- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Do Recent Institutional Investments Signal Upside for Equinix Stock in 2025?

Reviewed by Bailey Pemberton

- Wondering if Equinix stock is a hidden bargain or priced for perfection? Let's break down what the numbers and recent news are really saying about its value.

- Equinix shares recently rose 6.6% in the last month, reversing some earlier declines, though the stock is still down 12.1% year-to-date.

- One of the big headlines: several large institutional investors have increased their stakes in Equinix, reflecting growing confidence in the company even as the sector faces headwinds. There has also been speculation about digital infrastructure demand spurring renewed interest in data center providers like Equinix.

- When it comes to our value checks, Equinix scores just 2 out of 6, so the usual valuation tools might not be telling the whole story. Stay tuned as we dig deeper into what this really means, plus a smarter way to think about valuation later on.

Equinix scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Equinix Discounted Cash Flow (DCF) Analysis

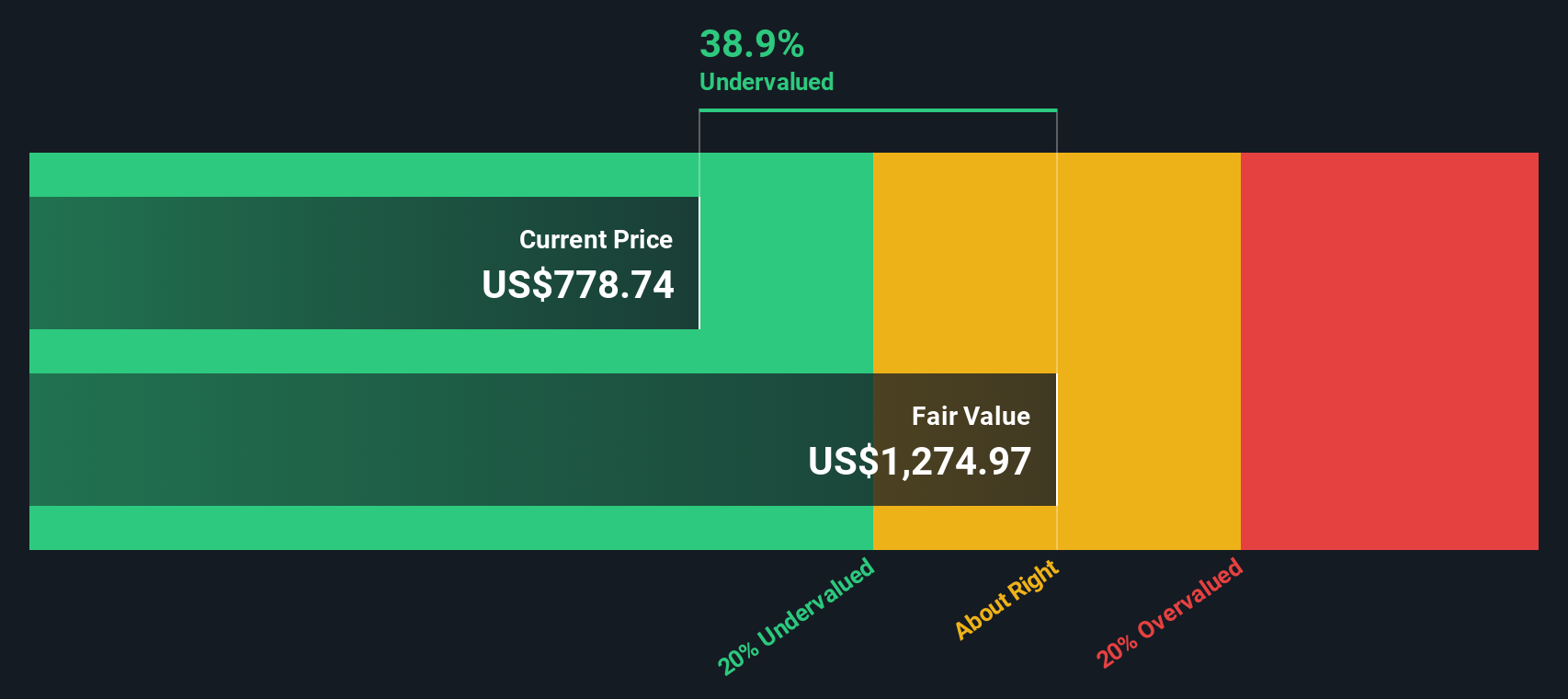

The Discounted Cash Flow (DCF) model estimates the present value of a company by projecting its future adjusted funds from operations and discounting those cash flows back to today. For Equinix, this approach starts with its most recent free cash flow, which stands at $3.36 billion. Analyst forecasts suggest continued growth, with free cash flow expected to reach approximately $5.44 billion by 2029. Looking further ahead, Simply Wall St extrapolates these numbers and projects free cash flow to approach $7.46 billion in 2035.

These projections are all denominated in US dollars, which aligns with Equinix's reporting currency. It is important to note that analyst estimates only extend five years into the future. Subsequent figures are modeled based on longer-term growth expectations.

Based on these forecasts, the DCF model calculates an intrinsic fair value of $1,260.53 per share. With the current market price implying a 34.2% discount, this analysis signals Equinix may be significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equinix is undervalued by 34.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Equinix Price vs Earnings

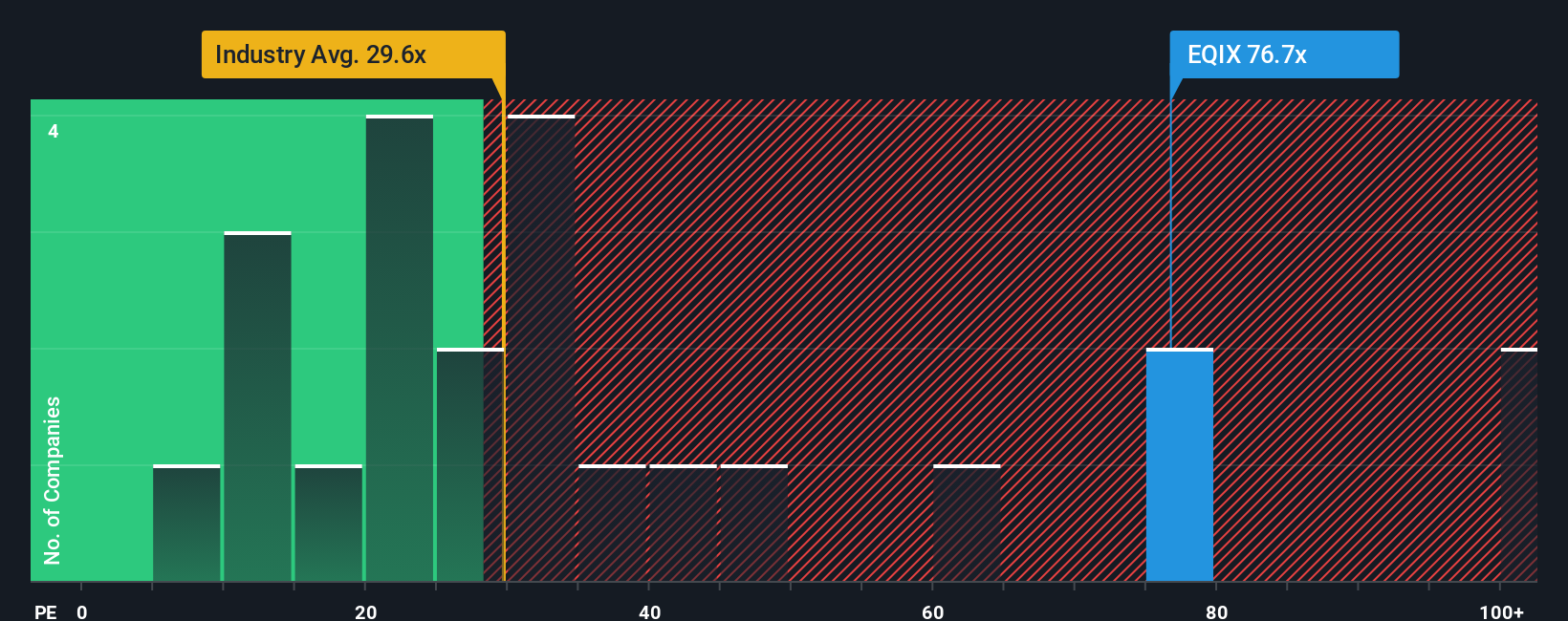

The Price-to-Earnings (PE) ratio is a widely used valuation metric when analyzing profitable companies. It reflects how much investors are willing to pay for each dollar of a firm's earnings. For established businesses with positive and stable profits, the PE ratio provides a direct view into market expectations and sentiment.

However, the "right" PE ratio is not set in stone. Companies with higher expected growth or lower risk often justify a higher multiple, while slower-growing or riskier businesses command a lower one. It is essential to consider these factors when judging whether a stock's PE ratio seems reasonable.

Currently, Equinix trades at a PE ratio of 76.08x. This is well above the average for specialized REITs at 17.29x and also higher than both its peer group at 27.87x and the industry at large. At first glance, such a premium might look excessive, but it is important to look deeper.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio, at 35.97x for Equinix, weighs variables such as earnings growth, profit margins, industry dynamics, company size, and risk factors. This approach provides a more nuanced picture than simple peer or industry comparisons. By looking beyond surface benchmarks, the Fair Ratio offers a more tailored measure of reasonable value for Equinix’s unique profile.

Comparing the actual PE of 76.08x to the Fair Ratio of 35.97x shows that Equinix is trading at a substantial premium even after accounting for its strengths and growth potential.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equinix Narrative

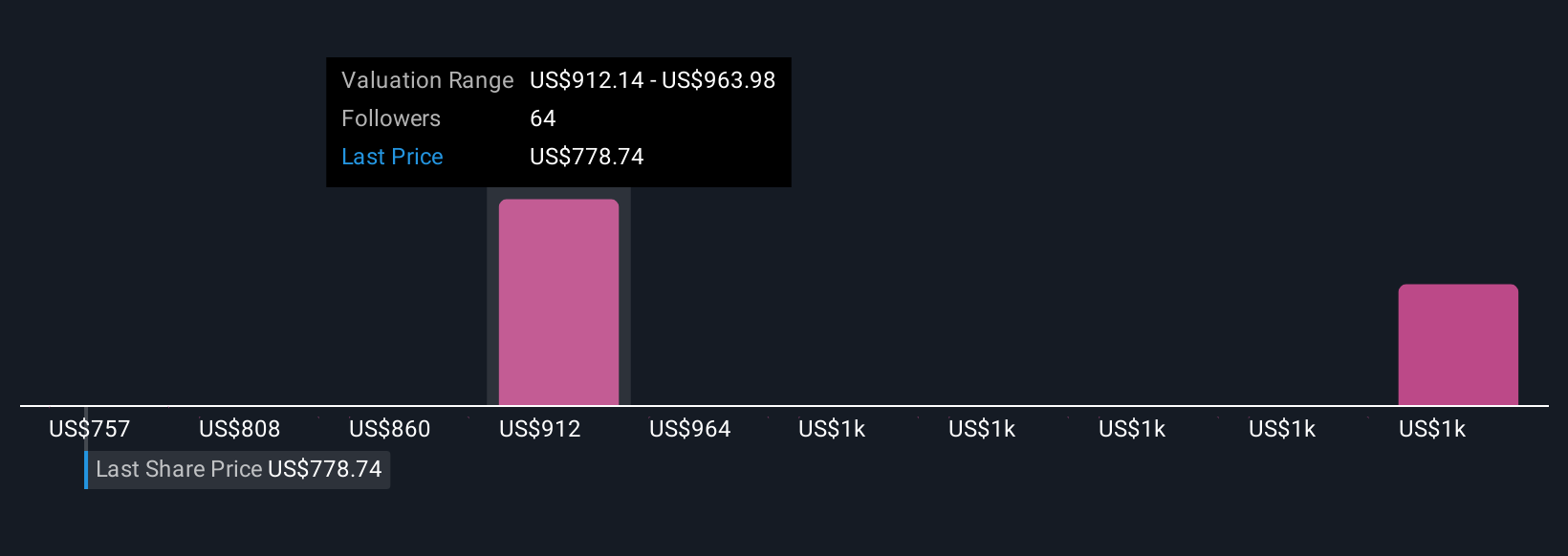

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personal story or perspective about a company, combining your own assumptions about its future revenue, earnings, and margins into a projected fair value. Instead of only focusing on the numbers, Narratives connect what you believe about Equinix, such as industry changes, execution risks, or opportunities in AI and cloud adoption, to concrete financial forecasts and a calculated fair value.

On Simply Wall St’s Community page, millions of investors create and update Narratives easily, helping each other see the logic behind their investment decisions. Narratives empower you to compare the fair value from your story with the current stock price, making it much clearer when to consider buying, selling, or holding. Better still, Narratives update dynamically whenever there is significant news or an earnings release, ensuring your outlook is always relevant and up to date.

For example, one Equinix Narrative might point to a bullish scenario, reflecting confidence in AI-driven demand and expansion, resulting in a $1,200 price target. Another might take a more cautious view, emphasizing execution risks or capital intensity, and see fair value closer to $804. Narratives make these differing perspectives and the reasoning behind them transparent, so you can decide with clarity and confidence.

Do you think there's more to the story for Equinix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives