- United States

- /

- Real Estate

- /

- NYSE:JOE

St. Joe (JOE): Evaluating Valuation After Strong Q3 Growth and Dividend Hike

Reviewed by Simply Wall St

St. Joe (NYSE:JOE) just reported third quarter results that showed sharp gains in both revenue and earnings, fueled by strength across residential real estate, hospitality, and leasing. The company also unveiled a 14% dividend hike, which signals optimism about its path ahead.

See our latest analysis for St. Joe.

St. Joe's momentum has clearly picked up steam lately, with a 14.5% one-month share price return and a year-to-date move of 27.2%. Investors seem to be responding enthusiastically to the strong third-quarter results, the sizable dividend increase, and an ongoing buyback program. Over the past year, total shareholder return stands at 13.3%. The long-term picture is even brighter, with a 69% three-year and 115% five-year total return, underscoring growing confidence and consistent value creation.

If this recent rally has sparked your interest, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

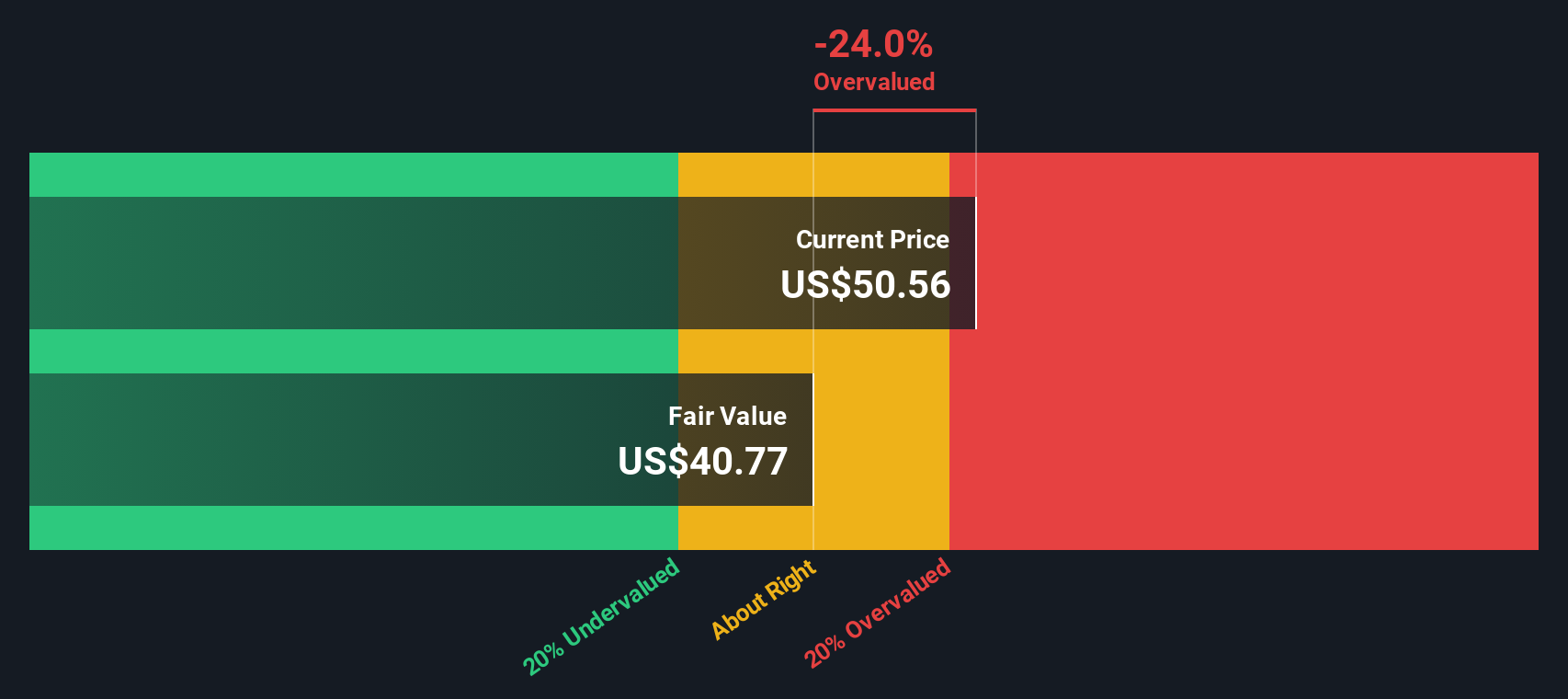

But with shares soaring and quarterly results beating expectations, does St. Joe still have room to surprise? Or is the market already pricing in the company's future growth prospects fully?

Price-to-Earnings of 31.3x: Is it justified?

St. Joe's current share price values it at a lofty price-to-earnings (P/E) ratio of 31.3x, significantly higher than peers. This ratio suggests bullish earnings expectations are integrated into the price.

The P/E ratio measures how much investors are willing to pay for every dollar of earnings. In real estate, it can reflect confidence in sustainable profit growth, recurring income, or scarcity value. At this level, the market is pricing in ongoing robust earnings or assigning a premium to St. Joe’s business model.

However, when compared to its sector, a different picture emerges. The average P/E for St. Joe's peer group stands at 10.7x, and the broad US real estate industry averages 25.3x. St. Joe trades well above both benchmarks. This indicates the market is either highly optimistic about its trajectory or could be overvaluing its growth potential.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 31.3x (OVERVALUED)

However, slower revenue or profit growth than anticipated could quickly dampen sentiment and challenge the premium valuation that investors have recently assigned to St. Joe.

Find out about the key risks to this St. Joe narrative.

Another View: Discounted Cash Flow Suggests Undervaluation

While St. Joe looks expensive compared to sector peers on the price-to-earnings ratio, our DCF model presents a different perspective. Based on future cash flows, St. Joe’s shares are actually trading nearly 30% below our fair value estimate. This is a significant contrast to what the earnings multiple implies.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out St. Joe for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own St. Joe Narrative

If you have a different perspective or want to dig deeper on your own terms, you can easily craft your own view in just a few minutes, Do it your way.

A great starting point for your St. Joe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't miss out on your next great opportunity. Expand your horizon today by selecting hand-picked stocks tailored to your interests and strategy on Simply Wall Street.

- Capture the potential of companies redefining medicine and patient care by checking out these 33 healthcare AI stocks to see who is at the forefront of healthcare innovation.

- Boost your quest for reliable income by scanning these 22 dividend stocks with yields > 3%, which offers yields above 3 percent and can help enhance your portfolio's long-term returns.

- Tap into undervalued gems that the market may be overlooking by using these 832 undervalued stocks based on cash flows and seize those hidden opportunities today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOE

St. Joe

Operates as a real estate development, asset management, and operating company in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success