- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (NYSE:CBRE): Assessing Valuation as Momentum Slows After Strong Multi-Year Performance

Reviewed by Simply Wall St

See our latest analysis for CBRE Group.

With its share price up 17.5% year-to-date and a 12.2% total shareholder return over the past year, CBRE Group has steadily rewarded patient investors. However, the momentum has cooled from the multi-year climb that saw a 164% five-year total return. Recent weeks of limited price movement may signal a pause as investors reassess growth prospects and valuation after such a strong run.

If you’re on the lookout for the next wave of market leaders, it’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With CBRE trading close to its all-time highs and still below analyst targets, investors now face a classic dilemma: is there real value left to unlock, or has the market already accounted for all the company’s future gains?

Most Popular Narrative: 12.9% Undervalued

The latest widely followed narrative assigns CBRE Group a fair value noticeably above its recent close, suggesting there could be further upside as the company capitalizes on its position in the sector.

CBRE's strategic realignment of its Project Management and Building Operations & Experience segments has resulted in strong financial performance and is expected to drive future growth by enhancing operational synergies, including shared client access and opportunities for mergers and acquisitions. This is likely to positively impact both revenue and net margins.

What if one surprising forecast underpins this bold valuation? This narrative hints at ambitious revenue expansion, sharper profit margins, and a decline in share count, all critical to its upside. Ready to see what numbers the narrative is betting on? You will be surprised at just how aggressive some of the projections are.

Result: Fair Value of $175.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainty and potential slowdowns in industrial leasing could quickly challenge even the most optimistic outlook for CBRE Group.

Find out about the key risks to this CBRE Group narrative.

Another View: Are Market Multiples Sending a Different Signal?

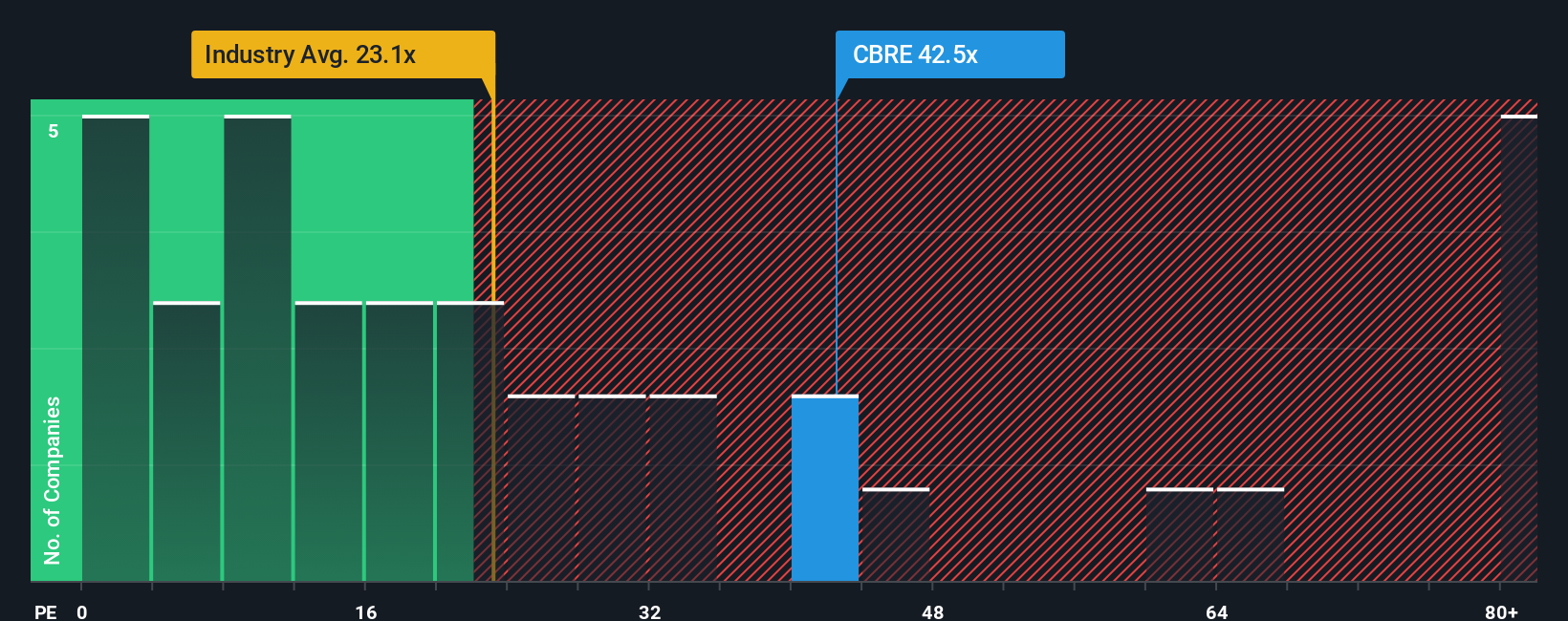

Looking at the company's price-to-earnings ratio can reshape how you see CBRE Group's value. At 36.4x, the shares are more expensive than both the US Real Estate industry average of 28.2x and the peer average of 25.4x. The fair ratio, based on underlying company drivers, is 26.8x. This suggests the current price may carry valuation risk if market sentiment shifts. Will investors keep paying up, or could a return to more typical ratios trigger a pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own perspective in just a few minutes, so Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay one step ahead. Open up your portfolio to exciting possibilities using these handpicked opportunities that could transform your financial future.

- Boost your passive income by checking out these 16 dividend stocks with yields > 3% with strong yields. This can help you grow wealth steadily as markets shift.

- Ride the AI innovation wave by researching these 25 AI penny stocks, which are rapidly changing everything from automation to healthcare and beyond.

- Seize the chance to unlock hidden value with these 874 undervalued stocks based on cash flows. Attentive investors often find tomorrow’s standouts before everyone else notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives