- United States

- /

- Health Care REITs

- /

- NasdaqGS:DHC

Diversified Healthcare Trust (DHC): Valuation in Focus as Investors Await Q3 2025 Earnings and Mixed Analyst Views

Reviewed by Simply Wall St

Diversified Healthcare Trust (DHC) is in the spotlight as investors await the company’s Q3 2025 earnings release. Market activity seems tied to expectations of another quarter in the red, along with modest revenue gains.

See our latest analysis for Diversified Healthcare Trust.

Shares of Diversified Healthcare Trust have surged over the past year, with an 87.7% year-to-date price return drawing attention despite swings in recent weeks. The total shareholder return over three years is an impressive 277.5%, suggesting that optimism is building as investors consider the company’s earnings outlook and shifting sentiment more heavily than short-term setbacks or volatility.

If you’re interested in seeing what else is catching momentum these days, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With the share price now hovering just above analyst targets and sentiment decidedly mixed, the key question for investors is whether DHC still offers upside potential or if all future growth has already been factored in.

Most Popular Narrative: Fairly Valued

With the narrative fair value now set at $4.25, almost exactly matching DHC’s recent close at $4.26, sentiment is closely aligned with the current market pricing. This makes DHC one of those rare cases where the consensus narrative sees little to no disconnect between price and fundamentals, at least for now.

Active portfolio repositioning, executing non-core asset sales and focusing on higher growth senior housing and medical office/life science properties, enables the company to concentrate capital on assets with sector tailwinds (strong demand for outpatient care settings) and embedded rent growth, supporting long-term revenue and FFO growth.

Curious what numbers this narrative is banking on? The real story is a combination of earnings revival, strategic asset plays, and a long-term growth thesis that could change the game. Find out exactly which trends and forecasts are behind this fair value call; the breakdown might surprise you.

Result: Fair Value of $4.25 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high leverage and potential drops in occupancy rates could quickly undermine the optimistic outlook that is already factored into DHC’s current valuation.

Find out about the key risks to this Diversified Healthcare Trust narrative.

Another View: Multiples Tell a Different Story

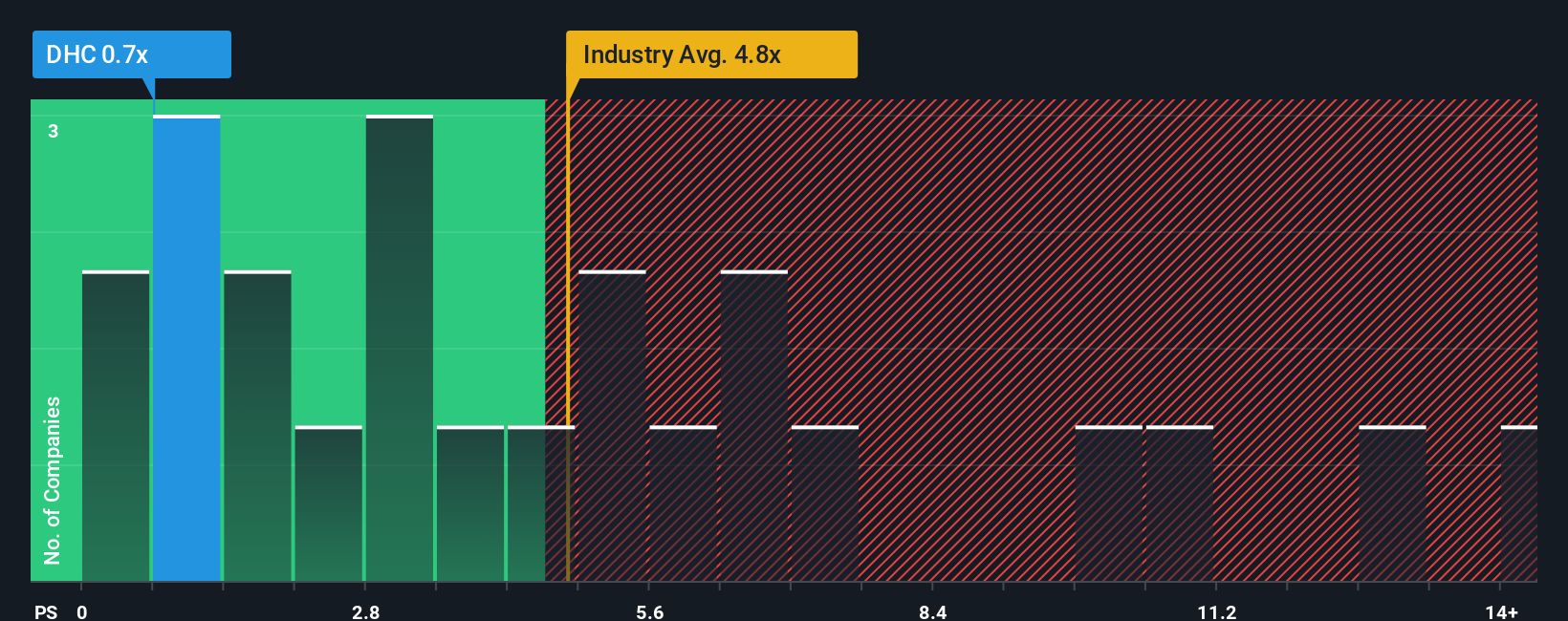

While the consensus sees DHC as fairly valued, our peer and industry comparison based on the price-to-sales ratio reveals more potential. DHC’s ratio sits at just 0.7x, which is much lower than both the peer average of 5.2x and the industry average of 4.8x. The fair ratio, which reflects where the market could head, is estimated at 0.8x. This gap signals a possible value opportunity, but how will investors weigh this against slower growth forecasts and profitability challenges?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diversified Healthcare Trust Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own perspective and narrative in just a few minutes. Do it your way

A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to just one name? Take control of your portfolio by tapping into powerful stock opportunities you might be missing out on right now.

- Uncover potential breakout winners with these 3589 penny stocks with strong financials. Spot those under-the-radar companies gaining strong financial ground.

- Supercharge your returns by targeting next-generation tech with these 26 AI penny stocks. Artificial intelligence is reshaping entire industries.

- Take advantage of market oversights and focus on the best value plays by targeting these 840 undervalued stocks based on cash flows, all grounded in robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHC

Diversified Healthcare Trust

DHC is a real estate investment trust focused on owning high-quality healthcare properties located throughout the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives