- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

A Fresh Look at eXp World Holdings (EXPI) Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

eXp World Holdings (EXPI) has been drawing renewed interest following a period of share price volatility. Over the past month, the stock gained 9%. However, its returns over the past year have trailed the broader market.

See our latest analysis for eXp World Holdings.

The recent 1-month share price return of nearly 9% suggests some momentum is re-emerging for eXp World Holdings, although its one-year total shareholder return of -18% reminds us that the longer-term trend remains challenged. With volatility still fresh in investors’ minds, the latest uptick might signal changing risk perceptions or renewed optimism about growth potential. However, the company’s track record over several years shows a bigger picture of ups and downs.

If you’re interested in what else is catching attention, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

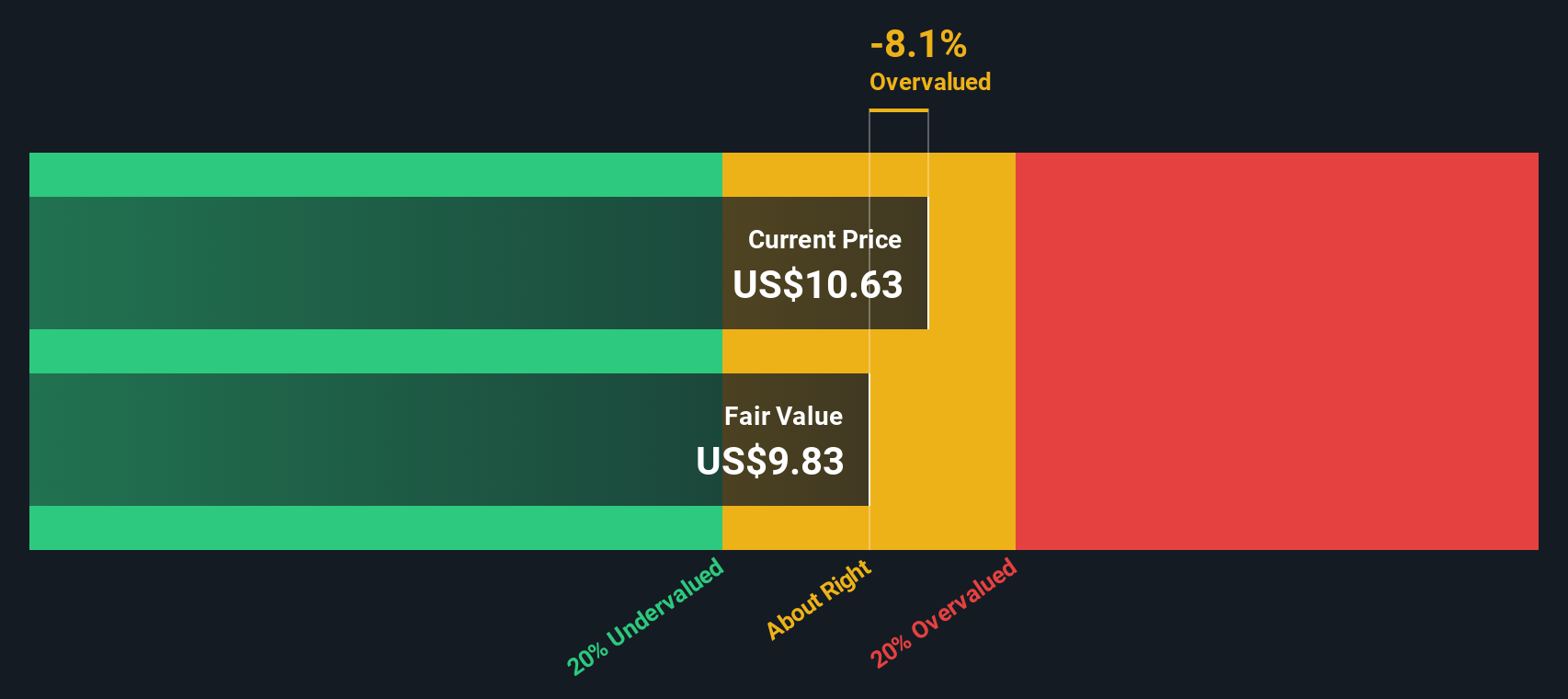

The question investors now face is whether eXp World Holdings’ shares remain undervalued after recent gains, or if the market has already factored in all its future growth prospects. Is there a buying opportunity, or has optimism run ahead of reality?

Most Popular Narrative: 14% Undervalued

Compared to its last close price of $11.13, the narrative suggests eXp World Holdings could be valued much higher, offering potential upside. This narrative is built on projections of robust recovery in profitability and aggressive growth assumptions for the years ahead.

Accelerating global expansion supported by a scalable cloud-based platform is allowing eXp to rapidly launch into new markets (Peru, Turkey, Ecuador, Japan, South Korea) and capture productive agents quickly. This increases potential transaction fees and top-line revenue in tandem with the ongoing digitalization of commerce and work.

Want to know what’s driving this optimistic price target? The narrative hinges on rapid growth into new markets and bold improvements in profit margins. Curious which ambitious numbers are baked into this outlook? There’s more under the surface. Find the key drivers powering this valuation in the full narrative.

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing commission compression and rapid shifts toward direct-to-consumer real estate could challenge eXp’s profit margins and traditional agent-centered business model.

Find out about the key risks to this eXp World Holdings narrative.

Another View: SWS DCF Model Offers a Contrasting Take

While valuation based on sales multiples suggests eXp World Holdings could offer compelling value, our DCF model comes to a very different conclusion. It estimates a fair value of just $7.32 per share, which is well below the current market price. Does DCF highlight real risks being overlooked, or is it too conservative given eXp’s growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily create your own narrative in just a few minutes. Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your portfolio and discover exciting new opportunities. These screeners can help you spot fast-moving trends and stay ahead of the market curve.

- Tap into emerging technologies by scanning these 25 AI penny stocks, packed with innovative companies advancing artificial intelligence and automation.

- Elevate your dividend income by reviewing these 14 dividend stocks with yields > 3%, featuring stocks delivering robust yields above 3% from industry leaders.

- Uncover companies transforming finance when you check out these 81 cryptocurrency and blockchain stocks, leading the charge in blockchain and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026