- United States

- /

- Real Estate

- /

- NYSE:MMI

Can Marcus & Millichap’s (MMI) Tech and Acquisition Push Redefine Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In November 2025, Marcus & Millichap reported improved third quarter results with revenue rising to US$193.89 million and a return to profitability, while also confirming an ongoing focus on technology investment, AI, and acquisitions to fuel long-term growth.

- The company showcased its evolving strategy at major industry events and reaffirmed its commitment to leveraging digital tools and expansion efforts to drive value for both clients and shareholders.

- We'll explore how Marcus & Millichap's emphasis on productivity growth through technology and acquisitions could shape its future investment case.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Marcus & Millichap Investment Narrative Recap

For shareholders, the core belief underpinning Marcus & Millichap's appeal remains its ability to convert investments in technology and acquisitions into enhanced productivity and more stable revenue, while managing the cyclical risk tied to commercial real estate transactions. The recent return to profitability and revenue improvement are encouraging, but the company's high exposure to brokerage commissions means that a sector slowdown remains the most prominent near-term risk; the earnings update mildly eases immediate concerns without fundamentally reshaping this risk profile.

The November 10 announcement highlighting the company’s continued pursuit of acquisitions to drive technology adoption and grow the MMI brand is most relevant to investors following this news. Efforts to expand capabilities and scale through inorganic growth could help address the critical need for productivity gains, which remains an important catalyst for reducing reliance on volatile transaction revenues.

However, while management points to new growth levers, investors should be aware that persistent fee compression and competitive threats remain a concern if ...

Read the full narrative on Marcus & Millichap (it's free!)

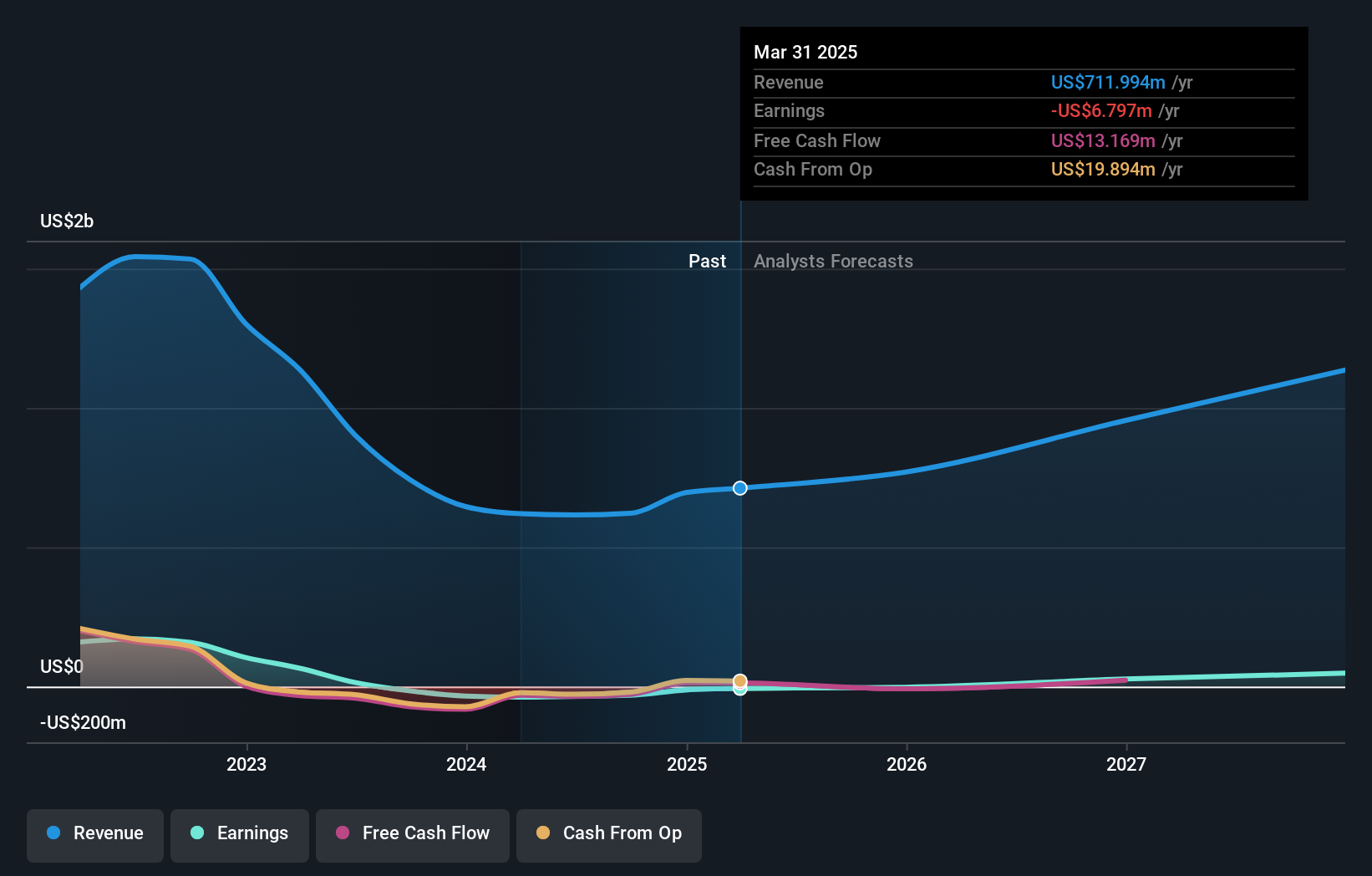

Marcus & Millichap's outlook anticipates $1.2 billion in revenue and $77.6 million in earnings by 2028. This implies a 17.9% annual revenue growth rate and a $89.9 million increase in earnings from the current $-12.3 million level.

Uncover how Marcus & Millichap's forecasts yield a $30.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Marcus & Millichap shares from as low as US$2.20 up to US$68.76 across three distinct perspectives. While some see significant growth potential through technology investment, others remain cautious given the company’s dependence on commission revenues in a shifting market.

Explore 3 other fair value estimates on Marcus & Millichap - why the stock might be worth over 2x more than the current price!

Build Your Own Marcus & Millichap Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Marcus & Millichap research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marcus & Millichap's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives