- United States

- /

- Real Estate

- /

- NYSE:JLL

What Jones Lang LaSalle (JLL)'s Strong Q3 Results and Buybacks Mean for Shareholders

Reviewed by Sasha Jovanovic

- In the third quarter of 2025, Jones Lang LaSalle reported an increase in sales to US$6,510.4 million and net income to US$222.8 million compared to the same period last year, while also completing the repurchase of over 239,000 shares between July and September.

- The completion of a share buyback program totaling more than 6.5 million shares since 2019 signals management's focus on capital return alongside recent earnings growth.

- We'll explore how Jones Lang LaSalle’s strong quarterly financial results could impact the company's investment narrative and future prospects.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Jones Lang LaSalle Investment Narrative Recap

To be a shareholder in Jones Lang LaSalle, you need to believe in the company's continued ability to expand recurring revenue streams and capture demand for integrated, energy-efficient real estate solutions. The recent surge in quarterly revenue and net income, as well as the completion of a substantial multi-year share buyback program, support a positive outlook but have not materially reduced the short-term sensitivity of JLL’s business to volatility in capital markets and leasing demand.

The strong Q3 2025 earnings announcement, which showed significant year-on-year increases in revenue and profitability, is particularly relevant to the investment story. While this result reinforces confidence in management’s strategy and cost discipline, investors should keep in mind that much of JLL’s fee income and transaction-based revenue remains susceptible to broader economic and market fluctuations.

Yet, despite increased profitability, investors should be aware that exposure to shifts in transactional markets can still present...

Read the full narrative on Jones Lang LaSalle (it's free!)

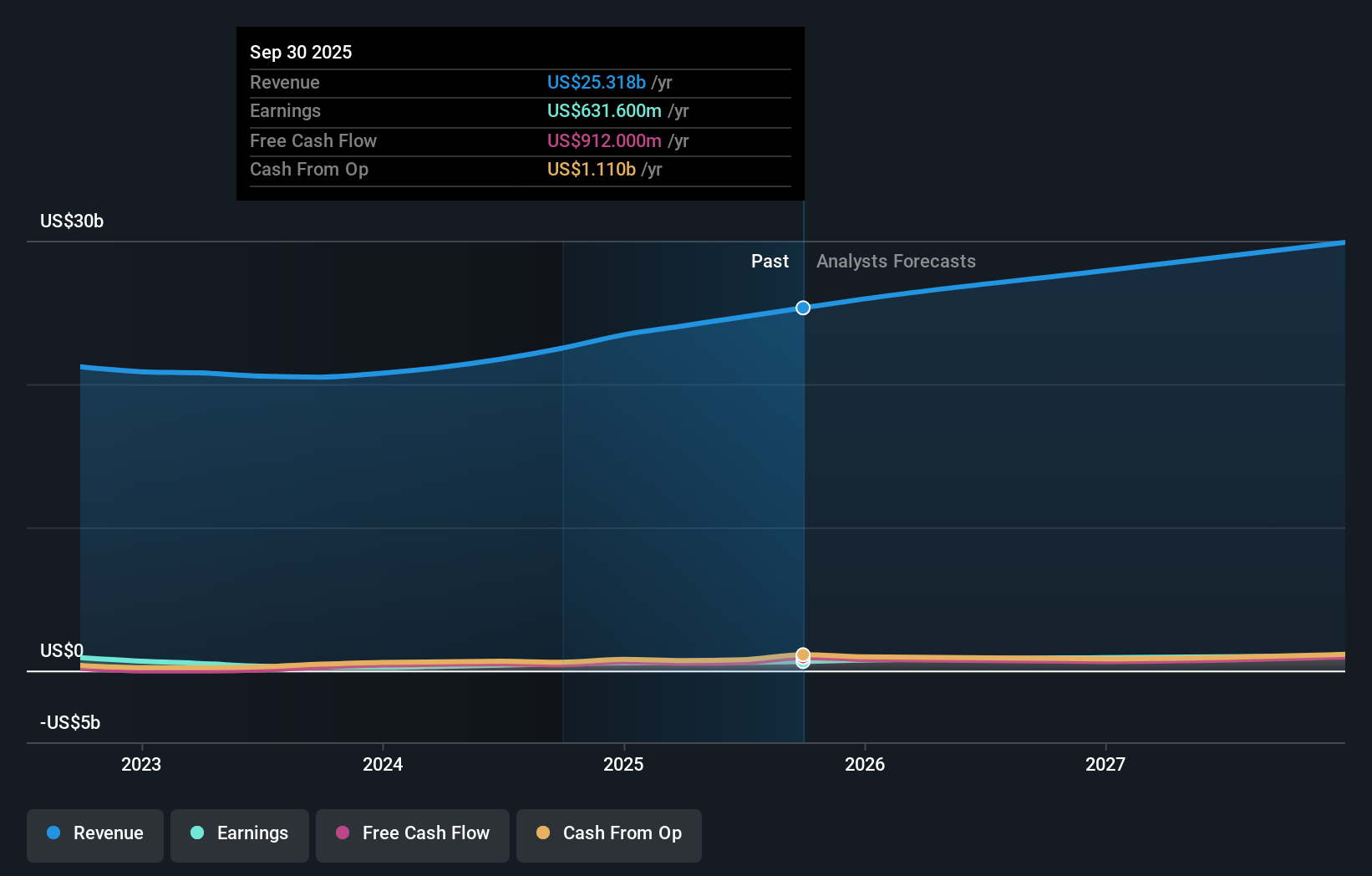

Jones Lang LaSalle's outlook sees revenues reaching $31.5 billion and earnings rising to $1.0 billion by 2028. This is based on an annual revenue growth rate of 8.4% and an increase in earnings of $436.1 million from the current $563.9 million.

Uncover how Jones Lang LaSalle's forecasts yield a $341.44 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Across two community estimates for JLL’s fair value, the range spans from US$341 to US$400 per share. Although recurring revenue growth stands out as a catalyst, the variety of views in the Simply Wall St Community shows just how differently investors assess the company’s future prospects.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth just $341.44!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

Operates as a commercial real estate and investment management company.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives