- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

Newmark Group (NMRK) Margin Beat Reinforces Narrative, But Valuation Premium Remains in Focus

Reviewed by Simply Wall St

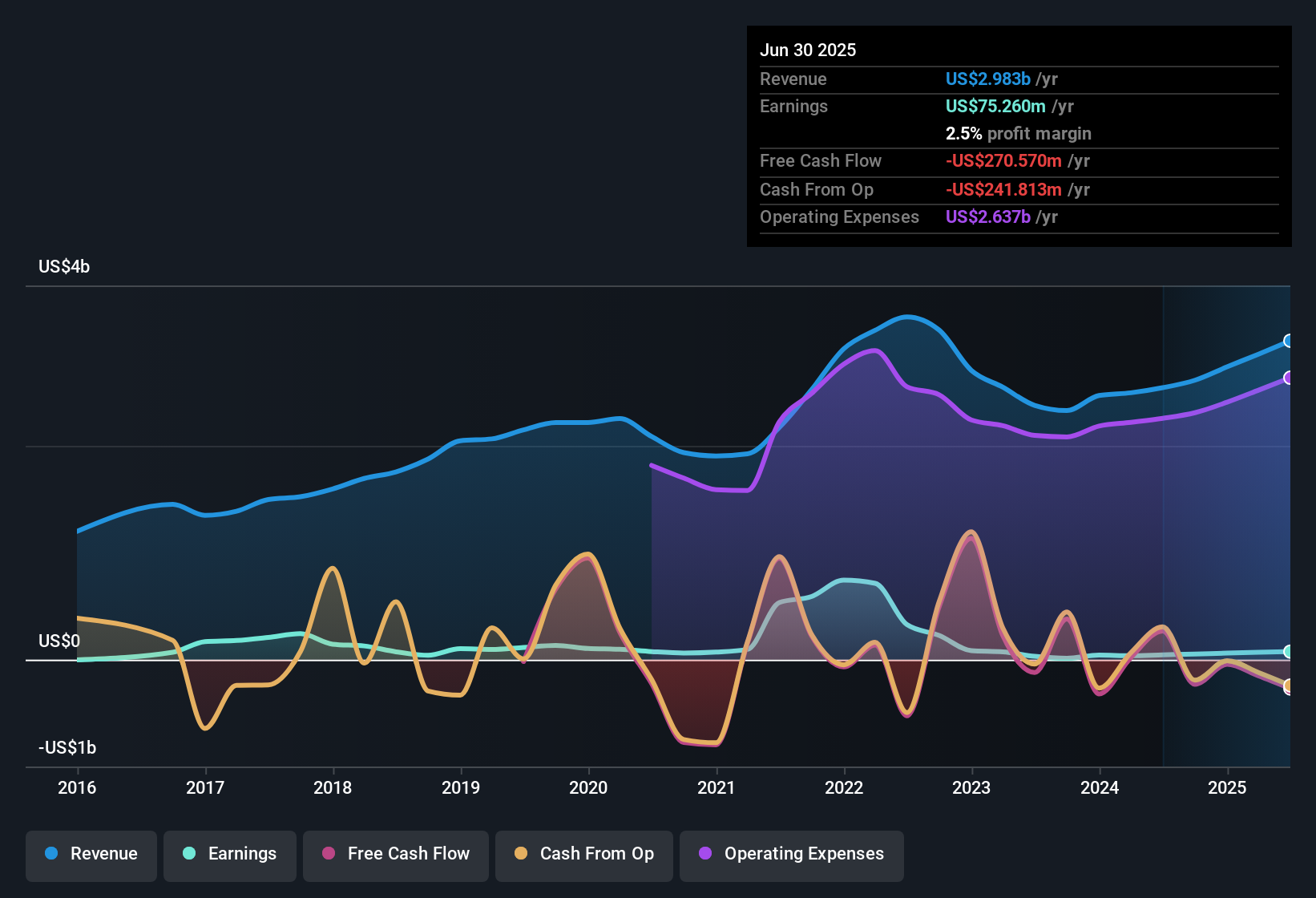

Newmark Group (NMRK) posted a significant turnaround this quarter, with profit margins rising to 2.5%, up from 1.8% a year ago, and EPS surging 69% year over year. The company’s strong annual earnings growth, which far outpaces its five-year average decline of 39.3% per year, contrasts with a share price of $18.07, still trading below its estimated fair value of $24.29. With a forecast for profit to grow 22.78% annually and a focus on higher quality earnings, Newmark is setting expectations for ongoing improvement in profitability.

See our full analysis for Newmark Group.Next, we will see how these headline numbers measure up against the community’s prevailing narratives and market expectations, highlighting where the latest results reinforce or challenge the broader story.

See what the community is saying about Newmark Group

Margin Expansion Sets Ambitious Future Target

- Analysts anticipate profit margins rising from the current 2.5% to 5.3% within three years, suggesting substantial operational leverage is still to be realized.

- According to the analysts' consensus view, the focus on alternative asset expansion, tech integration, and global market growth is expected to drive both recurring revenues and sustained margin gains. However, such optimism assumes margin improvements will materialize much faster than the company’s historical performance indicates.

- While the consensus sees technology and global reach fueling higher margins, past five-year average annual profit change was -39.3%. This points to a significant turnaround that must be delivered to validate these expectations.

- Expansion into new asset classes and geographic sectors is applauded in the narrative. Yet, it also introduces complexity and integration risks that could delay or limit margin progress.

P/E Ratio Outpaces Industry Peers

- Newmark trades at a price-to-earnings ratio of 42.4x, well above the US Real Estate industry average (25.3x) and its direct peer group (29.3x). This sets a high bar for delivering forecasted profit improvements.

- Consensus narrative highlights that bulls are relying on future earnings strength to justify the elevated P/E, expecting that rapid profit growth and recurring revenues from strategic M&A and talent acquisition will gradually bring valuations in line with the sector.

- Analysts expect profit growth of 22.78% annually and margins to more than double, which must happen for the stock’s P/E to become more reasonable over time.

- If the anticipated growth does not materialize at this pace, Newmark's premium valuation could become difficult to defend relative to industry benchmarks.

Share Price Closes Gap With Analyst Targets

- At $18.07, Newmark’s share price sits within 1.4% of the current analyst consensus price target of $19.40, and still trades at a discount to the DCF fair value of $24.29. This suggests limited immediate upside unless the company outperforms expectations.

- The consensus narrative notes that with such a narrow gap between price and target, investors are balancing improved earnings momentum against the firm’s riskier financial position, highlighted as the single major risk. This implies that future share appreciation may depend more on surpassing forecasts than just hitting them.

- Consensus sees fair value support at the $24.29 mark, but current pricing signals that the market wants more proof on sustained profitability before closing this valuation gap.

- Exposure to new geographies and tech investments, while promising, also adds volatility and execution risk that could widen or close the share price gap depending on how these bets play out.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Newmark Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers that stands out to you? Share your unique angle and build your own story in just a few minutes. Do it your way

A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Newmark’s margin pressures, premium valuation, and exposure to financial risks suggest the market still questions the company’s ability to deliver on its ambitious forecasts.

If you’re seeking stocks with stronger financial foundations and less balance sheet risk, use our solid balance sheet and fundamentals stocks screener (1984 results) to target companies built for stability through uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives