- United States

- /

- Real Estate

- /

- NYSE:CWK

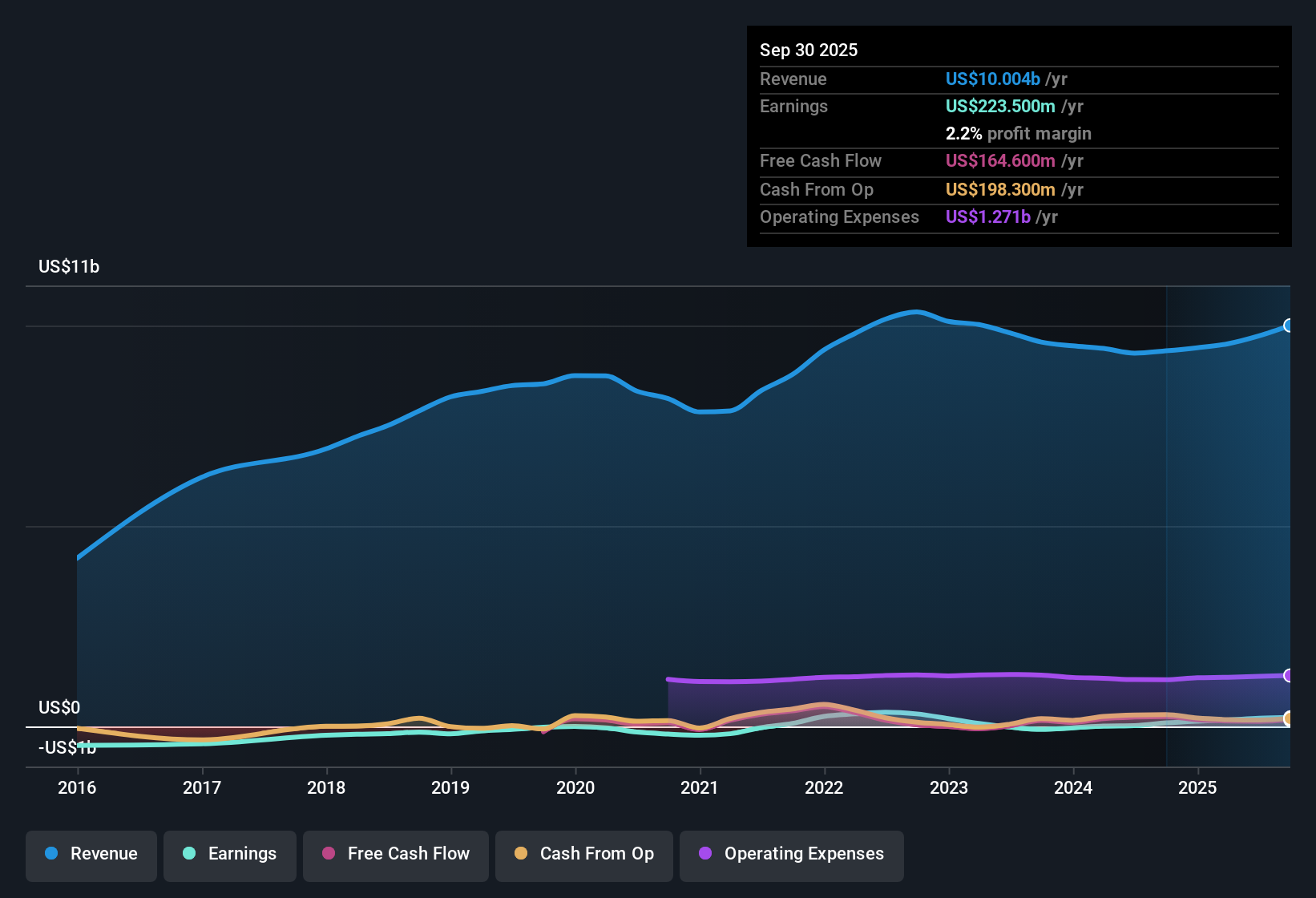

Cushman & Wakefield (CWK) Net Profit Margin Soars, Reinforcing Bullish Value Narrative

Reviewed by Simply Wall St

Cushman & Wakefield (CWK) reported net profit margins of 2.1%, a significant jump from 0.2% last year, and earnings growth of 899% over the past year, beating its five-year average growth rate of 24% per year. Revenue is forecast to grow at 5% per year, trailing the broader US market, while the stock trades at a Price-to-Earnings Ratio of 18.2x, below both the industry and peer averages. With margins and valuation metrics in focus, attention now turns to whether stronger profitability can offset concerns about the company’s financial position.

See our full analysis for Cushman & Wakefield.The next step is to see how these headline numbers stack up against the major narratives. This includes where the facts match the story and where the market’s expectations might need a rethink.

See what the community is saying about Cushman & Wakefield

Margins Projected to Expand, But With Cautious Optimism

- Analysts expect Cushman & Wakefield’s net profit margin to increase from 2.1% today to 3.0% in three years, reflecting ongoing operational improvements and cost discipline.

- The analysts' consensus view sees margin expansion as evidence the business can leverage technology and operational efficiencies. However, a high reliance on office leasing and capital markets leaves future profitability sensitive to downturns.

- Repeat improvements in adjusted EBITDA and net margins support the case for long-term earnings quality, as noted by consensus. Ongoing exposure to cyclical revenues is expected to keep volatility risk elevated.

- Deleveraging is reducing interest expense, but analysts highlight that persistent high debt and industry headwinds may cap the extent of sustainable margin growth.

- For a closer look at the numbers behind this balanced outlook and to see how analysts frame the biggest debates, dive into the consensus narrative for further insights. 📊 Read the full Cushman & Wakefield Consensus Narrative.

Recurring Revenue and Client Retention Remain Pillars

- Cushman & Wakefield’s global occupier services enjoy a 96% client retention rate, anchoring growth in steady, fee-based recurring revenue rather than one-off deals.

- The analysts' consensus view gives significant weight to recurring revenue streams for earnings stability, while also noting the firm’s sustained ability to grow fee-based services across project management, advisory, and facilities management.

- Consensus points to robust demand for consulting and portfolio optimization as supporting resilient top-line growth, even as broader US market revenue expansion is expected to outpace the company’s own projections.

- Analysts see expanding recurring service lines as critical for smoothing out quarter-to-quarter results in the face of sector cyclicality and digital disruption.

Valuation Stands Out Versus Peers

- Cushman & Wakefield’s Price-to-Earnings ratio of 18.2x sits well below the US Real Estate industry average (25.3x) and peer average (30.6x), with the share price at $16.18 and a sector consensus price target of $17.42.

- The analysts' consensus view contends the modest premium to current market price suggests Cushman & Wakefield is fairly valued. Valuation support is rooted in expectations for moderate profit and revenue growth amid persistent risks.

- Consensus cautions that the 0.5% gap between market price and analyst target reflects balanced expectations rather than a strong upside or downside signal, indicating analysts see limited mispricing today based on current fundamentals.

- Market optimism for DCF fair value (if used) appears muted in light of the company’s steady, not spectacular, growth assumptions and ongoing financial leverage.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cushman & Wakefield on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your perspective and shape your own narrative in just a few minutes, then Do it your way.

A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Cushman & Wakefield’s ongoing high debt and exposure to sector headwinds may limit its margin gains and increase financial risk for investors.

If a stronger financial footing matters to you, check out solid balance sheet and fundamentals stocks screener (1983 results) to discover companies with healthier balance sheets and less debt-driven volatility right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWK

Cushman & Wakefield

Provides commercial real estate services under the Cushman & Wakefield brand in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives