- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

Newmark Group (NMRK): Assessing Valuation After 31% Share Price Gain in 2024

Reviewed by Simply Wall St

Newmark Group (NMRK) shares have posted steady gains this year, with the stock up 31% year to date. The company’s recent performance invites a closer look at how its fundamentals and long-term prospects stack up for investors.

See our latest analysis for Newmark Group.

The momentum behind Newmark Group’s share price has held firm in 2024, with a 31% year-to-date gain reflecting renewed confidence after recent volatility. Despite short-term swings, the company’s three- and five-year total shareholder returns of 102% and 141% indicate strong value creation for long-haul investors.

If you’re searching for your next opportunity, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with its recent run-up, is Newmark Group's strong track record leaving room for further upside? Or has the market already priced in future growth, limiting the chance for investors to buy at a bargain?

Most Popular Narrative: 16.8% Undervalued

Most analysts believe Newmark Group's fair value is $19.80, noticeably higher than the last close of $16.48. This scenario raises big questions about future growth, margins, and the key drivers that could unlock further upside for the stock.

Accelerated expansion in alternative asset classes such as data centers, supported by robust demand stemming from AI and digital infrastructure, is driving above-industry revenue growth and higher-margin capital markets activities. This positions Newmark for long-term top-line and earnings expansion.

Curious which industry trends and bold growth bets put Newmark’s future earnings on the fast track? The key assumptions driving this valuation hint at ambitious forecasts and market-defying expectations. Want to see the exact numbers and strategies behind this high-stakes narrative?

Result: Fair Value of $19.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion into new regions or a sudden slowdown in high-demand sectors such as data centers could put pressure on Newmark's margins and growth outlook.

Find out about the key risks to this Newmark Group narrative.

Another View: What Do Market Ratios Say?

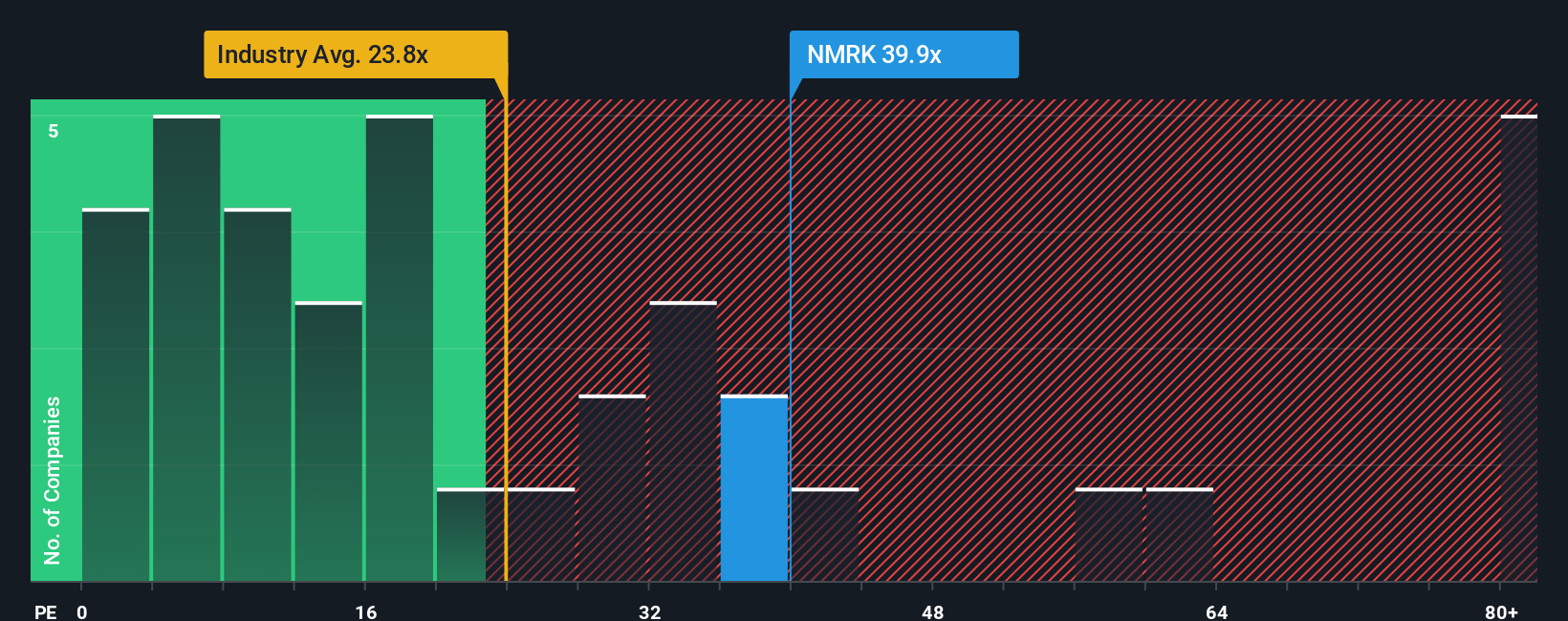

While many see Newmark Group as undervalued based on analyst forecasts, the company's price-to-earnings ratio of 28.7x is actually higher than both the US Real Estate industry average of 28.2x and its own fair ratio of 22.2x. Compared with peer averages (29.8x), it is on par, but when a stock trades above fair ratios, it suggests the market may already be factoring in strong growth and leaves less margin for error. Could this mean less upside if expectations do not play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Newmark Group Narrative

If you want a different perspective or prefer to dive into the details yourself, building your own Newmark Group narrative takes just a few minutes, so Do it your way

A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step in your investing journey and supercharge your strategy with fresh stock ideas. Ignoring these opportunities could mean missing out on tomorrow’s biggest moves.

- Explore the potential of technology-driven healthcare with these 30 healthcare AI stocks, which features groundbreaking solutions and future-ready innovation.

- Consider steady income streams by reviewing these 17 dividend stocks with yields > 3%, offering generous yields designed for resilient portfolios.

- Stay ahead of market trends using these 25 AI penny stocks, highlighting the next wave of artificial intelligence and data-driven enterprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives