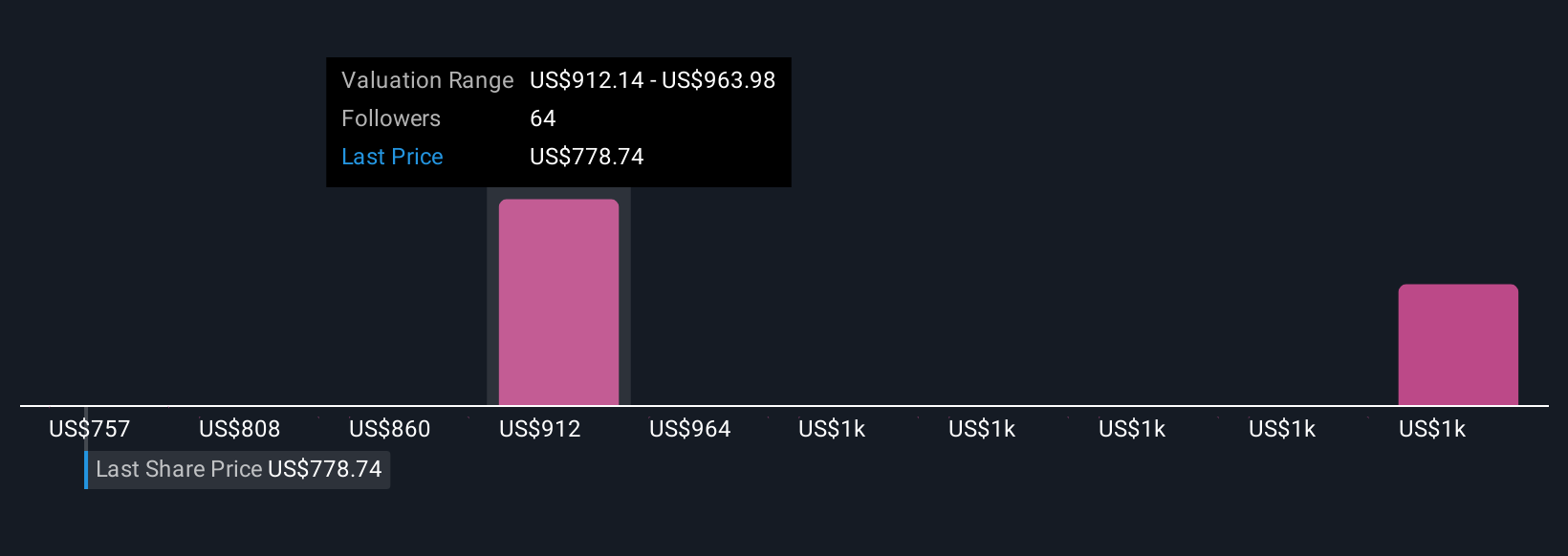

Simply Wall St Community members currently estimate Equinix’s fair value in a wide range from C$756.65 to C$1,246.87, with seven independent views. While many see meaningful upside, high leverage and sensitivity to debt costs could shape performance differently from consensus, so reviewing all viewpoints is crucial.

Explore 7 other fair value estimates on Equinix - why the stock might be worth just $756.65!

Build Your Own Equinix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinix research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equinix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinix's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success