- United States

- /

- Pharma

- /

- OTCPK:JUSH.F

Jushi Holdings (OTCPK:JUSH.F): Losses Narrowed by 15% Per Year, Profitability Still Elusive

Reviewed by Simply Wall St

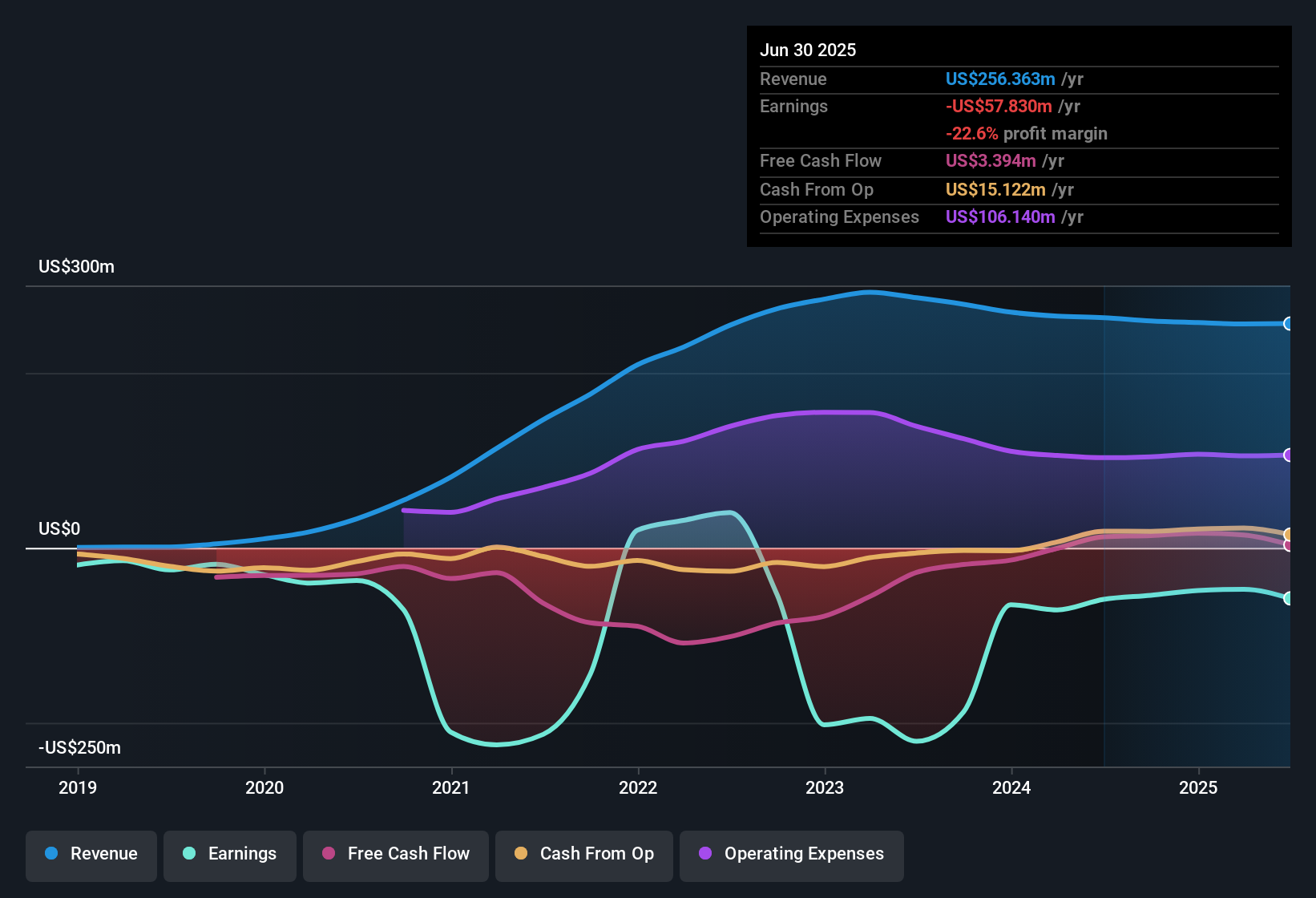

Jushi Holdings (OTCPK:JUSH.F) remains unprofitable but has narrowed its losses by an average of 15% per year over the past five years. With revenue projected to grow at 8.1% per year, which lags the broader US market’s 10.5% growth, and a current stock price of $0.60 trading below its estimated fair value of $0.93, investors are weighing growth against persistent profitability challenges.

See our full analysis for Jushi Holdings.Next, we’ll see how these figures compare to the most widely discussed narratives around Jushi Holdings. Get ready for a look at where the facts match the stories and where perceptions may need to shift.

See what the community is saying about Jushi Holdings

Margins Dip as Pricing Pressure Mounts

- Gross profit margins slipped from 50% to 44%, with the analysts' consensus view highlighting that competitive pricing in retail markets is outpacing Jushi's ability to absorb cost pressures.

- Consensus narrative notes that although retail and product innovation are cited as growth catalysts,

- margin erosion and market concentration are significant headwinds that could limit the positive impact of upcoming state-level regulatory changes,

- and recent declines in wholesale revenue increase reliance on internal retail channels, making margins even more sensitive to shifts in demand and competitive dynamics.

- Consensus narrative points out that a heavy debt burden of $192 million and consistently negative earnings mean Jushi must achieve both higher margins and stronger cash flow to meet analyst price target expectations.

- Material debt adds refinancing risk if industry or macro conditions worsen. With no forecast for profitability in the next three years, Jushi has limited flexibility until cost structure or gross margin trends turn markedly more positive.

- If retail expansion slows in favor of less capital-intensive projects, there is a risk that top-line growth and margin recovery could take longer than consensus projects.

Low Price-to-Sales Ratio Stands Out

- JUSH.F’s Price-to-Sales Ratio at just 0.5x is a fraction of peers (7.4x) and the US pharma industry (4.2x), suggesting that even with profitability challenges, the market is heavily discounting sales relative to the sector.

- Analysts' consensus view observes that this valuation gap could offer upside in the event of regulatory wins or sustained retail progress,

- yet the slow annual sales growth forecast of 8.1% versus the broader US market’s 10.5% leaves open the question of when, or if, the discount will close,

- and ongoing unprofitability means the low multiple could persist until Jushi closes the margin gap with industry averages.

Debt Load and Profitability Remain Key Risks

- The company faces a significant debt burden with $192 million outstanding and no expectation to reach profitability in the next three years, which amplifies risks around future dilution and refinancing.

- Analysts' consensus view contends that heavy leverage and continued net losses

- could restrict Jushi’s ability to fund growth or withstand unfavorable market cycles,

- so any delays in state or federal reform, or stretched cash flow from slower-than-expected sales or margin recovery, might force adjustments to the current growth trajectory.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Jushi Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the figures that others might have missed? Capture your view in just a few minutes and shape your own take on the outlook. Do it your way.

A great starting point for your Jushi Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Jushi Holdings continues to struggle with heavy debt, margin pressure, and an uncertain path to profitability over the next several years.

If you want companies with more robust financial health and less risk from leverage or refinancing needs, discover solid balance sheet and fundamentals stocks screener (1979 results) and upgrade your watchlist with stronger balance sheets today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:JUSH.F

Jushi Holdings

A vertically integrated cannabis company, engages in the cultivation, processing, retail, and distribution of cannabis for the medical and adult-use markets in the United States.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives