- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow (ZG): Evaluating the Stock’s Valuation Following the Launch of CreditClimb for Renters

Reviewed by Simply Wall St

Zillow Group (ZG) just introduced CreditClimb, a partnership with Esusu that gives renters an easy way to report on-time rent payments to the three major credit bureaus. This move could help renters improve their credit scores while also broadening Zillow’s reach in the rental market.

See our latest analysis for Zillow Group.

After a volatile year, Zillow’s latest product launch comes as the stock rebounds from a tough stretch. Although its share price slipped 16.5% over the past three months and remains nearly flat year-to-date, the stock is finding renewed momentum lately. It climbed 6.5% in a single day on the CreditClimb news. That said, its long-term story is mixed, with a stellar 101% total shareholder return over three years but a decline of over 13% in the past year.

If Zillow’s latest move has you wondering what else is gathering steam, it might be the perfect time to broaden your hunt and discover fast growing stocks with high insider ownership

With shares now rebounding and analysts targeting prices nearly 27% above current levels, the big question is whether Zillow is still undervalued by the market or if all that growth is already built in.

Most Popular Narrative: 20.9% Undervalued

Zillow Group’s widely followed narrative assigns a fair value notably above the last close of $69.98. This reflects strong conviction in the company’s digital expansion and future profitability, setting high expectations for what could lie ahead as tech-driven innovation gains traction.

The shift toward integrated, end-to-end digital transaction ecosystems (like Zillow 360 and Enhanced Markets) is enabling Zillow to capture more ancillary services revenue (mortgages, rentals, software). This reduces dependence on advertising while expanding top-line growth and supporting EBITDA margin expansion through operational efficiencies.

Curious what powers this bullish view? The narrative points to ambitious growth rates and scale in new revenue streams that could redefine how investors should value Zillow. There are some surprising leaps in both margins and future profits baked in. Want to know which assumptions make this valuation tick? The answers aren’t what you’d expect.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and increased competition from rivals could spoil the outlook. These factors threaten Zillow’s growth narrative despite recent tailwinds.

Find out about the key risks to this Zillow Group narrative.

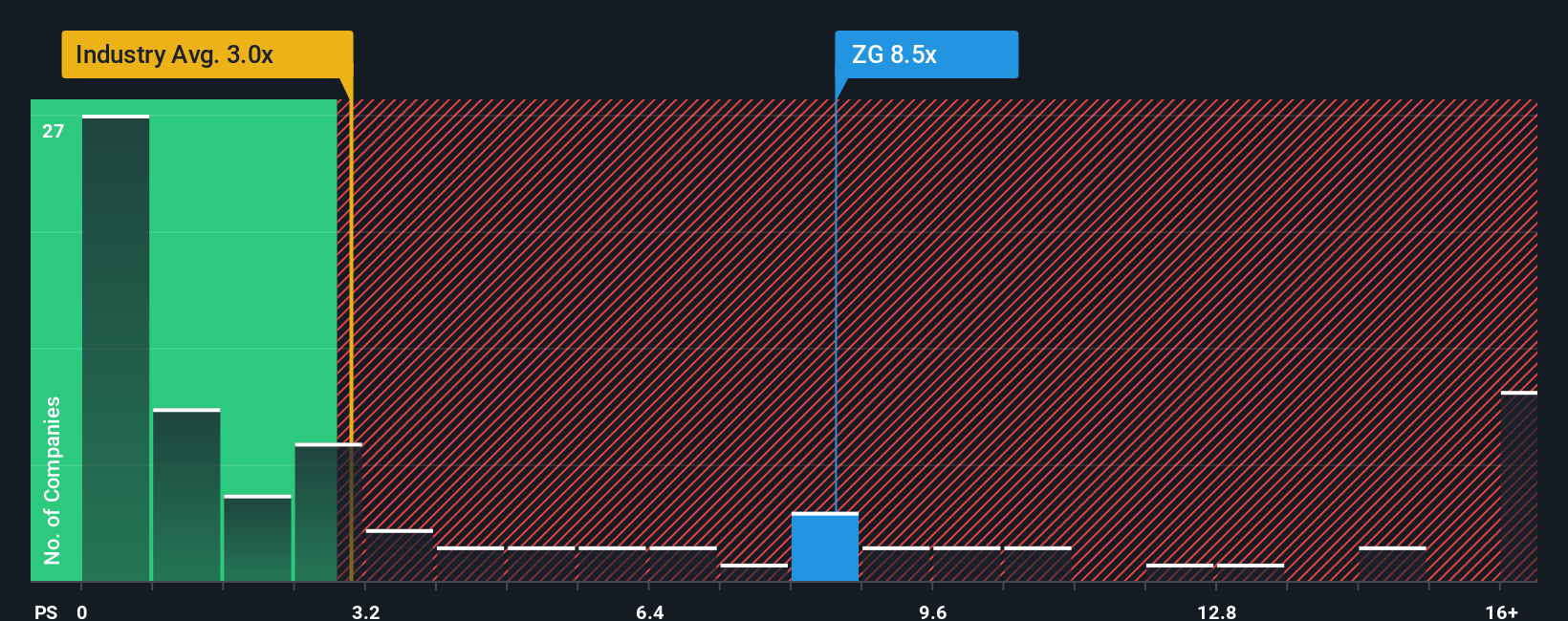

Another View: What Multiples Say

While some models suggest Zillow is undervalued, looking at its price-to-sales ratio presents a different perspective. Zillow trades at 6.8 times sales compared to the US industry average of 2.3 and a peer average of 3.1. Even its fair ratio is estimated at just 4 times sales. This substantial gap implies investors are paying a significant premium, which adds valuation risk even as future growth is anticipated. Is the market too optimistic, or does Zillow truly warrant its premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If you see the story playing out differently or want to dive into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for More Smart Investment Moves?

Don’t let your next opportunity pass you by. Use the Simply Wall Street Screener to uncover exciting stocks before they’re on everyone’s radar. Put your strategy into action today with these standout ideas:

- Boost your portfolio’s potential by staking your claim in these 926 undervalued stocks based on cash flows, a segment that the market may be overlooking right now.

- Unlock fresh income streams by targeting these 16 dividend stocks with yields > 3%, which offer higher yields and consistent returns.

- Get ahead of tomorrow’s innovation by tapping into these 26 quantum computing stocks, a group reshaping the tech landscape with breakthrough advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives